The Fed has a $4 trillion problem when the next recession hits

The last US recession, which triggered a global financial crisis, was the worst since the Great Depression. To prop up the plunging economy and stop spiraling unemployment after the 2008 crash, the Federal Reserve deployed some creative—and aggressive—measures, such as flooding the financial system with cash by buying trillions of dollars of treasuries and mortgage bonds.

The last US recession, which triggered a global financial crisis, was the worst since the Great Depression. To prop up the plunging economy and stop spiraling unemployment after the 2008 crash, the Federal Reserve deployed some creative—and aggressive—measures, such as flooding the financial system with cash by buying trillions of dollars of treasuries and mortgage bonds.

The yields on US treasury bonds determine interest rates for just about everything in America, and for much of the world. When there’s a decline in US government bond yields, which move inversely to prices, the cost for things like student debt, mortgages, and corporate borrowing also falls. Part of the Fed’s rationale for its massive bond buying program, known as quantitative easing, was to make it cheaper to borrow, thereby spurring consumer spending and encouraging companies to invest and expand.

Unemployment has improved and the economy is back on track, but the Fed is still saddled with more than $4 trillion of assets from its crisis-era buying spree, which could be a problem if the economy runs into trouble again soon. It’s been about eight years, or 96 months, since the US economy last slipped into recession, according to the National Bureau of Economic Research. Since 1945, the average economic cycle has lasted for roughly 70 months, measured from peak to peak or trough to trough. This suggests another downturn is, in a way, due. When the US economy is next in trouble, there may be limits to how much policymakers can fight back.

Fed chair Janet Yellen is making plans to slowly reduce the bank’s holdings. But as Kit Juckes, chief global FX strategist at Societe Generale, said this week, they will move so slowly that the balance sheet “will surely still be huge when the next recession comes along.” This probably explains why the Fed raised its benchmark interest rate this week, even though inflation lags the bank’s target and unemployment among some demographics remains high: doing so gives policymakers more room to maneuver when the next recession hits.

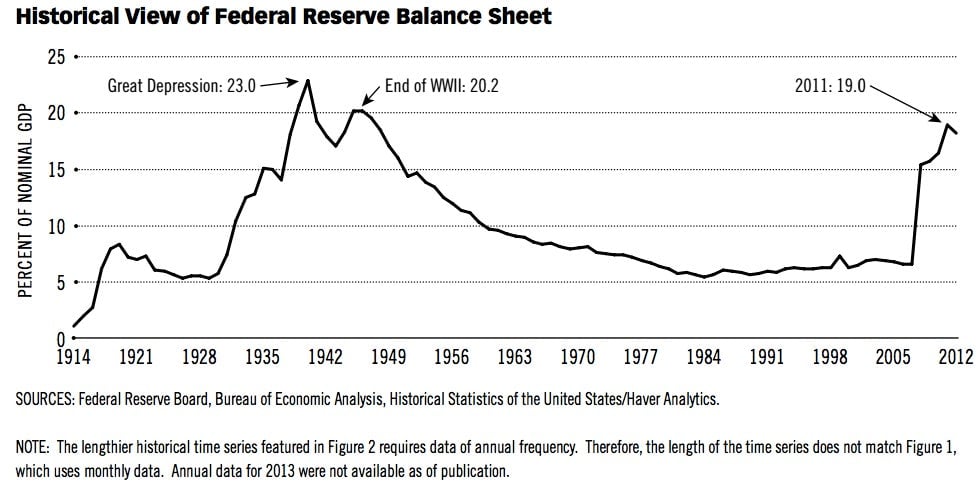

It’s worth remembering that the US has been in this situation before:

The Fed’s assets are currently worth about 23% of nominal GDP, which is roughly the same as it was during the 1930s following the Great Depression, according to the IMF and St. Louis Fed data. In the decades that followed World War II, the size of the central bank’s balance sheet shrank relative to the economy, as growth ensued and conditions returned to normal. The lesson? Central bankers can probably deal with another recession, but perhaps not a Great Recession.