Amazon paying $6,000 per user to buy Slack might make perfect sense

If Amazon decides to cough up $9 billion for the corporate messaging app Slack, it will pay the equivalent of nine times the valuation of a Netflix customer, or four times the price of a New York Times subscriber—two companies that managed to build actual barriers to entry.

If Amazon decides to cough up $9 billion for the corporate messaging app Slack, it will pay the equivalent of nine times the valuation of a Netflix customer, or four times the price of a New York Times subscriber—two companies that managed to build actual barriers to entry.

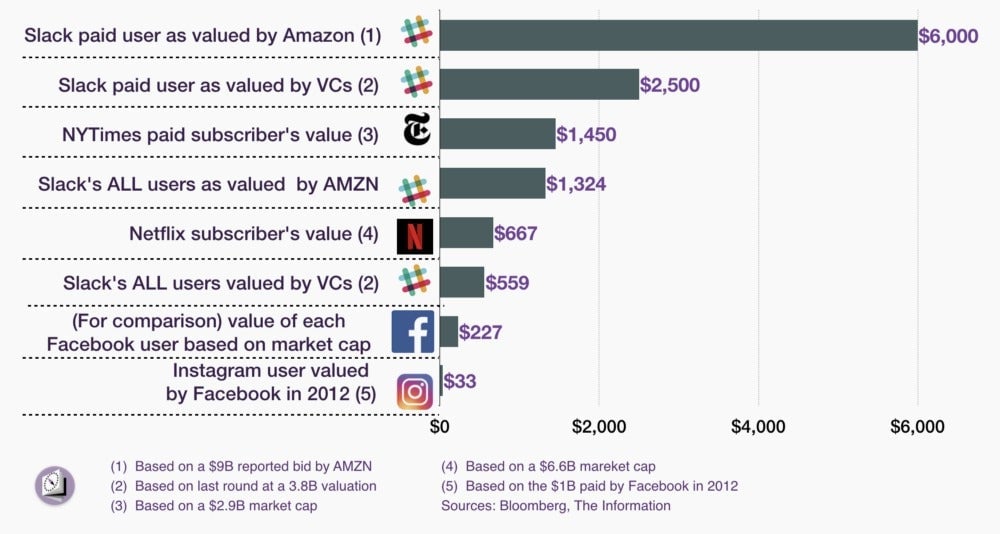

Looking at valuations on a per-user basis is always interesting. In the case of a possible acquisition of Slack by Amazon, it speaks volumes, either about the absurdity of Silicon Valley’s valuation practices, or about the acquisition’s expected upside.

As reported by Bloomberg, on a per customer basis, the price paid by Amazon for its putative Slack acquisition looks staggering:

If the Amazon deal goes through, the retail giant will pay the equivalent of nine times the value of a Netflix customer, and 4.14 times the value of a paid-for subscriber of the New York Times. These are two businesses that managed to erect high barriers to entry.

Netflix has amassed 99 million subscribers in 145 countries, built a sophisticated recommendation engine, made countless distribution deals, and put together its own creation pipeline by spending $6 billion this year alone for original content. Netflix is closely followed, and spurred on, by Amazon Studios’ own that will spend $4.5 billion in 2017.

As for the New York Times, its journalistic franchise is unique, and nearly impossible to replicate. (If and when the NYT someday goes for a truly global strategy, it will be a multi-billion-dollar company—we’ll discuss that in an upcoming Monday Note.)

By comparison, what are Slack’s defenses against competing businesses? To me, they’re next to zero. Facebook’s What’s App, Tencent’s WeChat, or an out-of-nowhere newcomer could take over Slack’s core business in a matter of months. Let’s look at Slack’s main features:

- The Slack app store with about 600 apps? Well, it is largely the result of the $80 million fund fueled by the company to create ex-nihilo an app ecosystem. After spending a year using Slack with my co-fellows at Stanford’s John S. Knight Journalism Fellowship, we ended up using one or maybe two extra apps. A large US media company that created 500 Slack channels was using no more than a dozen apps a year ago. The business sections of Apple’s AppStore or Google’s PlayStore are light-years ahead.

- Some network effect? Certainly not. The number of Slack users is pretty small: 1.5 million paying customers and ~5 million freeloaders. Slack might have thousands of customers at companies like Salesforce, Airbnb, or at Nasa’JPL, but these are segregated entities that do not contribute to a critical mass of users making adoption compulsory.

- Product innovation? Slack is filled with nice and smart features. It is easy to learn, has a great integrated help system, and connects almost seamlessly to the usual professional tools. It can effectively replace email within a group; it works well for projects; and it is reliable. The interface is fine (except for a terrible search engine). But I’m still struggling to find a set of features that can’t be easily replicated. I’m afraid there are none.

Why then might Amazon pay $9 billion for Slack?

The price tag on an acquisition also reflects the acquirer’s intentions.

First, Amazon is not likely to pay in cash but it will use its high-priced stock as a currency: it recently traded at $998 per share, and carries a price-earnings ratio of 185!

Two, it would save Amazon a great deal of time in adding an important piece of software to its enterprise services.

Three, Amazon might not even consider Slack’s market share or ARPU. Today, Slack has a recurring annual revenue of $150 million which gives it an ARPU of $100 per year. It must be noted that Slack features a peculiar pricing structure: it charges between $80 and $150 per active user per year, as opposed to charging all the people who have access to the platform—in other words, no “gym effect” where a large chunk of customer pay but don’t use the service. Considering Amazon’s obsession for rapid market share acquisition, the e-commerce giant might even make Slack available for free. In that case, the product’s current 6.8 million user base could quickly swell to 70 or 100 million; its operation (700 persons) would be blended in Amazon’s super-efficient operations, powered by a rounding error in Amazon’s immense technical infrastructure. The putative 70 or 100 million user base would still be a fraction of the estimated 600 million “knowledge workers,” a figure given by April Underwood, Slack’s Product VP to illustrate the potential of the company.

If that is Amazon’s grand plan for the messaging service, the price tag for each paying customer might not be a relevant notion.

“Ultra-growth” scenarios can yield spectacular results: in 2012, Facebook was widely criticized for paying $33 for each of the 30 million Instagram users that brought zero revenue. Now, with 700 million customers, the one billion dollars Facebook paid (in stock) looks like a bargain. But even if we take the entire Slack user base of 6.8 million, including free riders, the value for each is still around $1,300 as set by the putative Amazon deal. (Silicon Valley VCs are more “conservative” and say a Slack user is worth $559…). For a professional application that already has plenty of competitors, this makes a “great bargain” look very distant.

Then we have to remember another number—the one for people who made money betting against Jeff Bezos.