Shocking statistics show how the Great Recession reshaped America for the poor

Recessions always hit the poor hardest. Not only do low-income families have the tightest budgets, their incomes are also more precarious during downturns. In each of the past four recessions in the US, the lowest 20% of earners fared far worse, relatively speaking, than the average American.

Recessions always hit the poor hardest. Not only do low-income families have the tightest budgets, their incomes are also more precarious during downturns. In each of the past four recessions in the US, the lowest 20% of earners fared far worse, relatively speaking, than the average American.

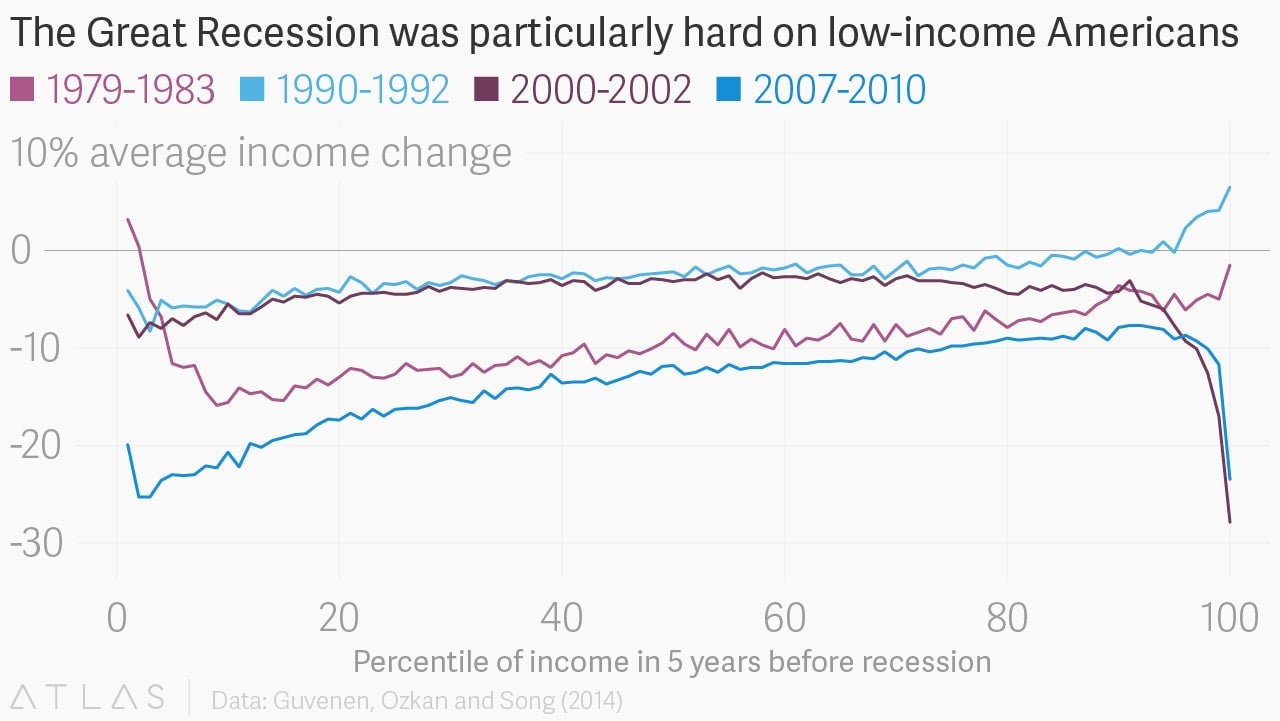

Yet recent research reveals that the most recent recession, the steep downturn triggered by the global financial crisis in 2007 and 2008 (often called the Great Recession), was particularly devastating for the lowest earners. The research, by economists at the University of Minnesota, the University of Toronto and the University of Michigan, found that the average working-age adult in the bottom 10% of earners suffered a relative loss of income two-and-a-half times larger than the richest 10%—a relative difference much bigger than the three previous recessions.

The researchers calculated the average income of 35-55 year old males in the five years before recessions, as well as their average income during the downturns. Their analysis shows that the poorest 10% of earners saw an average income decline of 23% during the Great Recession, a loss that was more than double any other recession in the past 40 years.

The Great Recession was the worst of these economic downturns, so it’s no surprise that the poor were hit hard. What is remarkable is how much harder they were hit than the rich. With an income loss of just under 10%, the average person among the top 10% of earners saw a decline less than half of what the bottom 10% of earners experienced.

What made the Great Recession so hard on the poor? Fatih Guvenen, one of the economists who worked on the research, says it might simply be linked to the magnitude of the shock, and not that some aspect of the economy that has fundamentally changed. The pattern of the four recessions analyzed suggests that the worse the recession, the larger the disparity between the effects on the rich and the poor.

In general, the poor’s incomes are more sensitive to the business cycle. During periods of economic growth, for example, the incomes of the bottom 10% are larger than any other group, in relative terms.

This research points to the importance of income volatility in the lives of low-income Americans. Although income inequality gets more attention, the unpredictability of earnings may be a bigger problem. The vulnerability of the poor to booms and busts is a powerful argument for a robust social safety net to protect workers at the lower rungs of the income scale.

For the complete picture of how economic downturns have impacted people at different income levels, consider the chart below. It shows the average income lost during recessions for each individual income percentile. The huge drop for the very wealthiest in the past two recessions are a result of the concentrated losses for people in the financial sector. More important are the declines at the other end of the chart, which represent widespread financial pain among the families who can least afford it.