Why do investors keep paying fund managers high fees for poor performance?

Active fund managers have been getting a lot of bad publicity lately, namely for a tendency to charge high fees and deliver low returns. This week a UK watchdog shamed Britain’s £6.9 trillion ($9 trillion) asset management industry for these reasons, and cited a worrying lack of competition as a root cause.

Active fund managers have been getting a lot of bad publicity lately, namely for a tendency to charge high fees and deliver low returns. This week a UK watchdog shamed Britain’s £6.9 trillion ($9 trillion) asset management industry for these reasons, and cited a worrying lack of competition as a root cause.

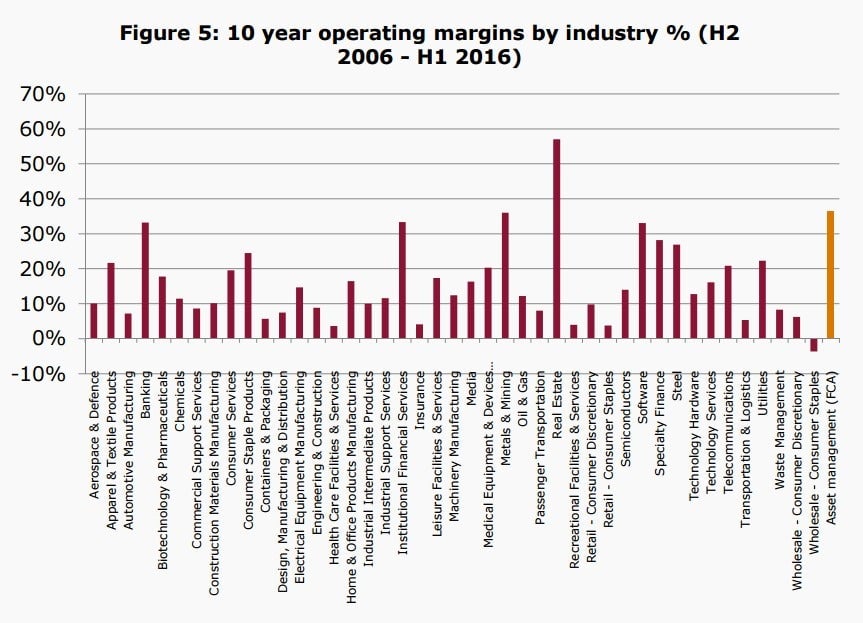

As part of its report, the Financial Conduct Authority (pdf) said that the asset-management sector boasts a hefty average profit margin of 36%. That’s better than just about every other industry in the country, from oil to software to pharma companies. This is a relatively recent rundown, taken from a previous report:

With such fat profit margins and so little competition, active asset managers can make a lot of money even if their performance is poor. Indeed, only 13% of actively managed UK equity funds outperformed the broad market benchmark last year, according to S&P (pdf).

In this environment, it’s easy to see why low-cost passive funds that simply track benchmark indexes are taking aim at the industry. But the FCA warns that even passive funds can be a bad deal for investors:

Neither active and passive funds outperform their benchmarks after costs. We found examples of poor value for money products in both active and passive strategies.

In part, this is because indexes do not reflect the real-world costs of investing—even the cheapest index funds levy some charges, after all. But also, the FCA notes that investors put £6 billion in passive funds with significantly higher fees than the average, for no obvious reason.

What gives? The FCA partnered with an online investment platform to investigate “clickstream” data from millions of customer visits, and found that fewer than 9% of browsers looked at fund charges, and customers only sorted fund listings by charges 0.1% of the time. Instead, investors are probably overemphasizing past performance, which as many know—or should know—is no guarantee of future results.