The US economy is smoking and here’s the proof

If the recent bout of solid jobs numbers hasn’t convinced you of the strength of the US recovery, take a look at the markets. The Russell 2000 index of small-capitalization US stocks is hitting record highs again Tuesday, flitting around 1010 at last glance.

If the recent bout of solid jobs numbers hasn’t convinced you of the strength of the US recovery, take a look at the markets. The Russell 2000 index of small-capitalization US stocks is hitting record highs again Tuesday, flitting around 1010 at last glance.

The companies included in the Russell tend to be smaller than those in the S&P 500 and have less extensive exposure to the global economy; they’re usually more domestically focused. Analysts typically view the index as a good barometer for the health of the US economy. The Russell is up roughly 19% so far this year, compared to a roughly 16% rise in the broader S&P.

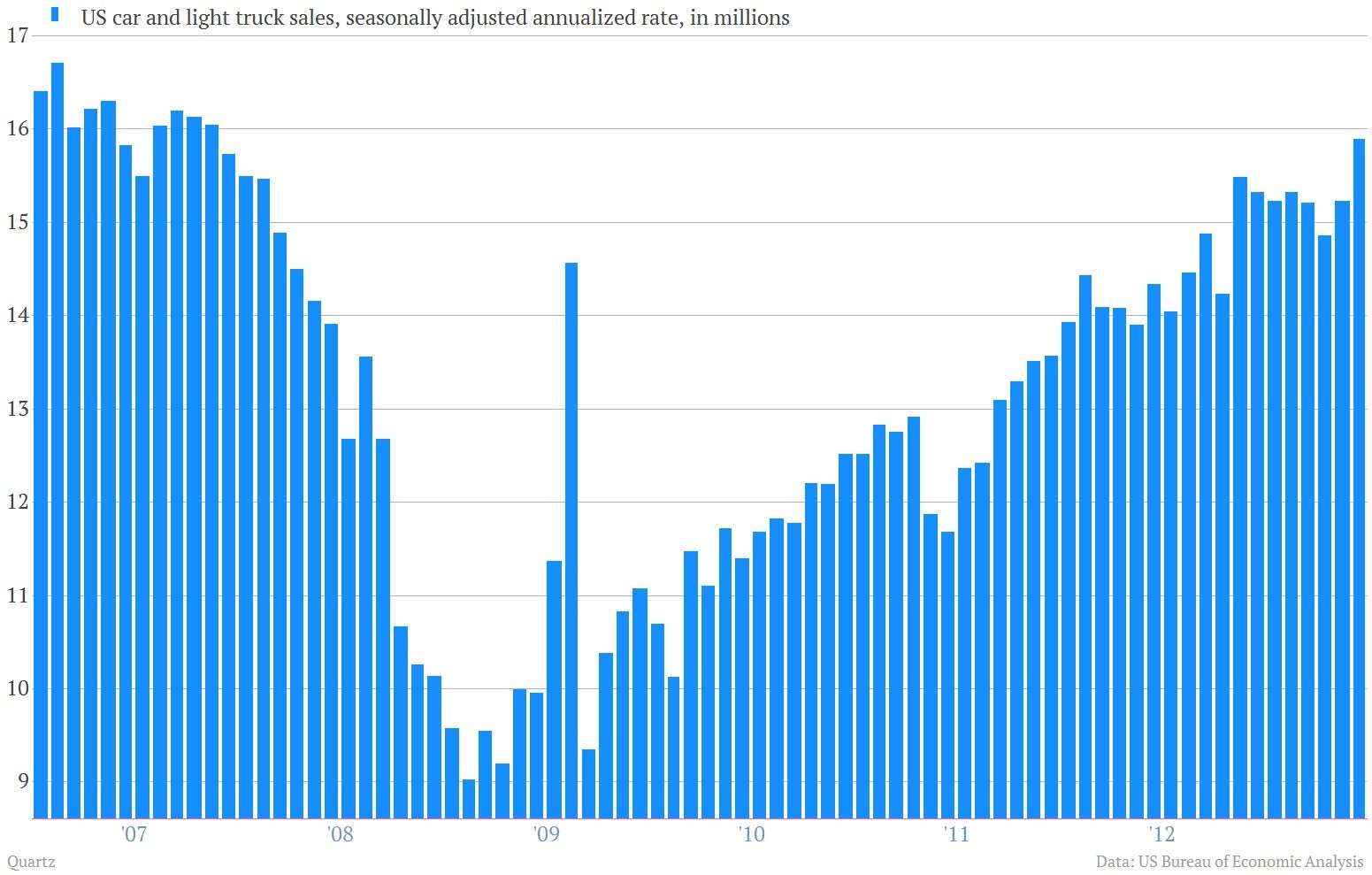

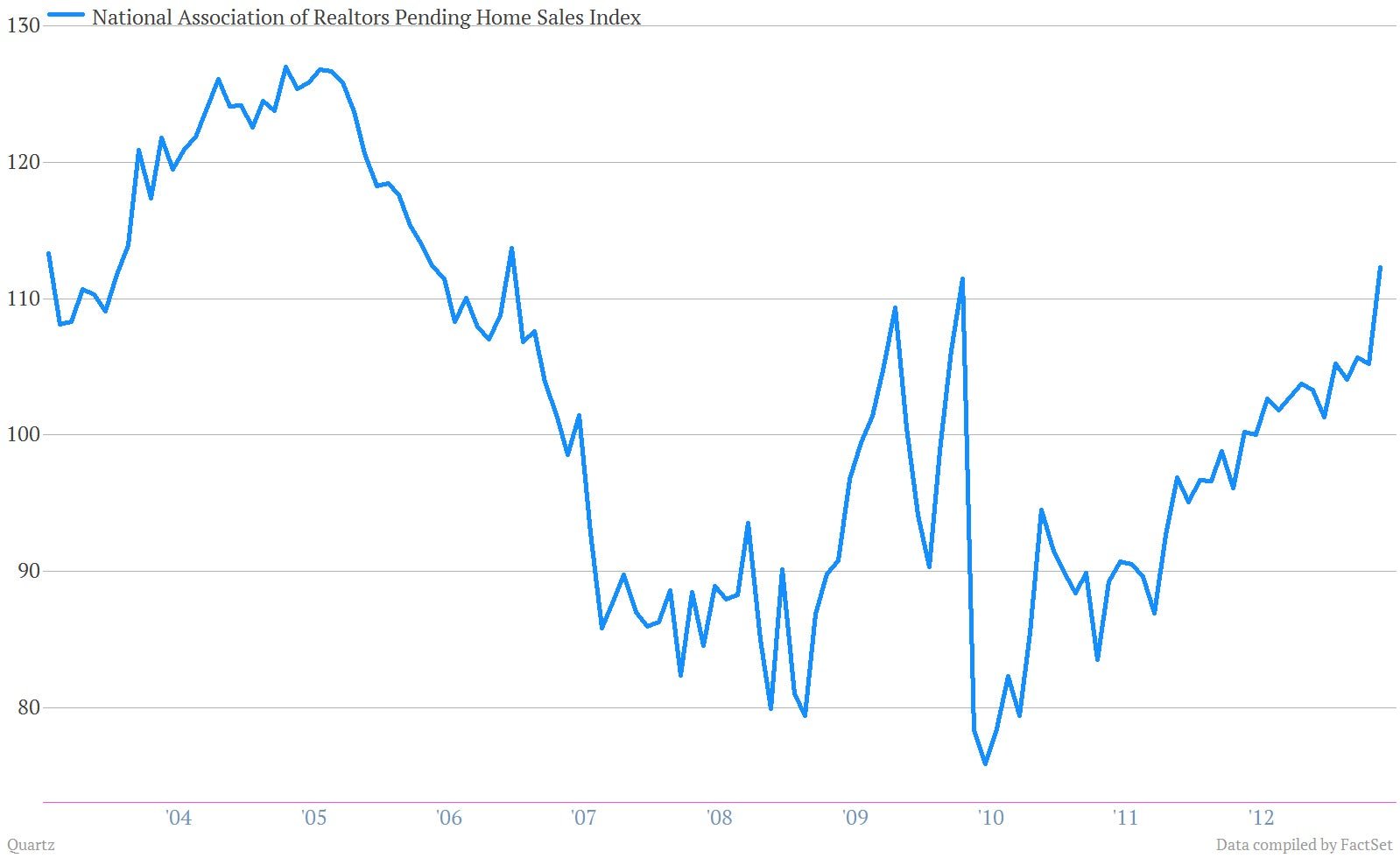

What’s driving the Russell’s stellar performance? Probably consumer spending, since the two biggest purchases for most American consumers—cars and houses—have been relatively strong lately.

Car sales hit a post-crisis high in June.

Housing sales hit their post-crisis high in May.

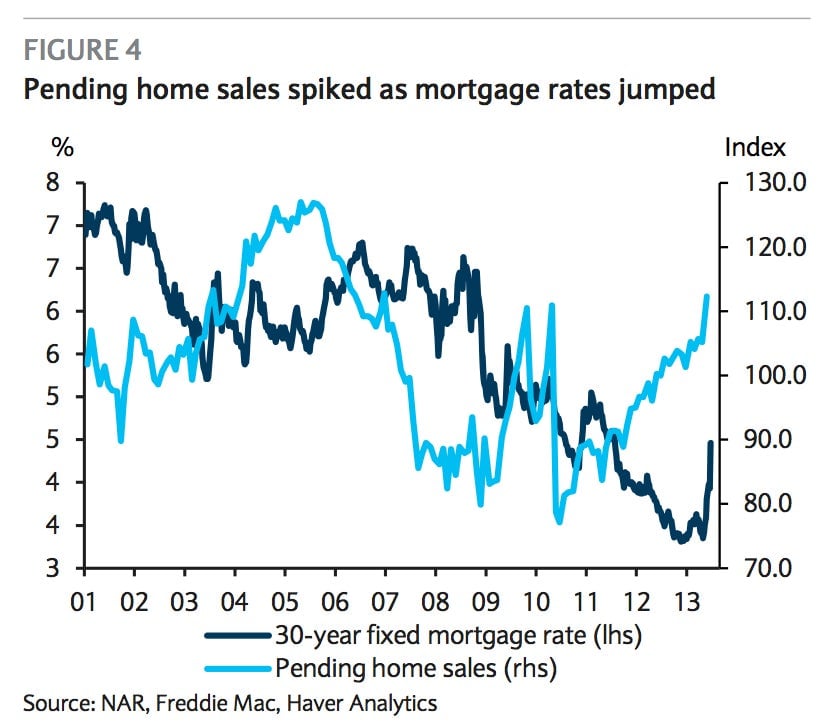

A potential problem with this good news: those sectors are especially sensitive to interest rates and have benefitted from the Federal Reserve’s efforts to keep rates low. The Fed’s recent suggestions that it may soon wind down those efforts has already pushed rates up, which could slow those parts of the economy.

Some analysts think the US recovery could endure rate hikes. Check out this chart from Barclays, which shows home sales surging right alongside interest rates. More of that would be a very good sign.