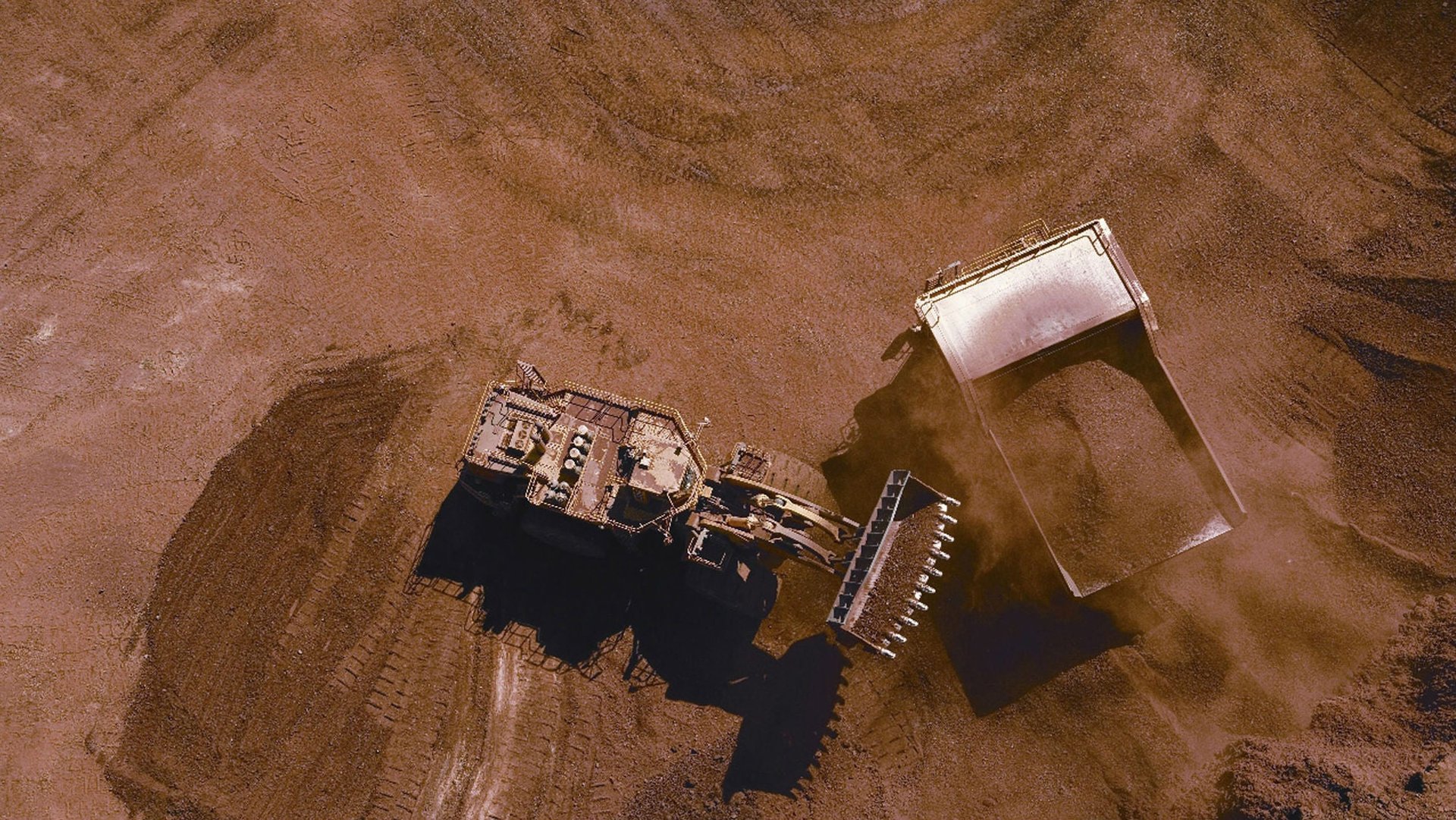

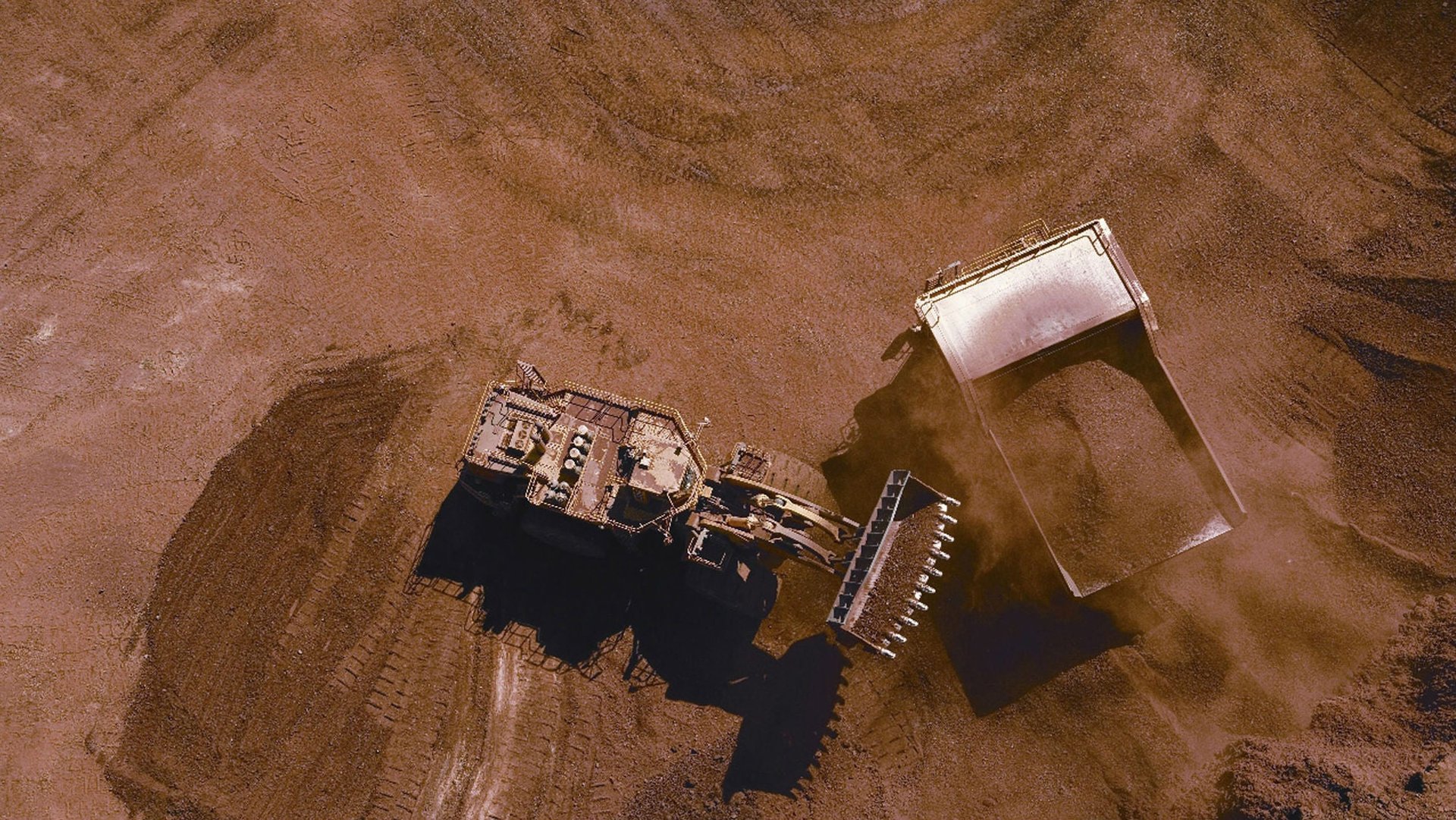

Forget manufacturing data. To gauge China’s slowdown, watch iron ore prices instead

Fresh signs of a slowdown in Chinese manufacturing Oct. 1 suggest that there are further adjustments to come for the world-wide network of commodities producers and shippers that feeds raw materials to the Asian giant. While analysts are ambivalent about the extent of the China slowdown, commodities markets have been sending sharp signals. Prices for iron ore dropped sharply in August, casting doubt over the the financial assumptions used to justify a range of investments in commodities projects. Canada’s Financial Post reports:

Fresh signs of a slowdown in Chinese manufacturing Oct. 1 suggest that there are further adjustments to come for the world-wide network of commodities producers and shippers that feeds raw materials to the Asian giant. While analysts are ambivalent about the extent of the China slowdown, commodities markets have been sending sharp signals. Prices for iron ore dropped sharply in August, casting doubt over the the financial assumptions used to justify a range of investments in commodities projects. Canada’s Financial Post reports:

With virtually no warning, the iron ore price fell off a cliff in August, plummeting about 30%. It was below US$85 a tonne by early September, compared with almost US$200 a tonne in 2010.

It was due to events in China, where iron ore demand vanished overnight as steelmakers went on a buyer’s strike and liquidated their inventories. This was the first major blow to the iron-ore market since the 2008 financial crisis, and it provided a hint of what a prolonged Chinese slowdown could mean for this sector.

The drop rattled investors in the Labrador Trough. At what point, they wondered, would this price volatility become a threat to the billions of dollars of planned investments in the region?

They didn’t have to wait long to get one answer. Labrador Iron Mines Holdings Ltd., a junior that is already in production, halted all capital spending in early September and stopped operating one of its processing plants.

“It was something that we had to do, and we did it quickly and decisively,” chief executive John Kearney says. “The month of August was surreal.”

That snapshot underscores how important the fate of China’s manufacturing sector is to the world economy, especially other commodity countries such as Canada and Australia, as well as planned tie-ups between global commodities giants Glencore and Xstrata, as Quartz’s Steve LeVine just pointed out.