These 17 words from Bernanke are pushing stocks back to record highs

Comments from Federal Reserve Chairman Ben Bernanke are giving global markets a lift today. The money quote came in a question and answer session yesterday following the US central bank head’s remarks at a National Bureau of Economic Research confab in Cambridge, Mass.

Comments from Federal Reserve Chairman Ben Bernanke are giving global markets a lift today. The money quote came in a question and answer session yesterday following the US central bank head’s remarks at a National Bureau of Economic Research confab in Cambridge, Mass.

“A highly accommodative monetary policy for the foreseeable future is what is needed for the US economy.”

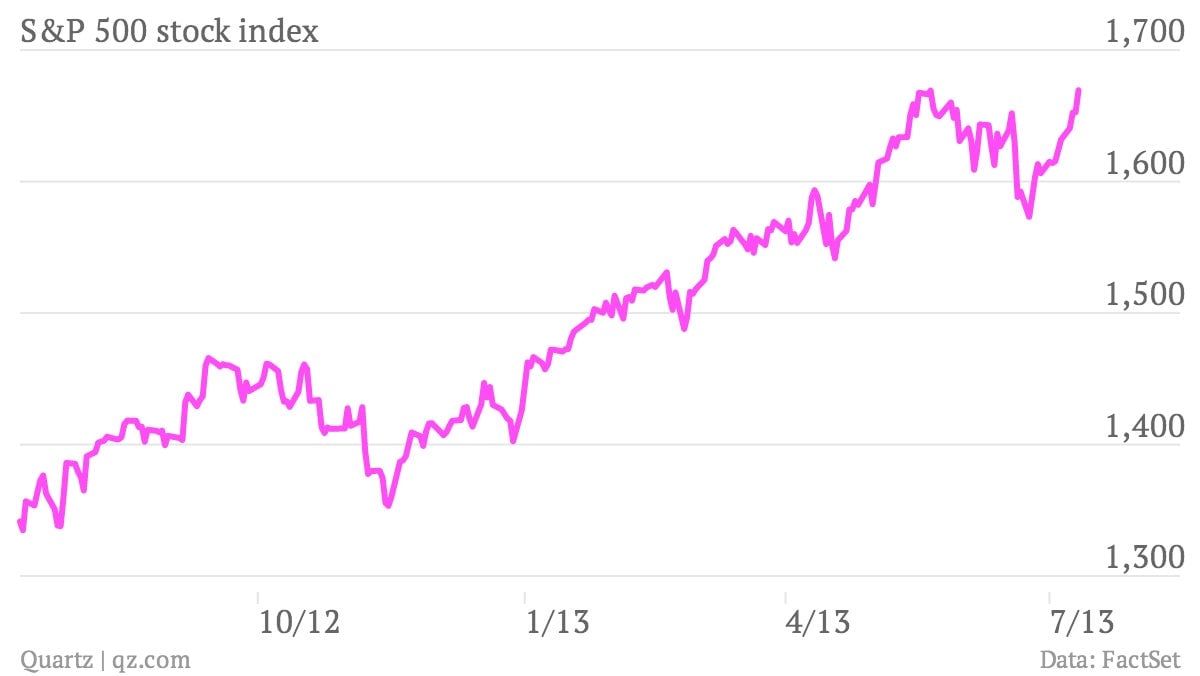

In recent months Bernanke seemed to suggest that the Fed might be closer to easing up on some of bond-buying programs it put in place to trying to keep rates low and support the economy. That seemed a major shift. And solid US economic data seemed to support the case for the Fed providing less help. The markets reacted. US interest rates jumped sharply. Retail investors started yanking cash from bond funds. Stocks softened. Emerging market bonds and stocks got hammered.

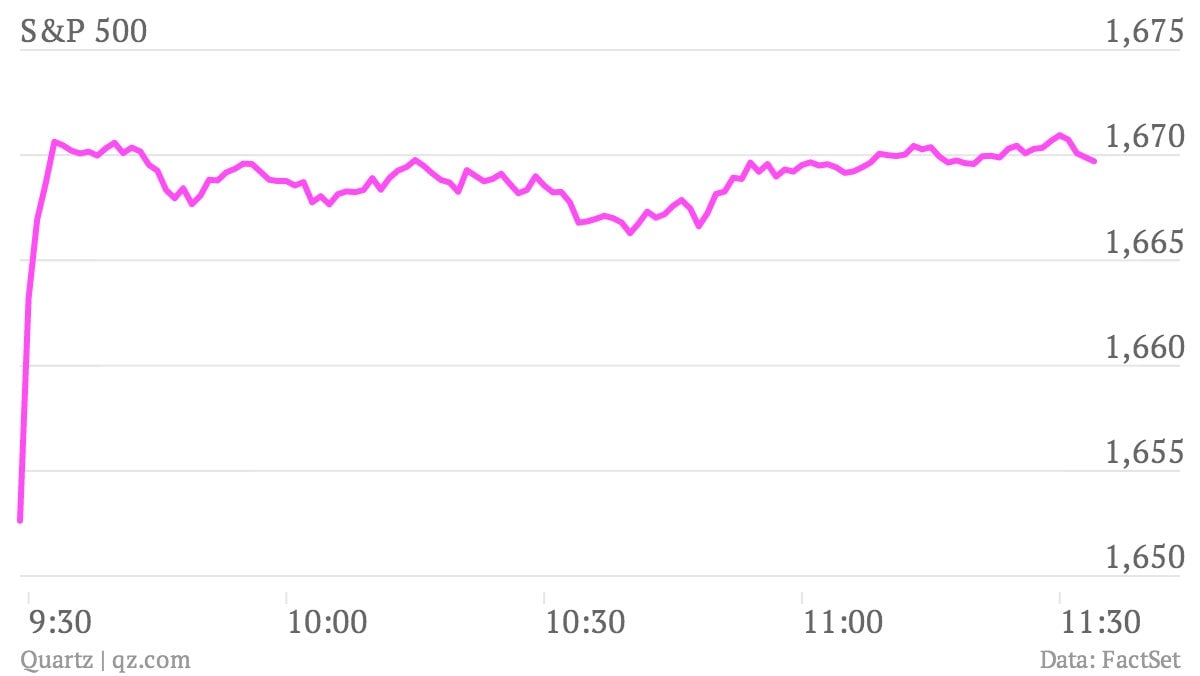

So, traders and investors found it pretty soothing to hear Bernanke seem to restate that the Fed’s guiding hand would stay on the markets for awhile. US stocks jumped at the open. And they have held their 1% gain through the morning.

In fact, if the market holds this level it would be another record high close, beating the May 21 finish of 1669.16 for the Standard & Poor’s 500 index. That would erase most of the recent softness in stocks, which began on May 22, when Bernanke first floated the idea of easing up on the Fed’s help for the economy.

You can make the argument that what Bernanke actually said shouldn’t be seen as that huge of a boon for the stock market. After all, even if the Fed cuts back on its bond buying support programs, monetary policy would still be “highly accomodative.” But who are we to argue with “efficient” markets?