Meet the American property tycoon set to control China’s answers to Netflix and Disneyland

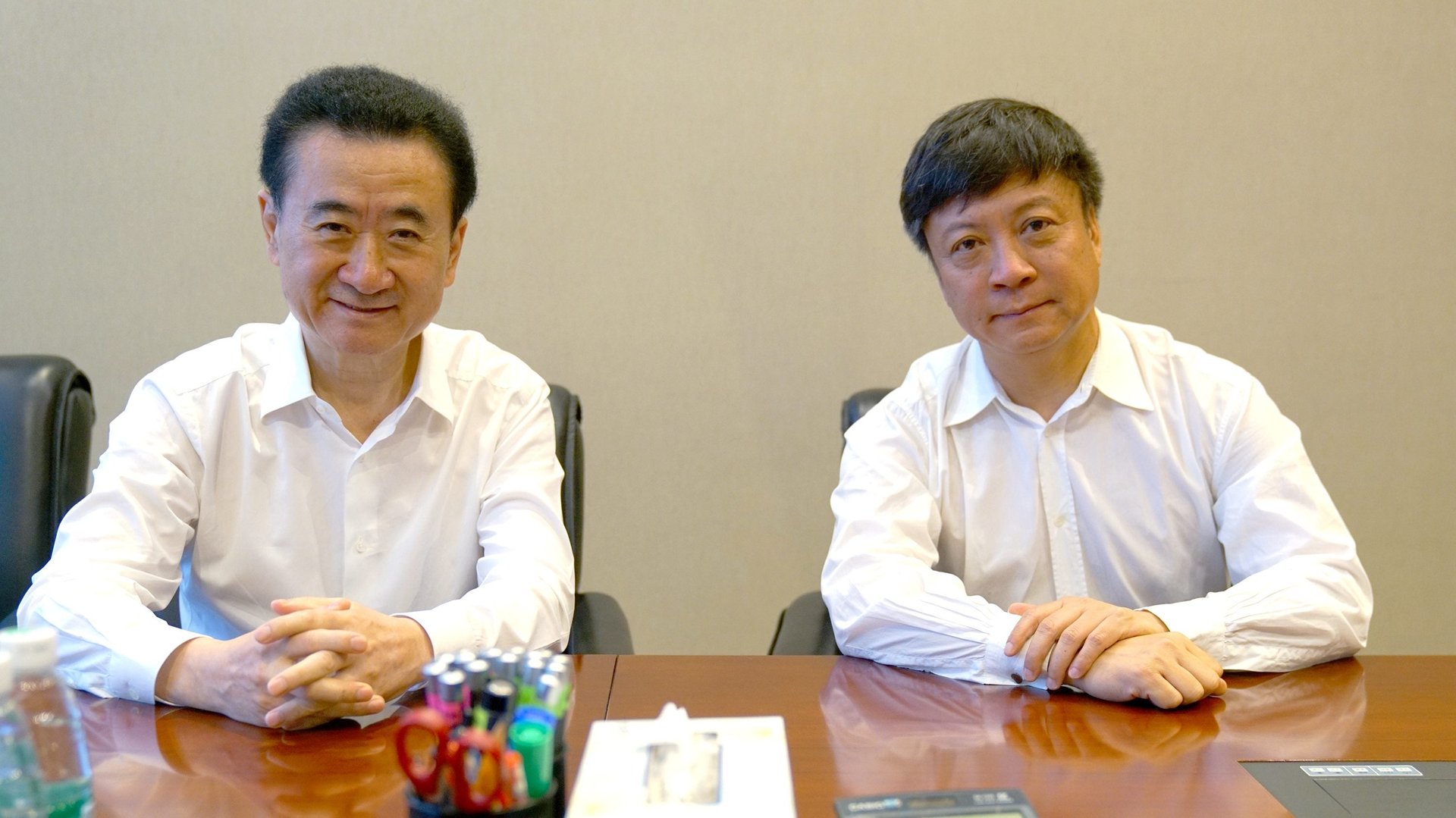

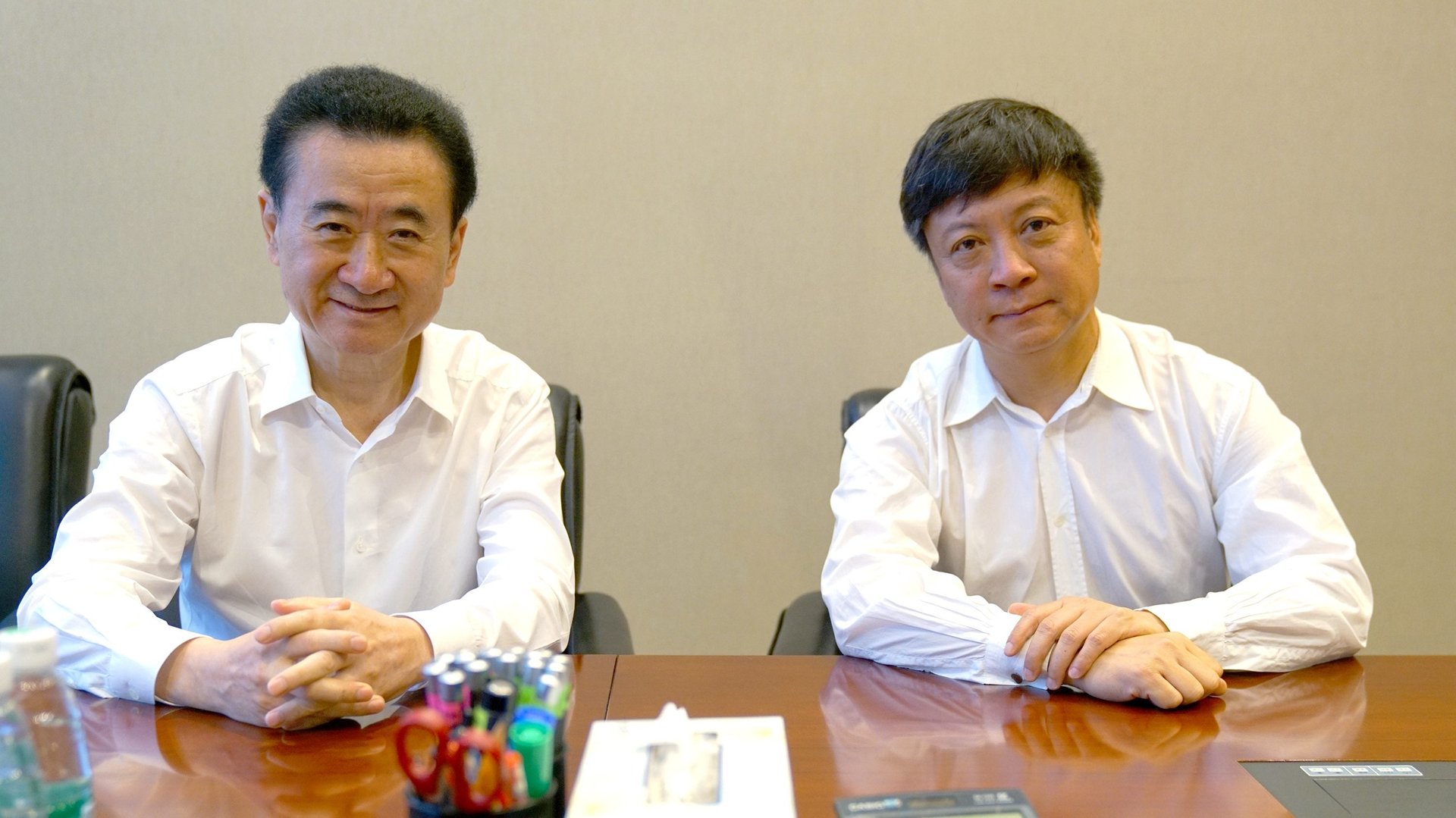

Some Chinese business moguls fall dramatically from grace. Others can bounce back from tough times to reach new heights. Right now, tycoon Sun Hongbin (pictured right) is squarely in the latter camp, with a giant leap this week into China’s entertainment industry.

Some Chinese business moguls fall dramatically from grace. Others can bounce back from tough times to reach new heights. Right now, tycoon Sun Hongbin (pictured right) is squarely in the latter camp, with a giant leap this week into China’s entertainment industry.

The 54-year-old American citizen, who served time for an embezzlement charge of which he was later cleared, is the founder and chairman of Sunac China Holdings, one of China’s largest and fastest-growing property developers. Sun graduated with a master’s degree in engineering from Beijing’s prestigious Tsinghua University and later attended a program at Harvard Business School while he was working at Chinese computer maker Lenovo. His youngest son Steven won the boys’ 16s singles title during an international tennis championship held in Florida in 2016, according to Sun’s latest post on Chinese microblogging site Weibo.

This week, Sunac, based in the northeastern port city of Tianjin, announced that it would buy a 91% stake in 13 tourism projects from Dalian Wanda Group, owned by China’s richest man Wang Jianlin, who once declared that his amusement parks would crush Disneyland in China.

The $6.5 billion deal came not long after Beijing, concerned about capital outflows, reportedly urged banks to take a closer look at Chinese firms that carried out massive overseas deals in recent years, like Wanda. The conglomerate bought AMC theaters in the US in 2012 and film studio Legendary Entertainment in 2016, spurring concern in Hollywood over Chinese influence in the industry.

But things took a turn when earlier this year, Wang confirmed in an interview with the Financial Times (paywall) that Beijing torpedoed his $1 billion purchase of American TV production company Dick Clark. And in a bid to reduce some of its 200 billion yuan ($30 billion) debt load, Wanda will also sell 77 of its hotels in China to Guangzhou-based R&F Properties for around $3 billion, it said yesterday (July 19) at a press conference.

Sunac was supposed to buy those hotels but backed out of the deal, according to announcements released by Wanda and Sunac last week. One reason may be that Sunac has already spent over 100 billion yuan–including the Wanda acquisitions–so far this year on M&A and land purchases, according to an estimate from credit ratings agency S&P. Last week, S&P downgraded Sunac’s long-term corporate bonds, and assessed its financial discipline as “negative.”

This isn’t Sun’s only entertainment play. Sun has also made headlines for his connection to another troubled Chinese company, tech conglomerate LeEco. Sun is expected to be elected chairman of the board of Leshi Internet Information & Technology Corp. Beijing, the Shenzhen-listed arm of LeEco, during a board meeting today (July 20), according to reports from financial magazine Caixin (link in Chinese) and the Financial Times (paywall).

LeEco, often known as “the Netflix of China” for getting its start in video streaming, was in a cash crunch at the end of last year after it expanded rapidly in businesses ranging from smartphones to sports streaming to electric cars. Leshi last year generated a record 22 billion yuan in revenue, but its net profit declined for the first time in six years, due to expansion in the smart TV sector, according the company’s annual report.

Earlier this year, LeEco founder Jia Yueting secured a $2 billion investment from Sun in various LeEco subsidiaries. As part of the deal, Sun became the second-largest shareholder of Leshi after Jia. Later, Jia resigned from his posts as CEO and chairman of Leshi, LeEco’s core video-streaming unit.

Sun mentioned in a July 17 news conference (link in Chinese) that Wanda and LeEco could cooperate in film production and distribution.

A spokesperson for Sunac didn’t reply to a request for comment.

The Wanda projects Sunac now owns will remain branded as part of Wanda Cultural Tourism City, a collection of theme parks, movie parks, aquariums, golf courses, and retail stores spanning China’s biggest cities and small towns. It looks like the job of crushing Disneyland will now fall to Sun.