Singapore’s GDP bounced back big-time in Q2, but don’t assume it will last

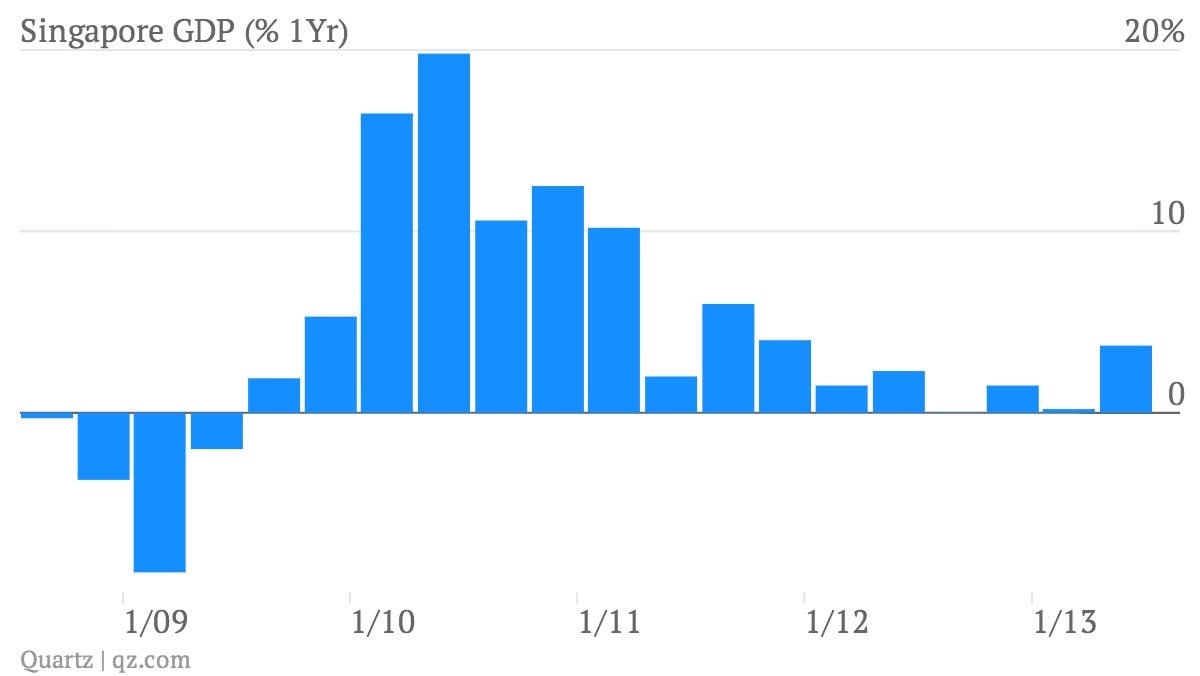

Singapore’s Q2 GDP was up 3.7% (pdf) compared with Q2 2012, based on advanced estimates from Singapore’s Ministry of Trade and Industry. That’s the biggest increase since 2011. The GDP grew an annualized 15.2% compared with the first quarter, after seasonal adjustments, far exceeding expectations, reports Reuters.

Singapore’s Q2 GDP was up 3.7% (pdf) compared with Q2 2012, based on advanced estimates from Singapore’s Ministry of Trade and Industry. That’s the biggest increase since 2011. The GDP grew an annualized 15.2% compared with the first quarter, after seasonal adjustments, far exceeding expectations, reports Reuters.

Here are the main takeaways:

- Manufacturing picked up, growing 1.1% in Q2 2012, compared with a 6.9% contraction in Q1 2013. The government attributed this to soaring trade in biomedical manufacturing and electronics clusters.

- Construction surged 5.6% compared with the same period last year. That’s still strong, though it’s down slightly from the 6.8% growth in the first quarter.

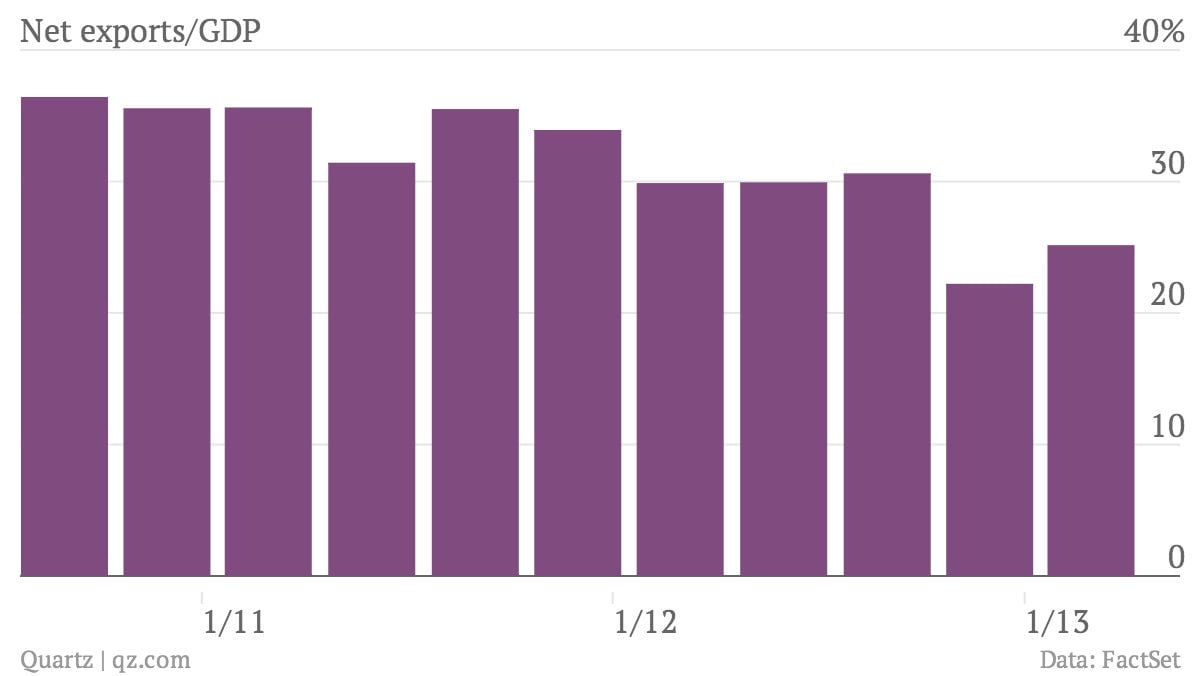

- The rebound might not be sustainable. Singapore’s economy is highly dependent on trade, and as the state of the global economy has worsened, net exports have powered less and less of its growth (Q2 net exports have not yet been released):

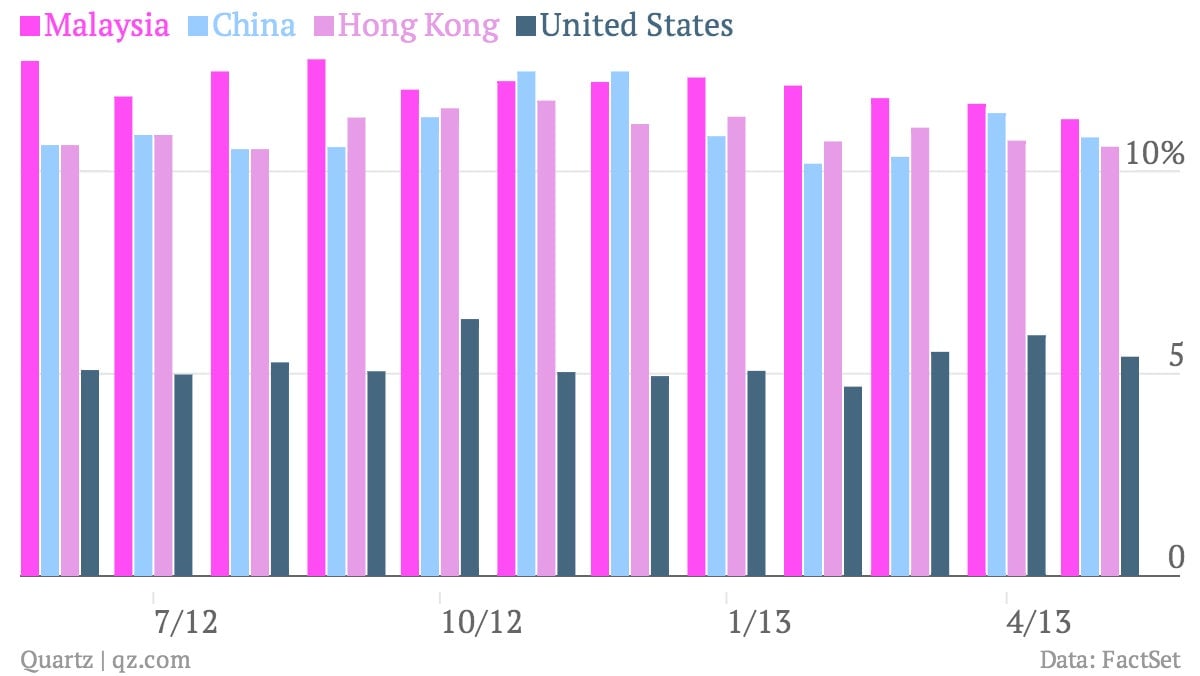

As you can see in the chart above, the combined weight of China and Hong Kong would likely offset surges in demand from Malaysia and the US.