Every state wants to build the next Silicon Valley, but Wisconsin’s attempt has the best name

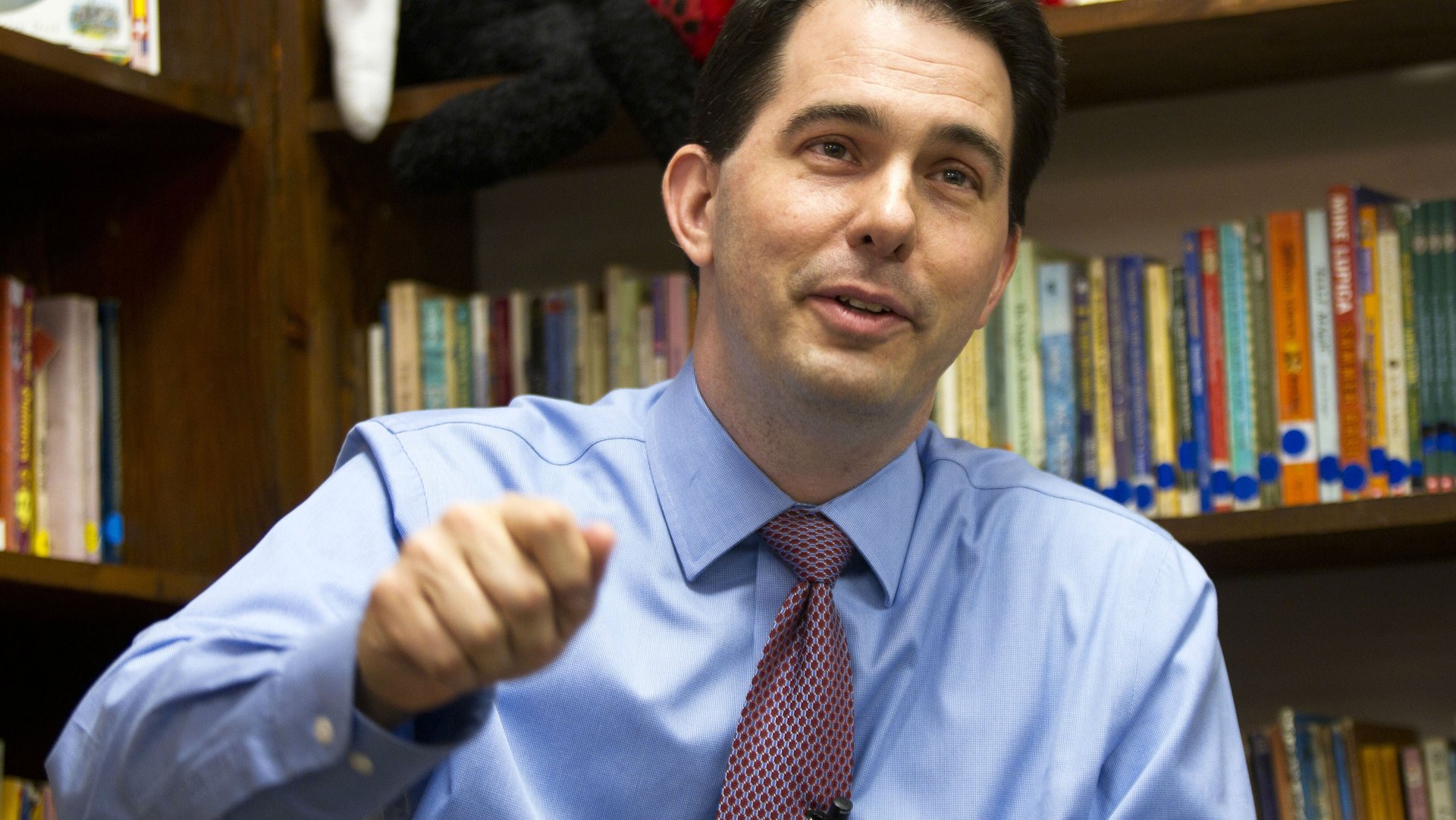

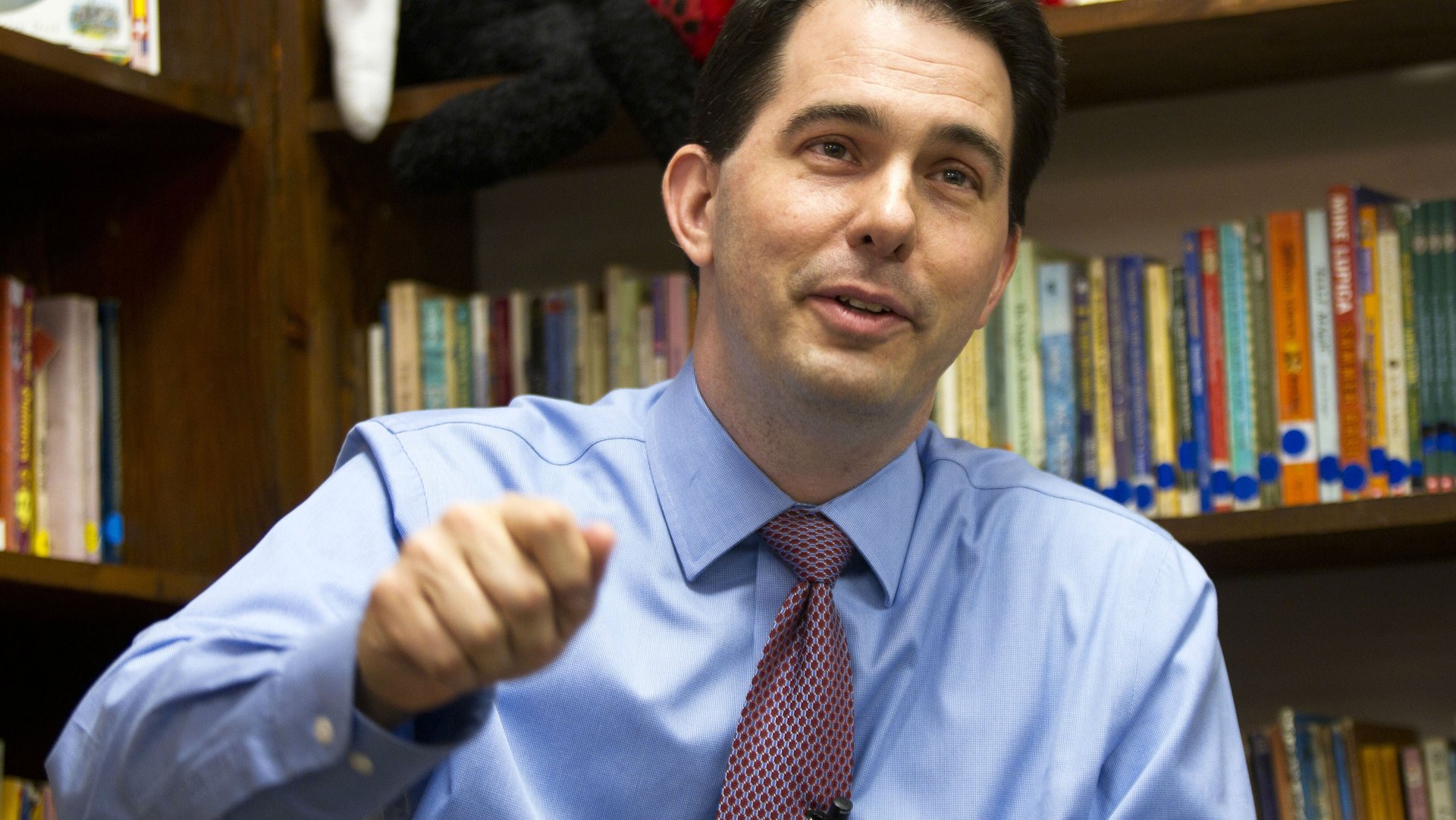

The day after Foxconn, one of the world’s largest electronics manufacturers, announced plans to build a $10 billion LCD screen factory in Southeastern Wisconsin, governor Scott Walker hosted an event for business leaders at which he and Foxconn founder and chairman Terry Gou signed a memorandum of understanding about the plan. On the badges of each attendee were written in big block letters the words that have become the governor’s defacto slogan for the project: “Welcome to Wisconn Valley.”

The day after Foxconn, one of the world’s largest electronics manufacturers, announced plans to build a $10 billion LCD screen factory in Southeastern Wisconsin, governor Scott Walker hosted an event for business leaders at which he and Foxconn founder and chairman Terry Gou signed a memorandum of understanding about the plan. On the badges of each attendee were written in big block letters the words that have become the governor’s defacto slogan for the project: “Welcome to Wisconn Valley.”

“We are calling this development ‘Wisconn Valley,’” Walker had recently told the Washington Post, “because we believe this will have a transformational effect on Wisconsin just as Silicon Valley transformed the San Francisco Bay area.”

The slogan “Wisconn Valley” was also prominently featured in a fact-sheet about the deal distributed to lawmakers, and as a hashtag on the governor’s tweets.

Experts say turning Wisconsin into the next Silicon Valley—an ecosystem of skilled labor and support that attracts these companies—will involve more than one Foxconn factory.

“I think it’s the dream of every mayor, governor, and every political leader not just in the United States, but all around the world, that we’re going to turn ourselves into the next Silicon Valley,” says Christopher Balding, a professor of economics at Peking University. “If you look back on places where there is an industrial cluster, a lot of times there is a seed in getting the ball rolling. It’s totally possible that the Foxconn factory is the seed that gets the ball rolling on an industrial cluster. However history also tells us that there are more of these events that don’t result in an industrial cluster.”

Eli Friedman, an associate professor of international and comparative labor at Cornell University, called the idea that Wisconsin could become the next Silicon Valley “preposterous.”

“Silicon Valley became what it is today precisely at the moment that production was leaving, much of it headed to Asia,” he says. “The intellectual property associated with manufacturing that takes place in Wisconsin will be owned by Foxconn or whichever brand Foxconn is supplying, and there is little reason for the company to relocate R&D or other high skilled, highly paid jobs.” Walker said the jobs created at the Foxconn factory would pay an average salary of $53,875 plus benefits.

After losing a third of its manufacturing jobs over the past two decades, many industry leaders believe that the United States now has a new opportunity to gain market share in what a recent McKinsey report called a “new kind of digital manufacturing” that relies less on human labor for routine work. States have competed to host these factories.

But large factories alone do not a Silicon Valley make, partly because they’re expensive. Foxconn will be eligible for between $200 million and $250 million per year in economic incentives after it builds the factory, where it expects to employee 3,000 people within four years (with “potential to grow” to 13,000). When fully staffed, its payroll is projected to be around three times that amount, $700 million per year. “Wisconsin can only have so many $10 billion plant investments before they face a real budgetary problem,” Balding says.

Rather, Balding argues, creating an industrial cluster in Wisconsin is more likely to depend upon the development of suppliers and support companies, things like business parks and venture capital firms.

Foxconn could possibly jump start such an ecosystem (according to the governor’s office, the company will spend about a third of its $4.26 billion supplier purchases in the state) but at this point, it hasn’t started to build the factory.

“Wisconn Valley,” like the factory that inspired it, still has a long way to go until it’s up and running.