That collapse in June US housing starts isn’t as scary as it looks

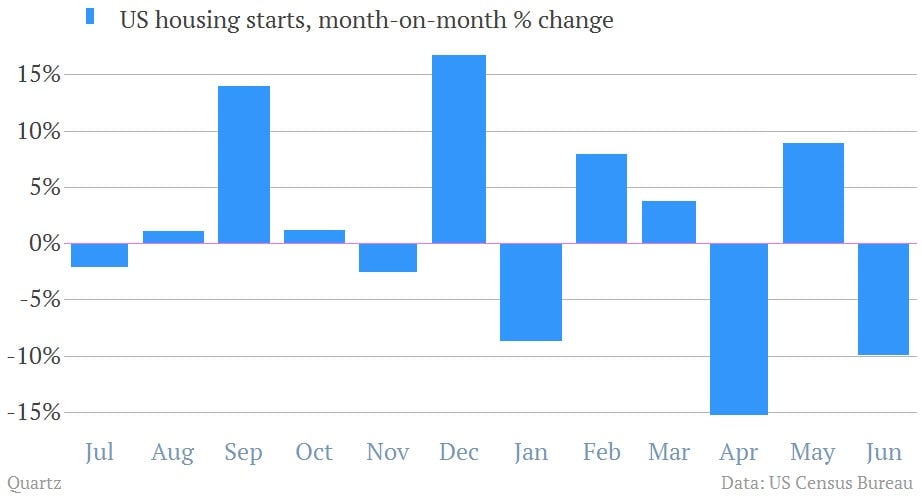

The headline 9.9% drop in US housing starts looks pretty bad. Is the driving force behind the US recovery—which Federal Reserve chairman Ben Bernanke placed first and foremost in his just-released congressional testimony—starting to falter?

The headline 9.9% drop in US housing starts looks pretty bad. Is the driving force behind the US recovery—which Federal Reserve chairman Ben Bernanke placed first and foremost in his just-released congressional testimony—starting to falter?

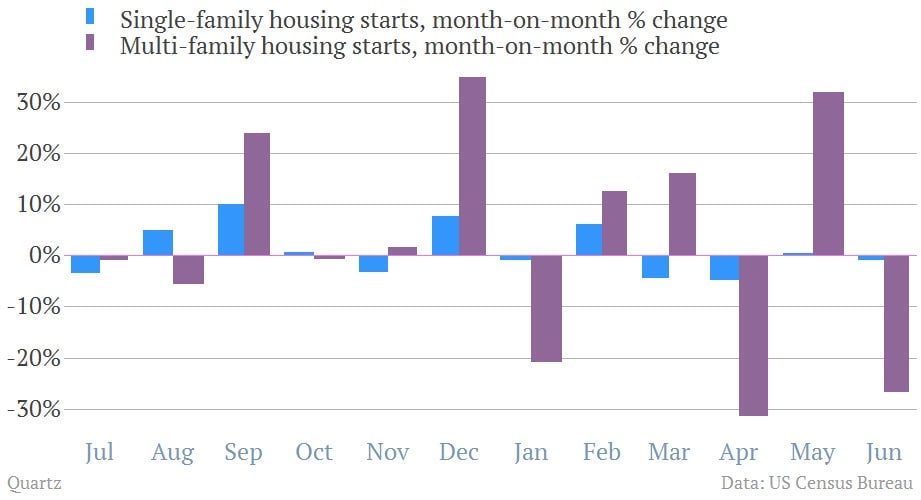

Short answer? No. The sharp falloff in June was led by a more than 26% decline in starts in the notoriously choppy multi-family housing starts. But what’s crucial to the US recovery is the single-family sector. That also declined slightly, by 0.8%. But it’s still not nearly as bad as 9.9%.

The single-family decline isn’t great. But we wouldn’t worry about it too much. After all, the home builders themselves are in the best mood they’ve been in since early 2006. And they’re the ones who can see what’s in the order books.