The EU may make it easier for Britain to sign a post-Brexit China trade deal

The European Union’s plan to make it harder for China to acquire European companies could make it easier for Britain to forge a trade deal with Beijing after Brexit.

The European Union’s plan to make it harder for China to acquire European companies could make it easier for Britain to forge a trade deal with Beijing after Brexit.

That’s one scenario following a “hard Brexit,” in which the UK retains few, if any, special links to the EU. This would free the UK from the bloc’s rules and restrictions, like the one that requires trade deals to be negotiated by Brussels on behalf of member states. Considering Britain’s desire to sign its own trade deals to bolster its economy post-Brexit, it could emphasize its differences to the EU as part of the negotiations.

Brussels is expected to push back on Chinese takeovers of European companies in key areas such as infrastructure and manufacturing by pushing for more “rigorous screening,” according to the Financial Times (paywall). This is after months of reports that the EU and US have been fretting about China gaining a technological edge by taking over key companies abroad.

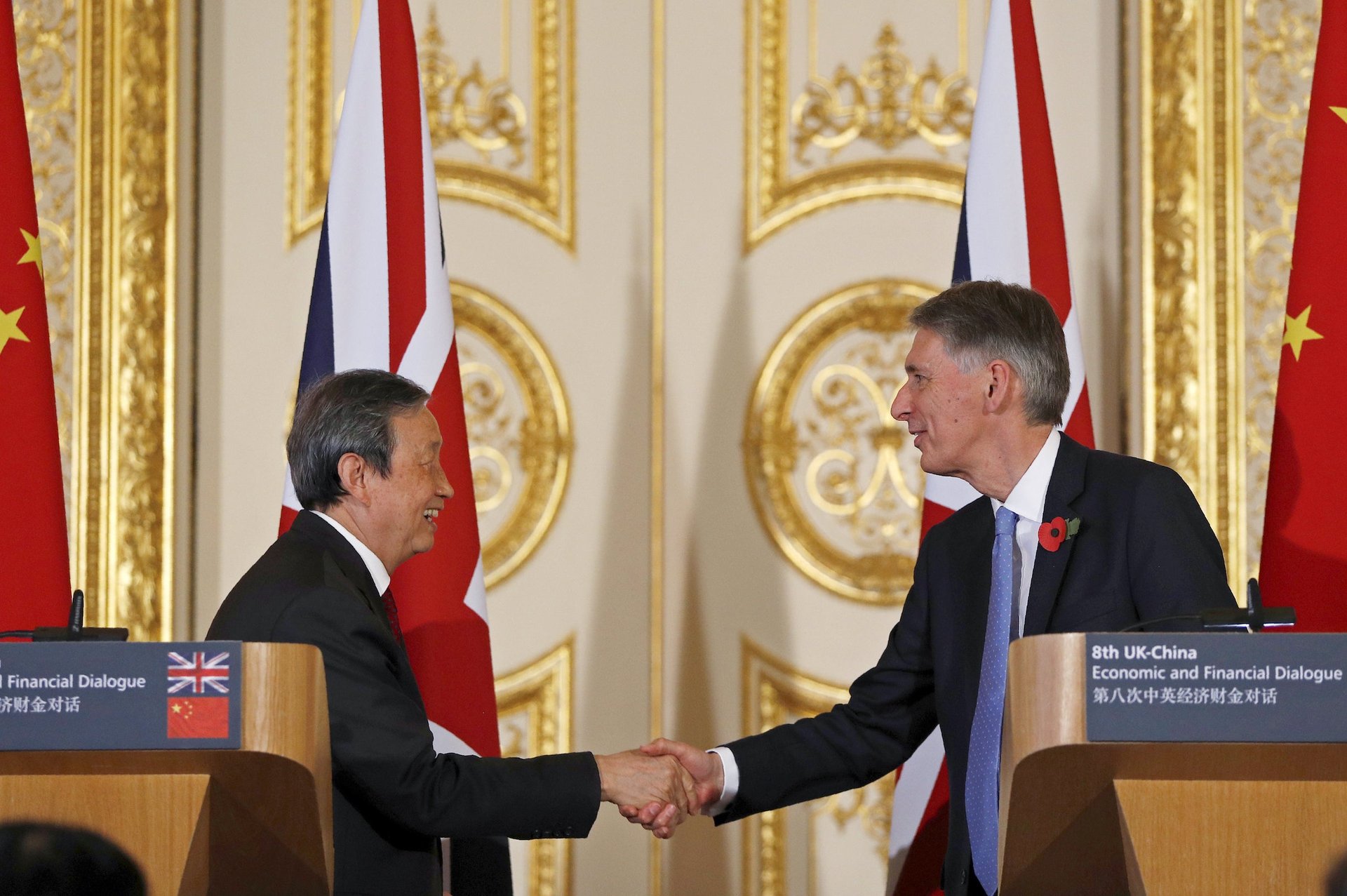

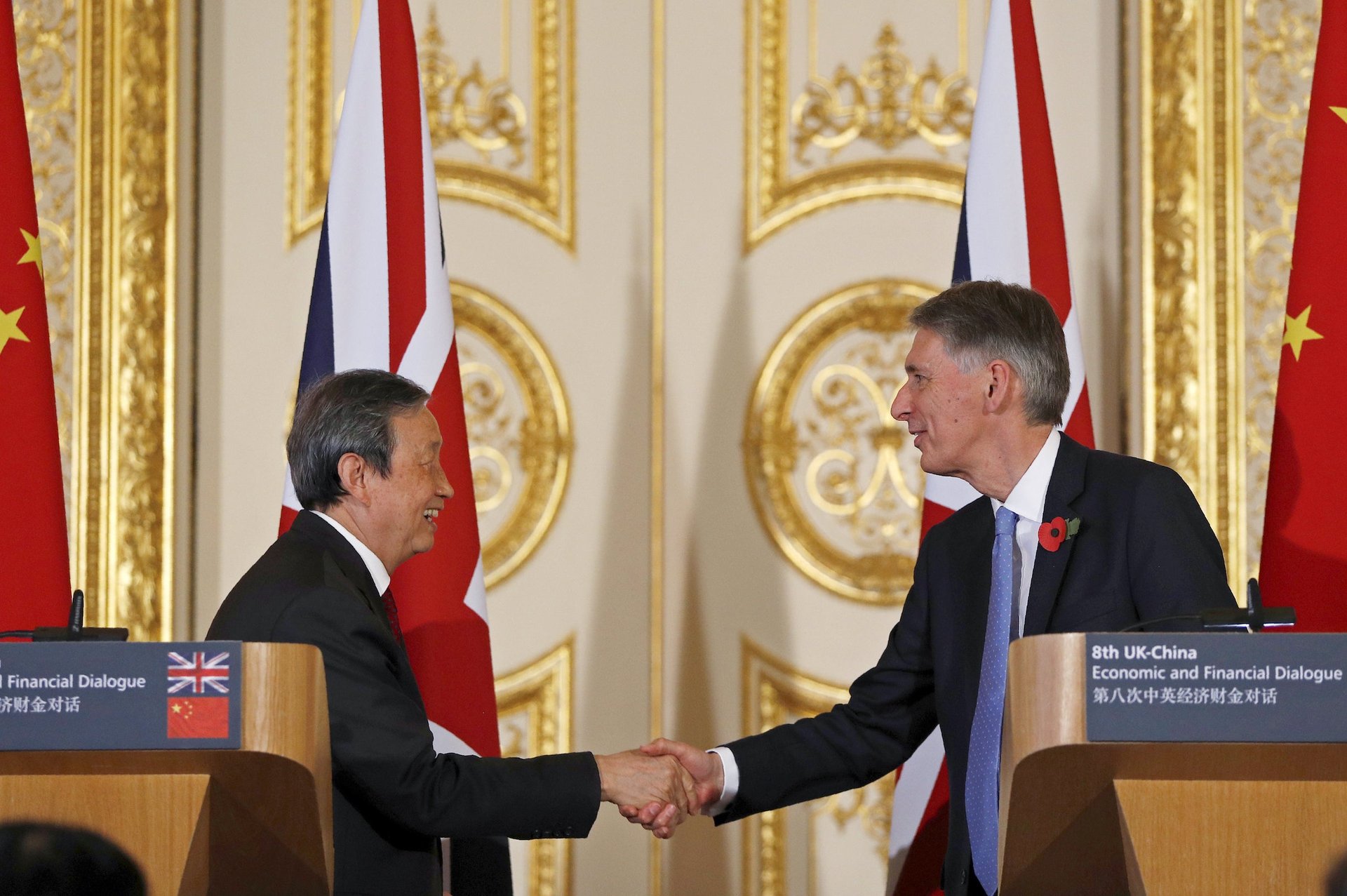

With Britain heading towards a “hard Brexit,” it will be pretty desperate for new trade deals to replace the ones it benefited from as a member of the EU. Prime Minister Theresa May has dispatched key members of her cabinet around the world for talks, pledging to seal its trade deals (pay wall) as soon as possible with major economies.

Even if the EU makes it harder for China to seal deals, there are obstacles for Britain to overcome when it comes to convincing China to give it more attention. The uncertainty about the effects of Brexit has dampened GDP growth, and the potential destabilizing impact of a “hard Brexit” (paywall) may put off investors from sinking money into the economy in the future.

But China appears to have a strong appetite for investing in Britain. Even when its ambassador to UK government grumbled about its $20 billion-plus nuclear power deal being put on hold (it is partly financed by a Chinese consortium), he also noted that ”I hope the UK will keep its door open to China” (paywall).

China is the sixth-largest investor in Britain, according to Grant Thornton. London, in particular, has been the destination for large-scale investments, including China’s CC Land buying the iconic “Cheesegrater” skyscraper for £1 billion ($1.29 billion) earlier this year.

There are some suggestions that Chinese investors are taking a breather while they see how Brexit talks shape up. But Dealogic says that more $15.6 billion worth of M&A deals by Chinese buyers are currently pending in the UK. If completed, these deals alone would exceed all of the deals made by Chinese entities in 2016, itself a bumper year.