Verizon Wireless keeps racking up subscribers

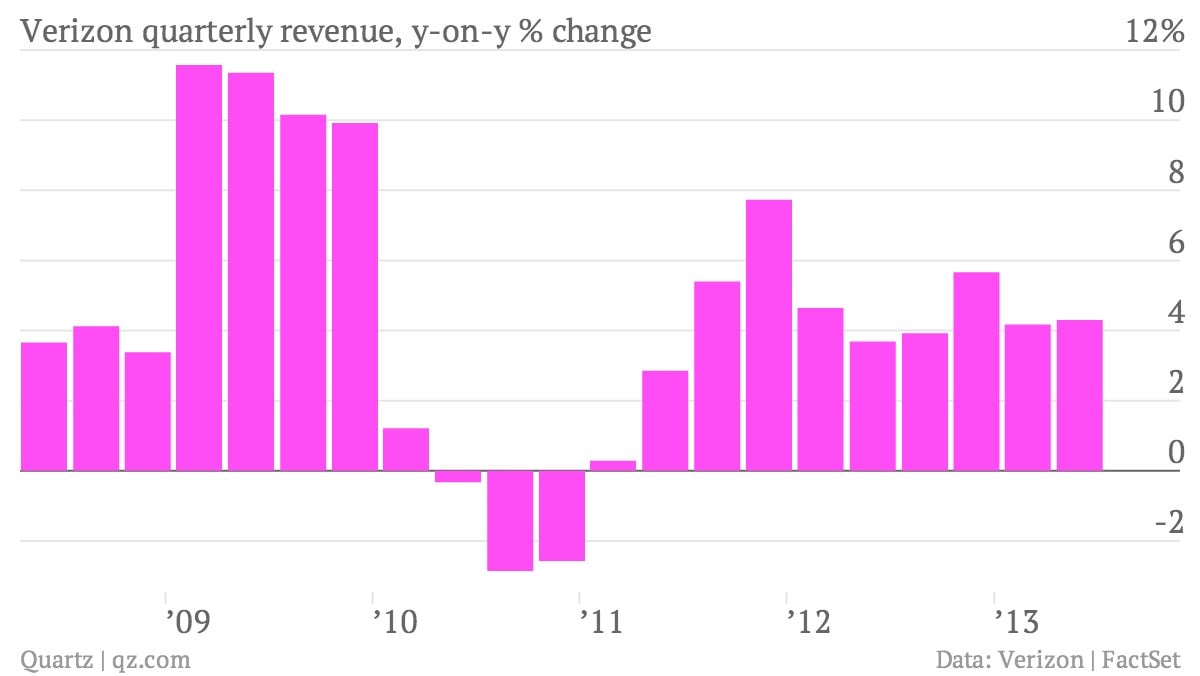

The numbers: Solid. Revenues rose 4.3%. Verizon profits increased 23%. It added 941,000 contract wireless subscribers, the most profitable kind. That’s a 6% year-over-year increase. But investors didn’t seem too impressed; the stock is down.

The numbers: Solid. Revenues rose 4.3%. Verizon profits increased 23%. It added 941,000 contract wireless subscribers, the most profitable kind. That’s a 6% year-over-year increase. But investors didn’t seem too impressed; the stock is down.

The takeaway: Verizon wireless is growing like gangbusters. Unfortunately, the New York-based telecom giant doesn’t get all the profits. Verizon Wireless is a joint venture with Vodafone, which is entitled to 45% of the bottom line.

What’s interesting: Verizon has been trying to get Vodafone to part with its share of Verizon Wireless for years. Vodafone is understandably reluctant to let such an investment go, but Verizon may start playing rough. Its agreement with Vodafone says it has to pay up, but it doesn’t say when. Verizon is making noises (paywall) about opting instead to pay down debt rather than pay the large dividend, which would deprive Vodafone of a big chunk of its revenue and raise pressure on the company.