Meet the world’s hot new growth market: the US

So far this earnings season, the winning growth market for investors isn’t tech or China or frontier economies. It’s the US.

So far this earnings season, the winning growth market for investors isn’t tech or China or frontier economies. It’s the US.

GE’s just-released earnings spotlighted strength in the US, where orders were up 20%, which CEO Jeff Immelt called “the strongest we’ve seen in some time.”

Fellow industrial conglomerate Honeywell mentioned that the US housing rebound was bolstering its businesses that make residential heating and cooling equipment, as well as fire alarms and security systems. “The numbers are all better in the U.S. for those businesses,” CEO Dave Cote said in a conference call with analysts.

Also today, appliance maker Whirlpool boosted its full-year US shipments forecast on expectations that demand tied to US housing will increase.

It doesn’t take complex math to figure out what’s going on here. The US economy is emerging from the economic wreckage of the financial crisis more heartily than many other regions of the world. Europe continues to struggle. China is about to hit the wall. (At least according to Paul Krugman.) And from India (paywall) to Brazil, emerging markets that were supposed to drive corporate growth are looking increasingly like big letdowns.

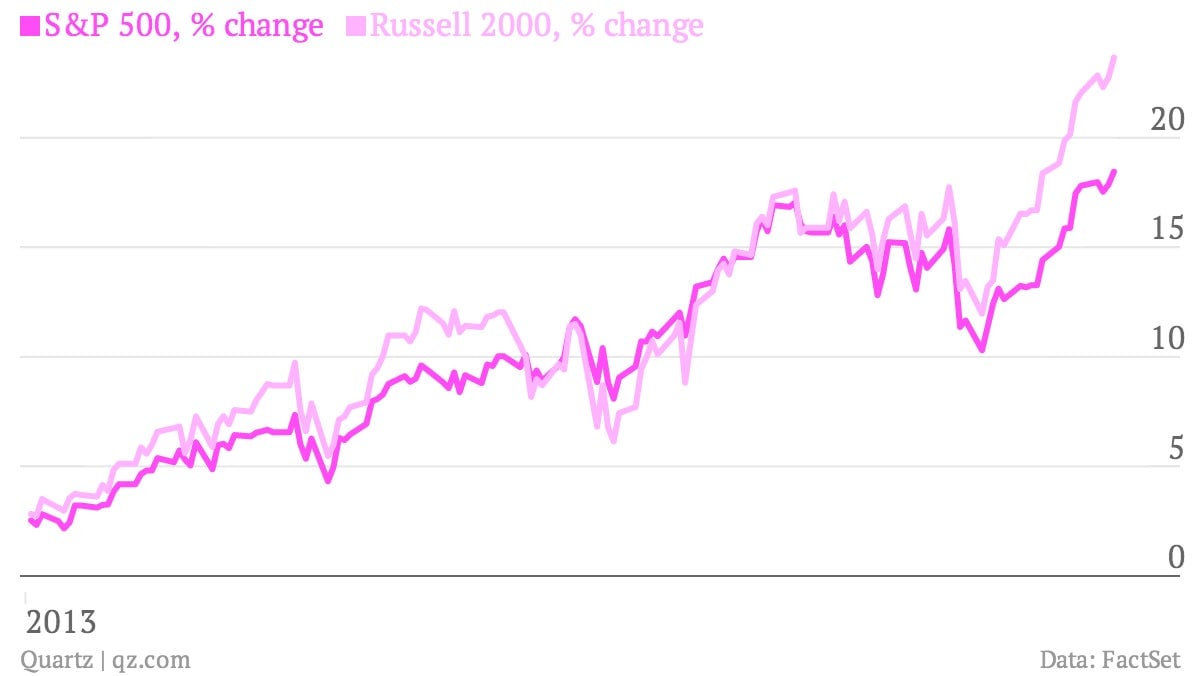

Investors seem to have taken note. Check out how the US-centric Russell 2000 index of small capitalization stocks is racing ahead of the broader, blue-chip stock market measures over the last few weeks. That’s partly because larger companies have more exposure to the global slowdown.

A Barclays analysis of earnings reports among Russell 3000 companies—a broad measure of both large and small-cap stocks—shows that companies with more than 30% of sales from outside the US have posted year-over-year sales growth that was worse than companies with less than 30% of sales sourced overseas. “Clearly, the domestic economy is supporting US equities growth and, thus far, somewhat offsetting the drag from abroad,” Barclays analysts wrote.