Hedge funds are rushing into cryptocurrencies to juice their weak returns

Hedge funds have been trounced by the stock market in recent years. Now they are eyeing a new asset class that might provide the big returns their clients pay them to produce: bitcoin and cryptocurrencies.

Hedge funds have been trounced by the stock market in recent years. Now they are eyeing a new asset class that might provide the big returns their clients pay them to produce: bitcoin and cryptocurrencies.

Bitcoin has risen nine-fold in the last 12 months and is trading at an all-time high. Ether has surged 30-fold this year. Most hedge funds aren’t even beating the S&P 500. Yet they profit handsomely for their underperformance, charging clients the standard 2% in fees and 20% in investment gains. No wonder their customers are bailing out for passively managed assets, like index funds.

The spectacular returns from crypto assets have led more hedge fund managers to investigate them as a new place to put money. ”They want to juice their returns,” says one San Francisco-based analyst, who works at an equity fund with $4 billion under management. The analyst says he’s currently taking a close look at cryptocurrencies, on the direction of his portfolio manager. Cryptocurrencies “are going up, the portfolio managers don’t understand it, and this may last for the next decade, so they need to know. Everyone is talking about it,” says the analyst, who asked not to be named.

Traditional hedge funds aren’t alone. A slew of new vehicles have launched to take advantage of the rising crypto markets. In July, Forbes counted 15 new funds poised for launch, while Autonomous Research tallied 55 active funds. Trade newsletter Hedge Fund Alert reported in July (pdf) that 62 new funds were preparing to launch, citing law and accounting firms who were helping with the process. “It’s just crazy,” one partner at a firm told the newsletter.

One high-profile fund that launched in August is New York-based Blocktower Capital, run by Ari Paul, a former portfolio manager at the University of Chicago, and Matthew Goetz, who was a vice president at Goldman Sachs. With a target of $100 million under management, the two believe they can make a killing in the nascent crypto markets with their institutional experience. “[Blocktower] will be applying the playbook of professional trading and portfolio management from other asset classes like equities and bonds to this alpha-rich environment,” Goetz said.

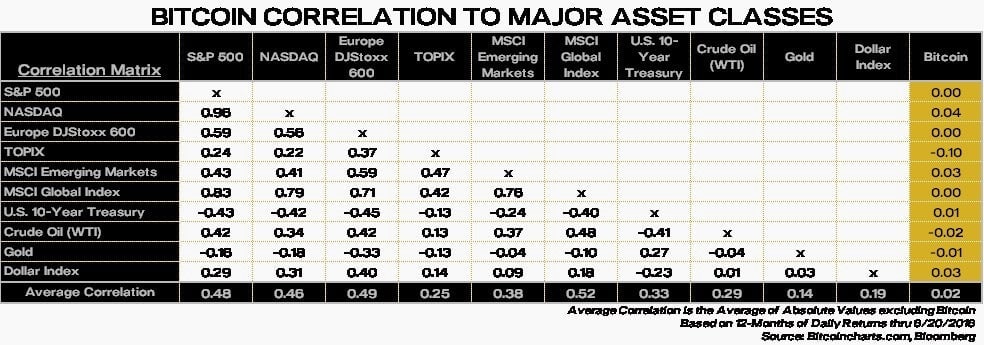

Fund managers aren’t just chasing eye-popping returns. Cryptocurrencies have other useful properties. For instance, their price movements are largely independent of other major asset classes. That’s the argument of Silicon Valley-based Pantera Capital, one of the earliest institutional investors in the area. Pantera was founded by Wall Street titan turned crypto investor Dan Morehead, a former chief financial officer at Tiger Management. It published research last July showing that bitcoin has nearly no correlation to global stocks, commodities, and traditional currencies.

Brian Kelly, who runs crypto hedge fund BK Capital Management in New York, believes the correlation argument is what’s driving new money into the crypto markets. “Digital assets are a new non-correlated asset class for investors. These new funds are responding to demand,” he says.

It might not be as easy to grab a slice of the profits from the “alpha-rich” crypto markets as these new, Wall Street-trained entrants believe. Mike Komaransky, who ran one of the biggest over-the-counter bitcoin trading desks for years at Cumberland Mining, a subsidiary of commodities trading giant DRW, left the firm in June to work on a new project—which won’t be a crypto hedge fund, but a data product for bitcoin price information. “I am not starting my own fund. I think it is a poor career choice for 90% of the people attempting it,” he says. “Managing a crypto fund for many of these people is a task akin to paying very close attention to a basket of penny stocks—or worse, usually.”

That warning isn’t keeping new players from joining the crypto game, and that means more cash pouring into such investments soon. “It’s this wall of money that’s about to hit the markets,” says Kelly of BKCM. “That makes me think we are in the early innings of this rally.”

Correction: A previous version of this article said Blocktower has $100 million under management; it is raising that amount.