With China’s growth faltering, dark days lie ahead for Taiwan, South Korea and Singapore

Orders for Taiwanese exports flopped unexpected in June, falling 3.5% on the same month last year, the fifth straight month of declines. That slowdown appears to be dragging industrial production down with it; last month, that metric fell 0.4% on the previous year, upsetting expectations for a 2.8% rise. Here’s a look at export orders:

Orders for Taiwanese exports flopped unexpected in June, falling 3.5% on the same month last year, the fifth straight month of declines. That slowdown appears to be dragging industrial production down with it; last month, that metric fell 0.4% on the previous year, upsetting expectations for a 2.8% rise. Here’s a look at export orders:

That fall is partly due to China’s slowdown. Export orders from the mainland and Hong Kong, which make up more than a quarter of the total value of global exports, fell 8.6% since May, and were down 1.9% on June 2012.

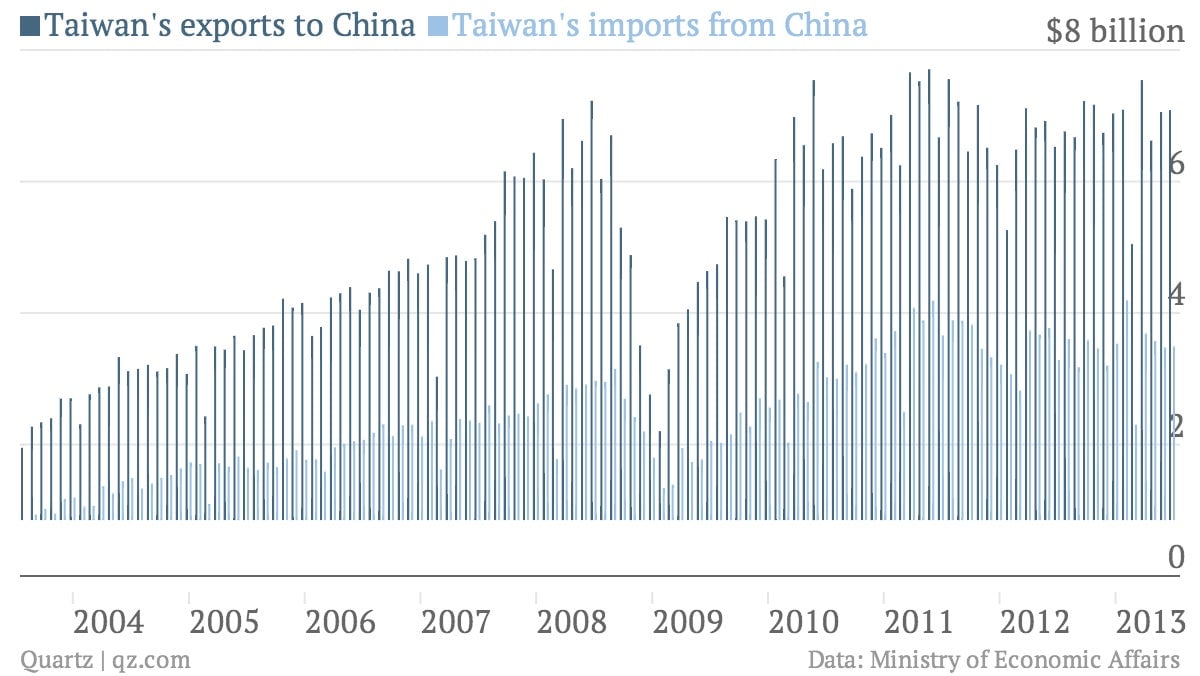

Taiwan has run a fairly consistent trade surplus with China, which leaves it vulnerable to slowdowns in the Chinese economy. Take a look:

South Korea suffers from a similar dynamic:

Singapore’s better, but still vulnerable:

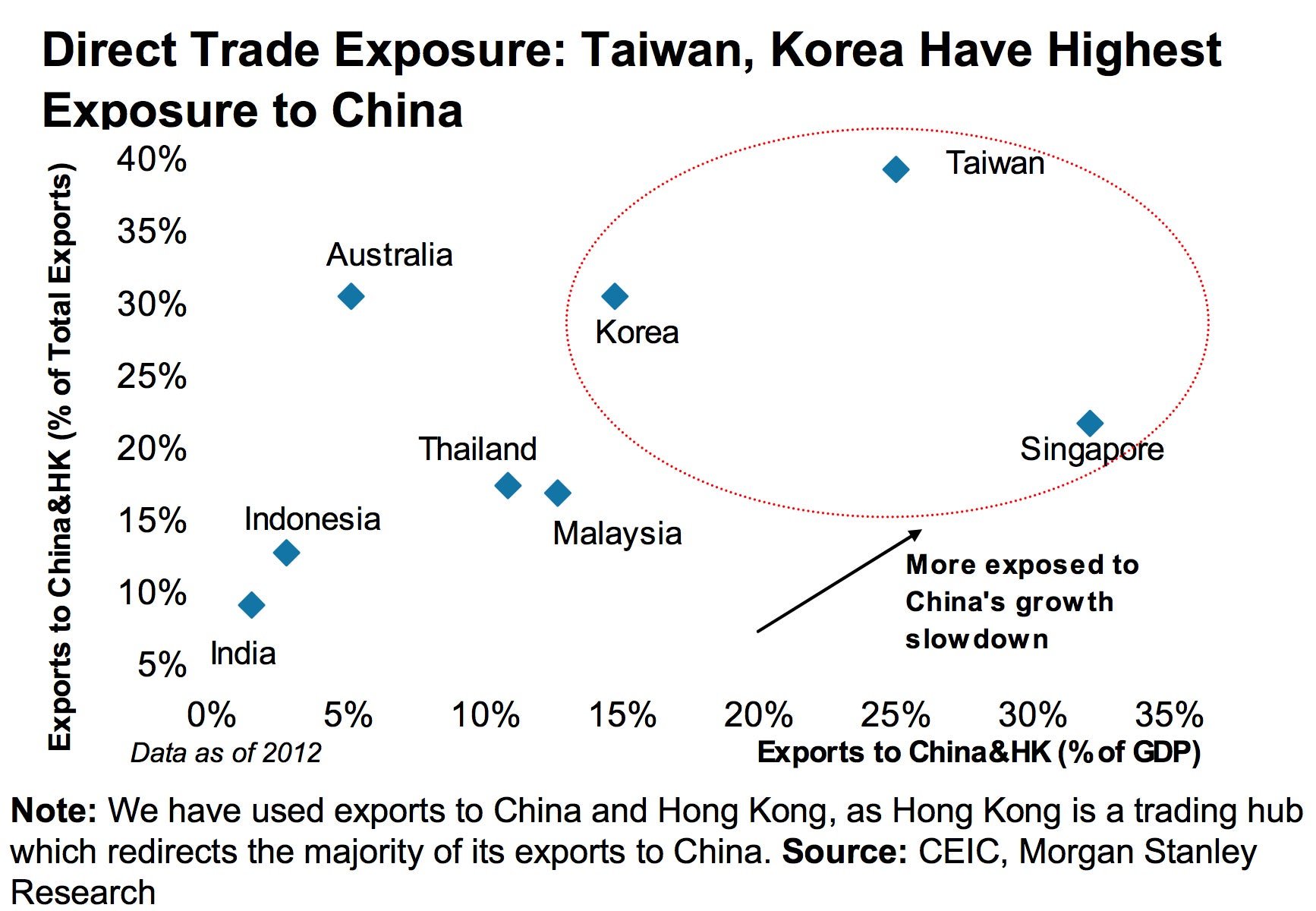

That’s one big reason why, in a recent note, Morgan Stanley flagged those three countries as danger zones in the (highly likely) event of a severe Chinese economic slump:

Running yawning trade surpluses can’t go on indefinitely. China learned that lesson with the onset of the global financial crisis, which wiped out a huge chunk of demand for its exports in Europe and North America. Now Taiwan, South Korea and Singapore are learning the same.