Here’s the problem with Abenomics

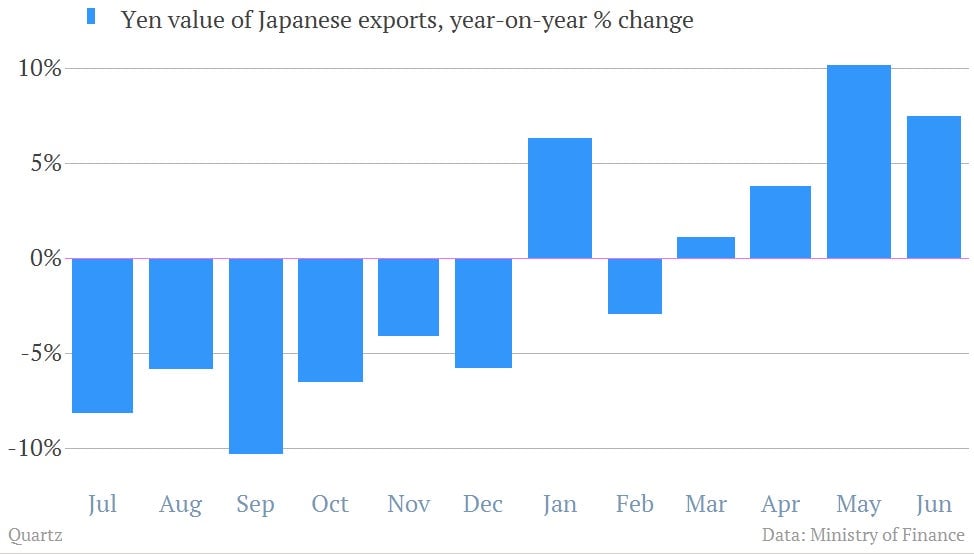

Fresh signs that the Abenomics plan to weaken the yen is helping shore up the Japanese exports arrived Tuesday. The yen value of exports jumped 7.4% in June versus the prior year, thanks to shipments of cars to Europe and the U.S. and rebounding trade with China.

ByMatt Phillips and Matt Phillips

Fresh signs that the Abenomics plan to weaken the yen is helping shore up the Japanese exports arrived Tuesday. The yen value of exports jumped 7.4% in June versus the prior year, thanks to shipments of cars to Europe and the U.S. and rebounding trade with China.

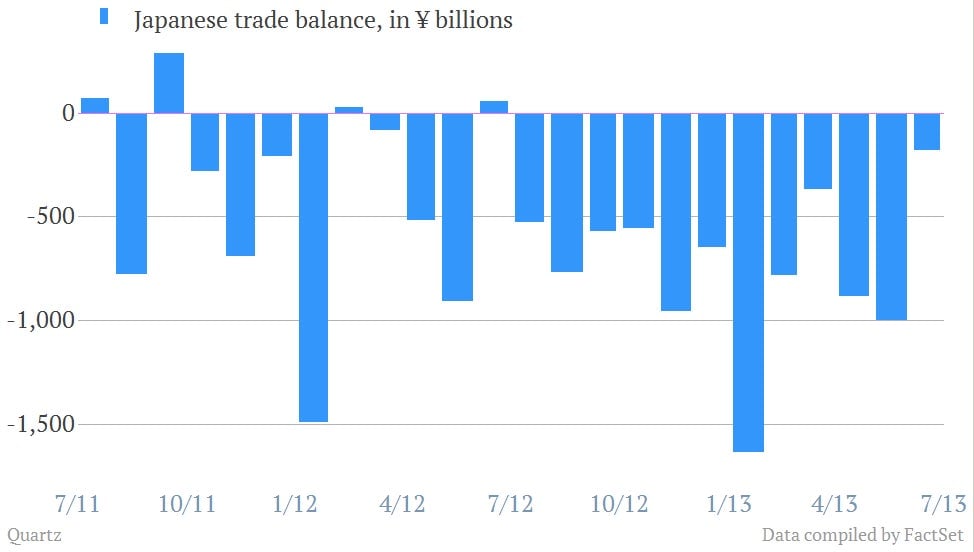

Unfortunately, the yen value of imports surged 11.8% as the energy hungry country’s fossil fuel imports—which are priced in US dollars—also jumped thank to the weak yen. June marked the country’s twelfth-straight trade deficit, thought it was noticeably smaller than other recent monthly imbalances.

An for what it’s worth, a rise in the price of imported goods might not be unwelcome for policy makers, who are trying jolt Japan out of a decades-long flirtation with deflation.