US financial firms are having a killer earnings season, but their stocks are only doing so-so

We’re just over the half-time mark in earnings season, with more than 250 of the S&P 500 companies having stepped into the accounting confessional and coughed up quarterly numbers. It’s pretty clear who the big winners are: The financial firms.

We’re just over the half-time mark in earnings season, with more than 250 of the S&P 500 companies having stepped into the accounting confessional and coughed up quarterly numbers. It’s pretty clear who the big winners are: The financial firms.

Through last Friday (July 26), the S&P 500 financial sector was reporting the largest “beat”—the difference between consensus estimates and actual results—of any sector in the index, with earnings coming in on average 10.7% higher than expected. In a research note, FactSet analyst John Butters points out that “companies that have reported significant upside earnings surprises include Goldman Sachs (+31%), Travelers (29%), Bank of America (+27%), and JPMorgan Chase (+11%).”

Bloomberg notes that “banks, brokers and insurance companies make up 16.8 percent of the S&P 500, almost double the level from 2009 and closing in on technology companies at 17.6 percent.” (The size of company and sector weightings in the index is determined by market capitalization and the amount of shares available to be publicly traded.)

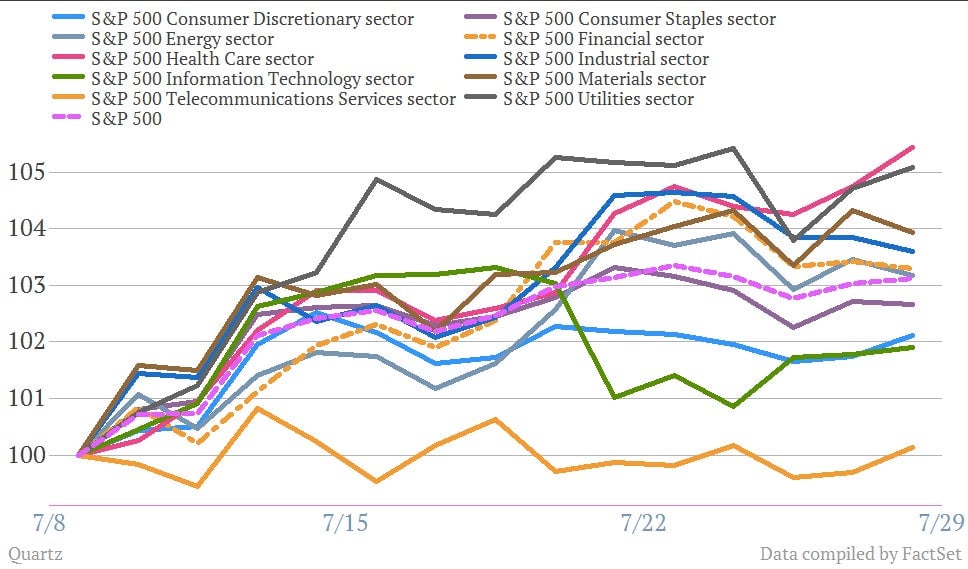

But interestingly, despite the megabeats from the financials, their stock prices haven’t been having the best ride this earnings season. In fact, since the season began on July 8, it’s healthcare stocks that have surged the most: 5.4% through Friday, compared to a 3.3% gain in the financial sector. That’s partly because health-care earnings have been beating expectations by about 7.2%, but stocks also appear to be getting a lift from the Obama administration’s decision, announced in early July, to delay implementation of crucial parts of its marquee health-care overhaul law. Here’s a look at the various sectors’ stock performance—indexed to 100—since July 8. Despite beating its earnings more impressively than all the rest, the financial sector has had only the fifth best-performing stocks.