Why Mexico’s migrant workers stiffed mom this Mother’s Day

Every once in a while, lifeless economic data reveals a glimmer of humanity.

Every once in a while, lifeless economic data reveals a glimmer of humanity.

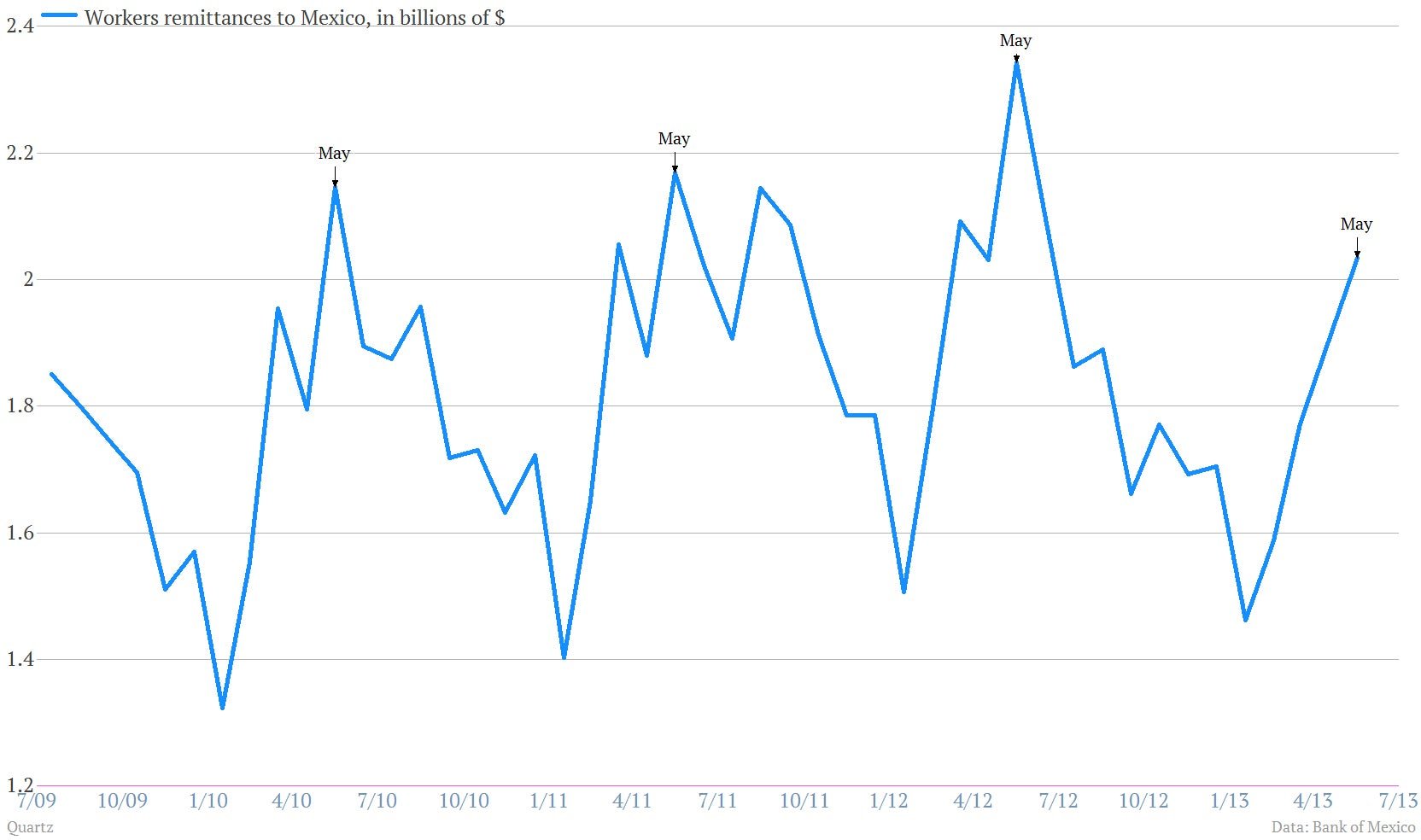

Case in point: Morgan Stanley analysts noted recently that remittances from migrant workers to Mexico tend be heaviest in May, when workers send more of their wages back home for Mother’s Day. That’s a sweet sentiment. But it seems that Mexico’s migrants might have been a bit less generous with mom this year. Remittances tumbled 13% in May, compared with May 2012.

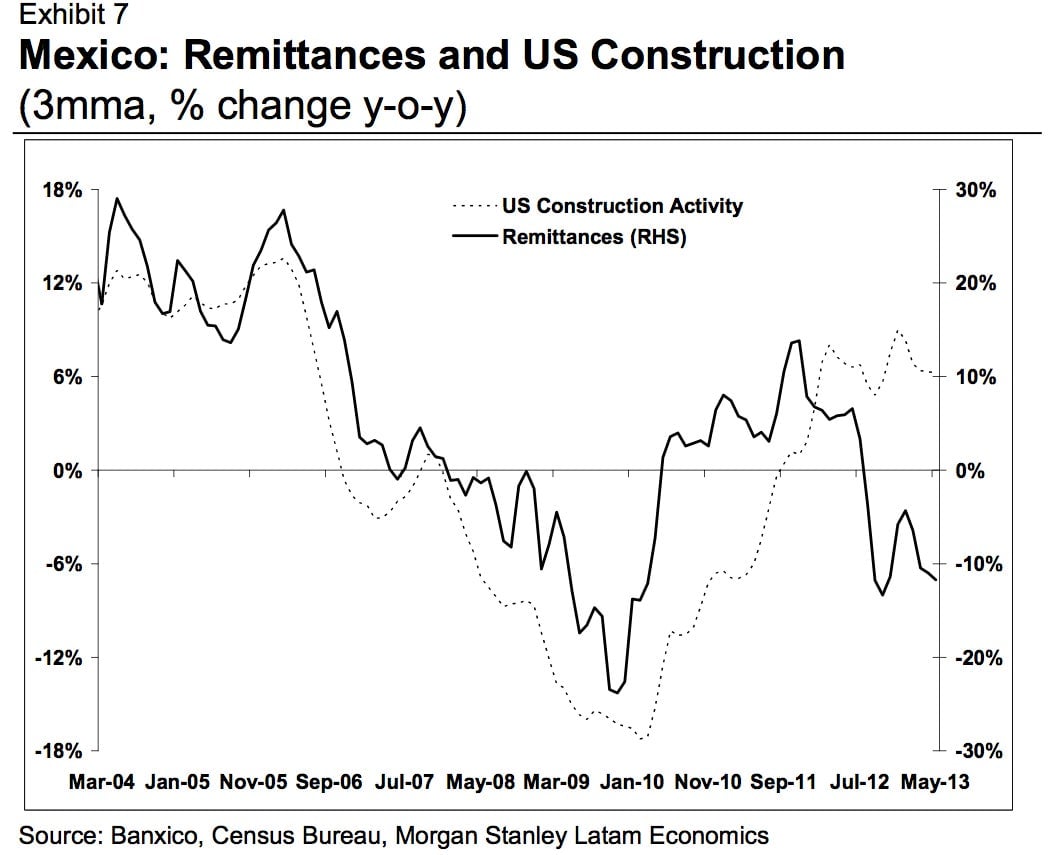

That’s a bit strange given the rebound in the US residential real estate market. In the past, construction activity has been closely correlated to remittances back to Mexico. Both plunged at the same time during the housing bust in 2008-09. Likewise, they’ve risen in lockstep over the past few years. But that relationship has broken down more recently.

Morgan Stanley analysts suspect that part of the decline in the official remittance numbers “may be related to the rally in the exchange rate between mid-2012 and April of this year, which historically has acted as a temporary disincentive to send money home.” (In other words, workers thought that they might be able to get more pesos for their greenbacks in future, and so have held onto them during the recent bout of peso strength.)

Still they confess to being somewhat befuddled that “recent improvement in labor market conditions in the US—including in construction—has curiously not translated into stronger remittance inflows.”