Why you don’t want to be Chilean when China slows down

The country that helped propel record growth in Latin America is threatening to undo it.

The country that helped propel record growth in Latin America is threatening to undo it.

In just over 10 years, China has become the world’s largest consumer of dozens of commodities, several of which dominate South American exports. China now imports over 60% of the world’s iron ore—Brazil’s leading export; over 60% of the world’s soybeans—Argentina’s leading export; 30% of the world’s copper—Chile’s leading export; and 33% of the world’s non-ferrous metals—Peru’s leading export.

The relationship has been good for Latin America: China has sent back manufactured goods like cheap electronics in return, and all in all, trade has increased by more than 20-fold. But it has also created a potentially dangerous dependence on China.

You can see this dependence in the proportions of each country’s exports that go to China:

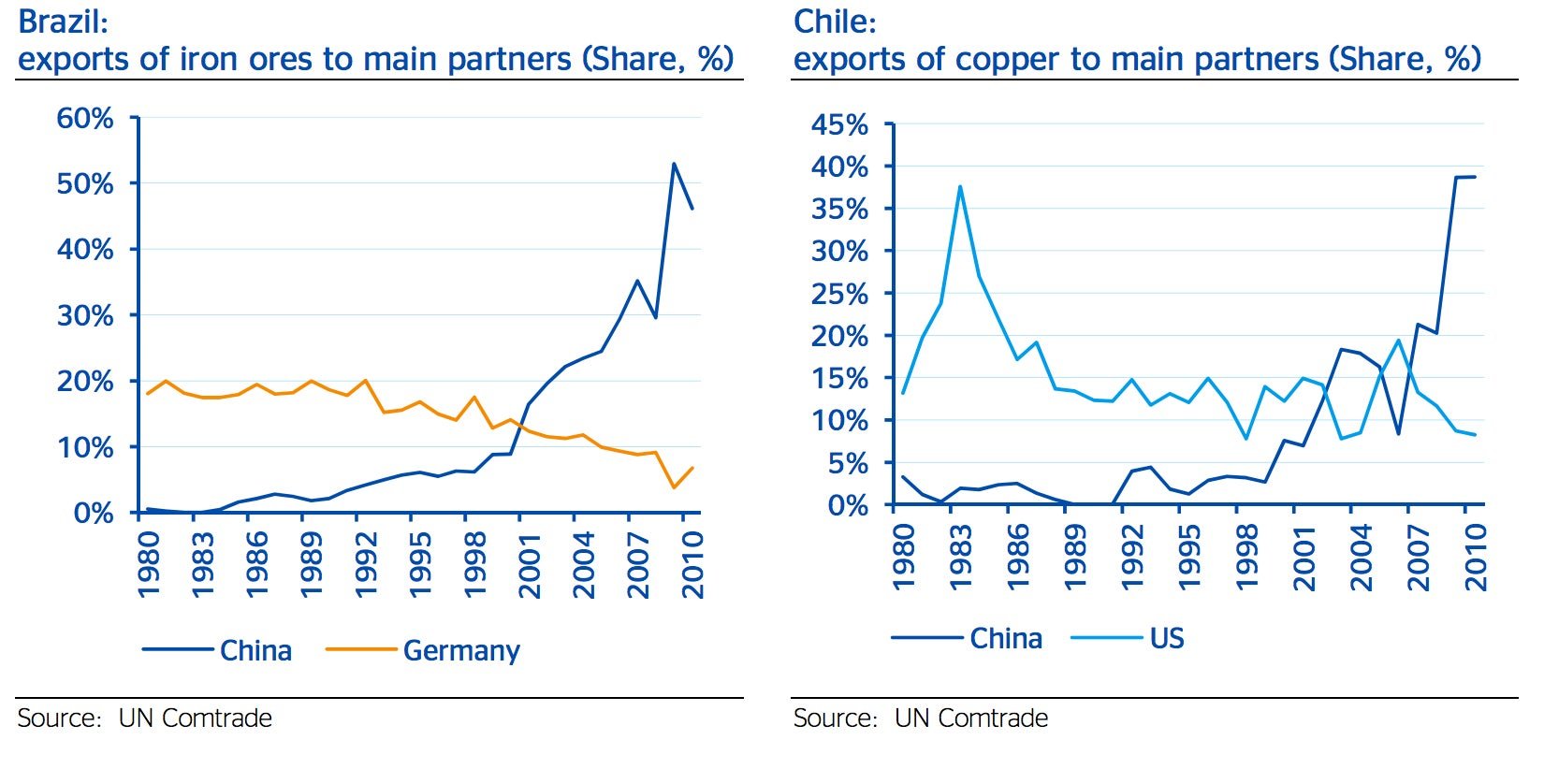

You can also see it in the share of those countries’ commodity exports to China. In general, commodities account for over 60% of exports in almost every Latin American economy, and China is easily the leading importer of Brazilian iron ore and Chilean copper…

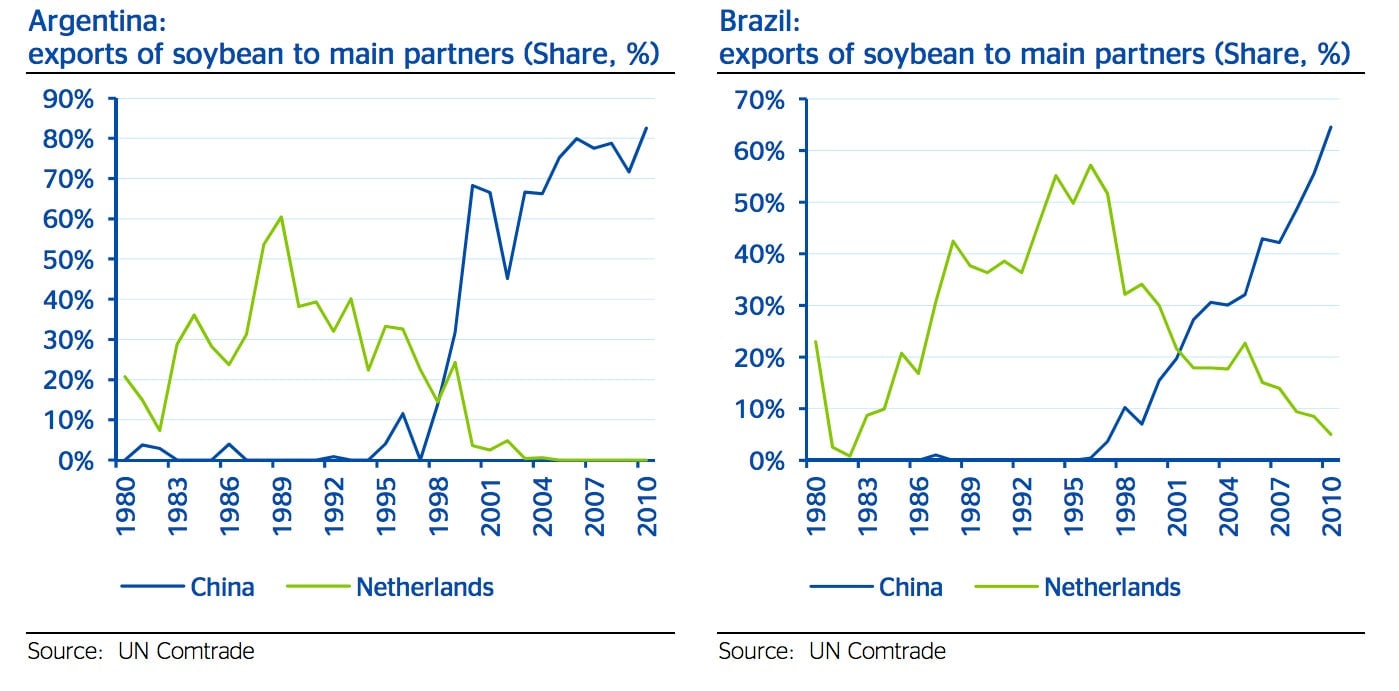

… as well as Brazilian and Argentine soybeans:

But over the past two years China’s economic growth has slowed from around 10% a year to a little over 7%, and the World Bank expects something closer to 5% a year over the next 10 years. That means less demand for infrastructure and industry, and thus for commodities.

Latin America is feeling the pinch. Growth in Brazilian exports to China more than halved in the first half of 2012 alone, and has continued to fall. Brazil’s economy, which only two years ago was growing at over 7%, grew by only 1% last year, and is slated to grow at a paltry 2% in 2013. Several commodity prices, including the price of copper, have fallen drastically. Chile in particular has been hard hit; its economy is heavily dependent on copper exports, and its copper exports are largely driven by Chinese demand and global copper prices.

The slowdown in Latin America, however, may not be directly a result of falling exports to China. In both Brazil and Argentina, exports to China account for less than 2% of the economy, according to a report published by BBVA Research earlier this year. Only Chile, where these exports are nearly a third of GDP, is substantially exposed in that regard. But a downturn in China also drives down raw-materials prices worldwide, so it reduces the revenues Latin American countries make from their commodity exports to other countries too.

A report from the UN’s Economic Commission on Latin America and the Caribbean (Eclac) last week said that “we are probably at the end of the increase in basic produce export prices associated with the expansion in China.” If that holds true, metal exporters like Peru, Chile and Suriname will suffer, as will oil exporters like Venezuela, Bolivia and Ecuador, and food exporters like Argentina, Brazil and Uruguay.