The FOMC statement’s first paragraph—illustrated!

There’s very little new in the most recent missive from the powerful US central bank. The biggest tweaks in the statement from the Fed’s Federal Open Market Committee were in its assessment of US economic conditions which came mostly in the first paragraph and seemed to suggest that the economy had softened slightly.

There’s very little new in the most recent missive from the powerful US central bank. The biggest tweaks in the statement from the Fed’s Federal Open Market Committee were in its assessment of US economic conditions which came mostly in the first paragraph and seemed to suggest that the economy had softened slightly.

We decided the give you the illustrated version.

Release Date: July 31, 2013

For immediate release

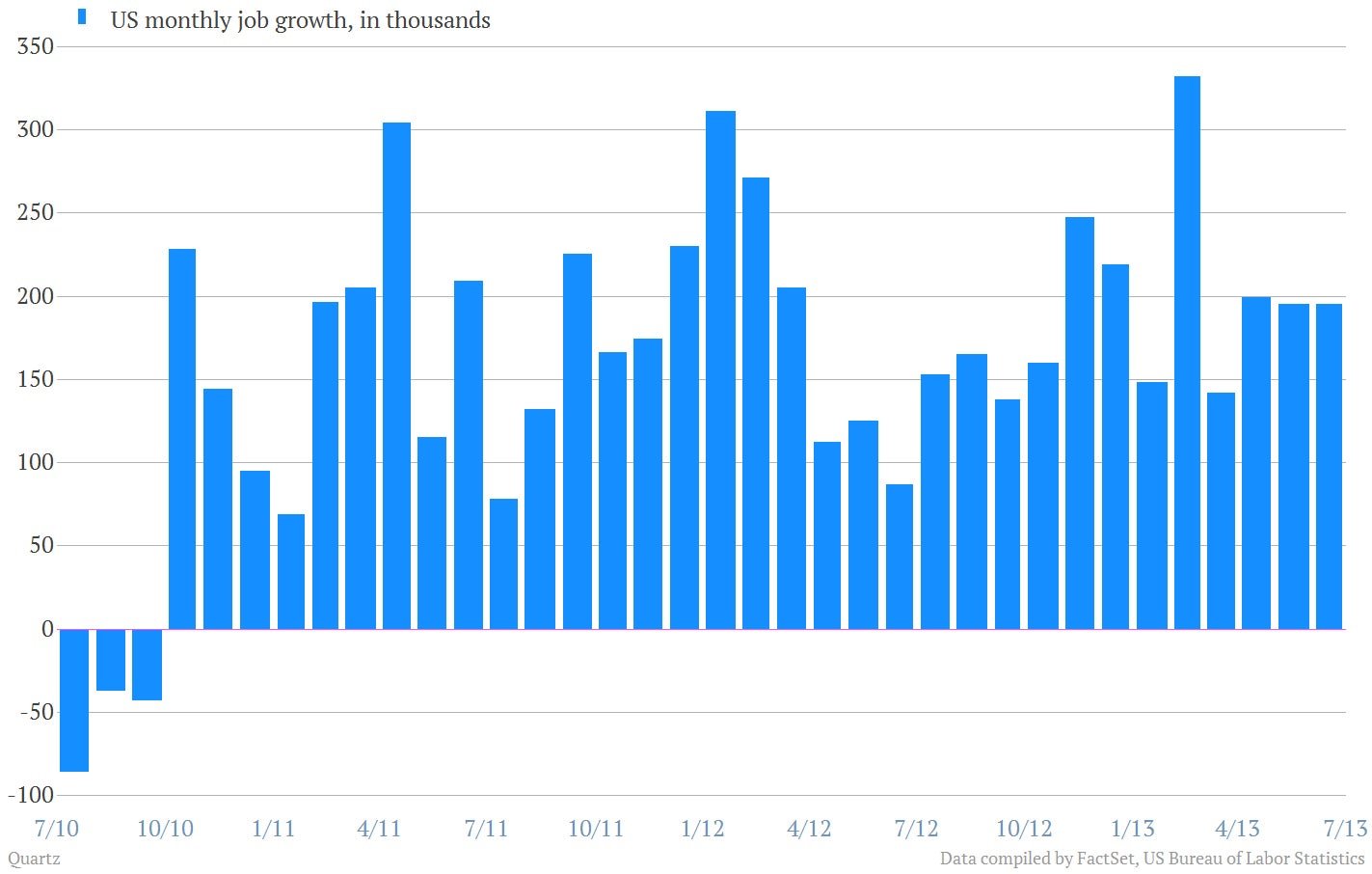

Information received since the Federal Open Market Committee met in June suggests that economic activity expanded at a modest pace during the first half of the year. Labor market conditions have shown further improvement in recent months, on balance…

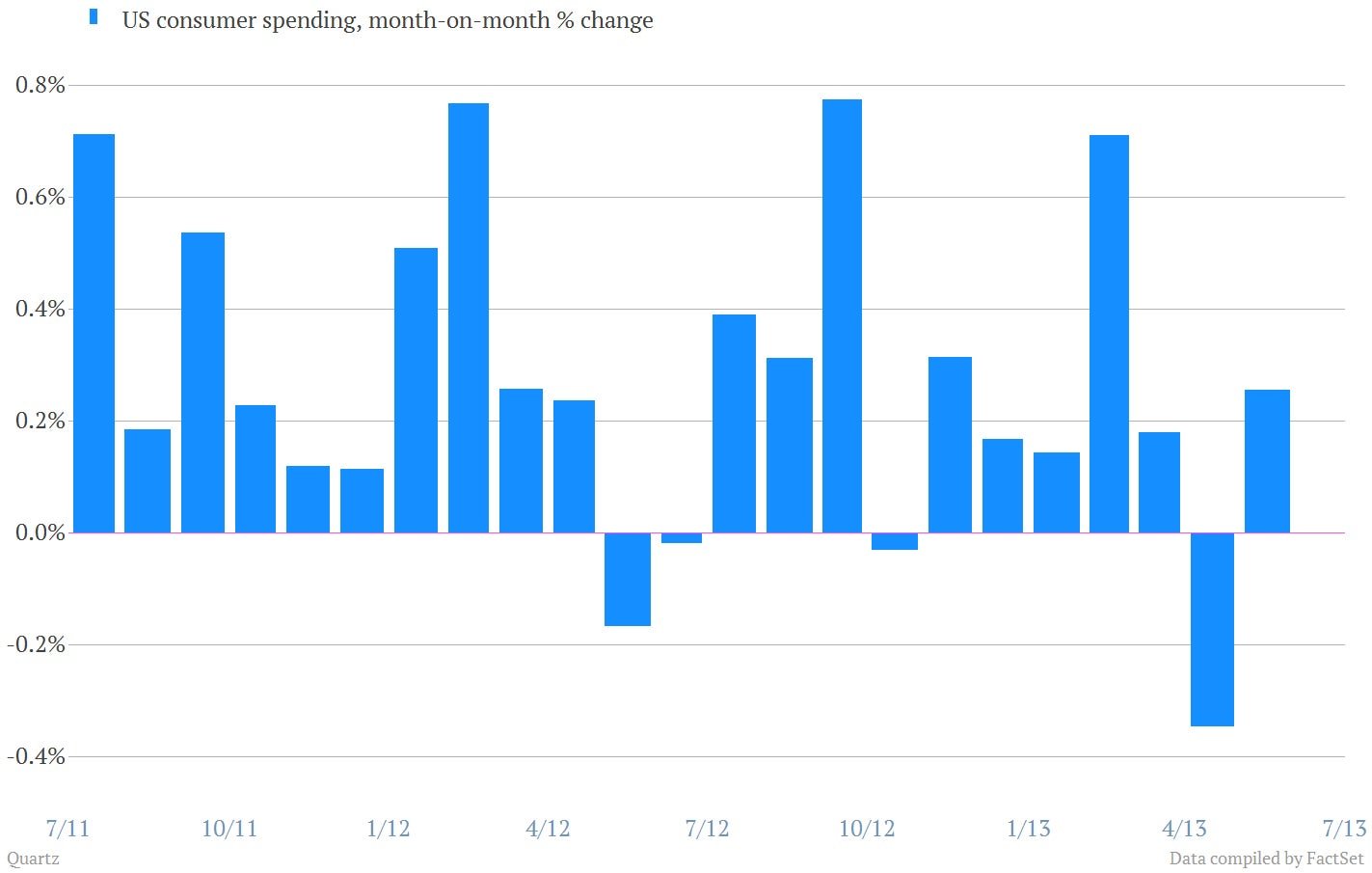

Household spending …

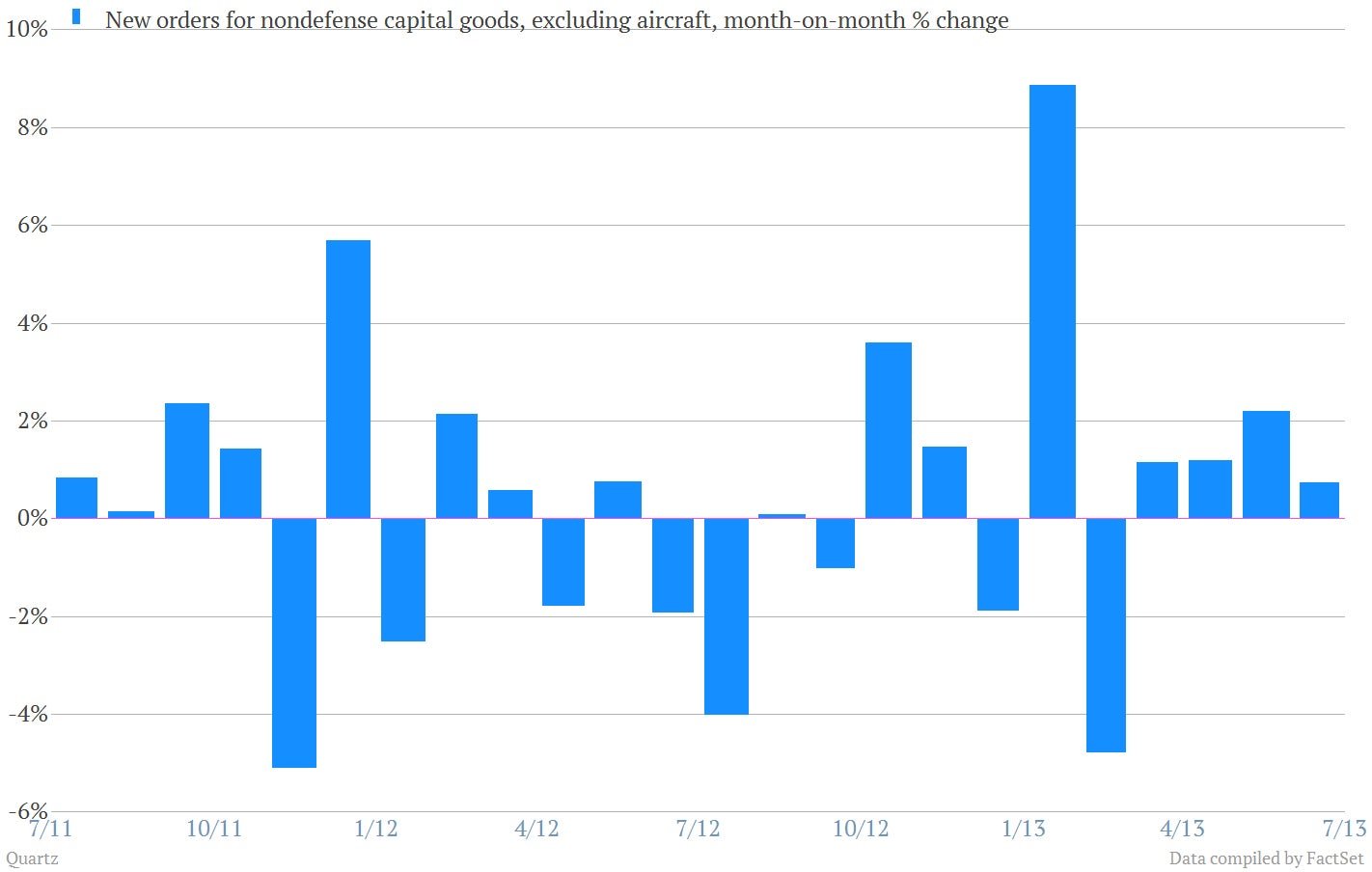

… and business fixed investment …

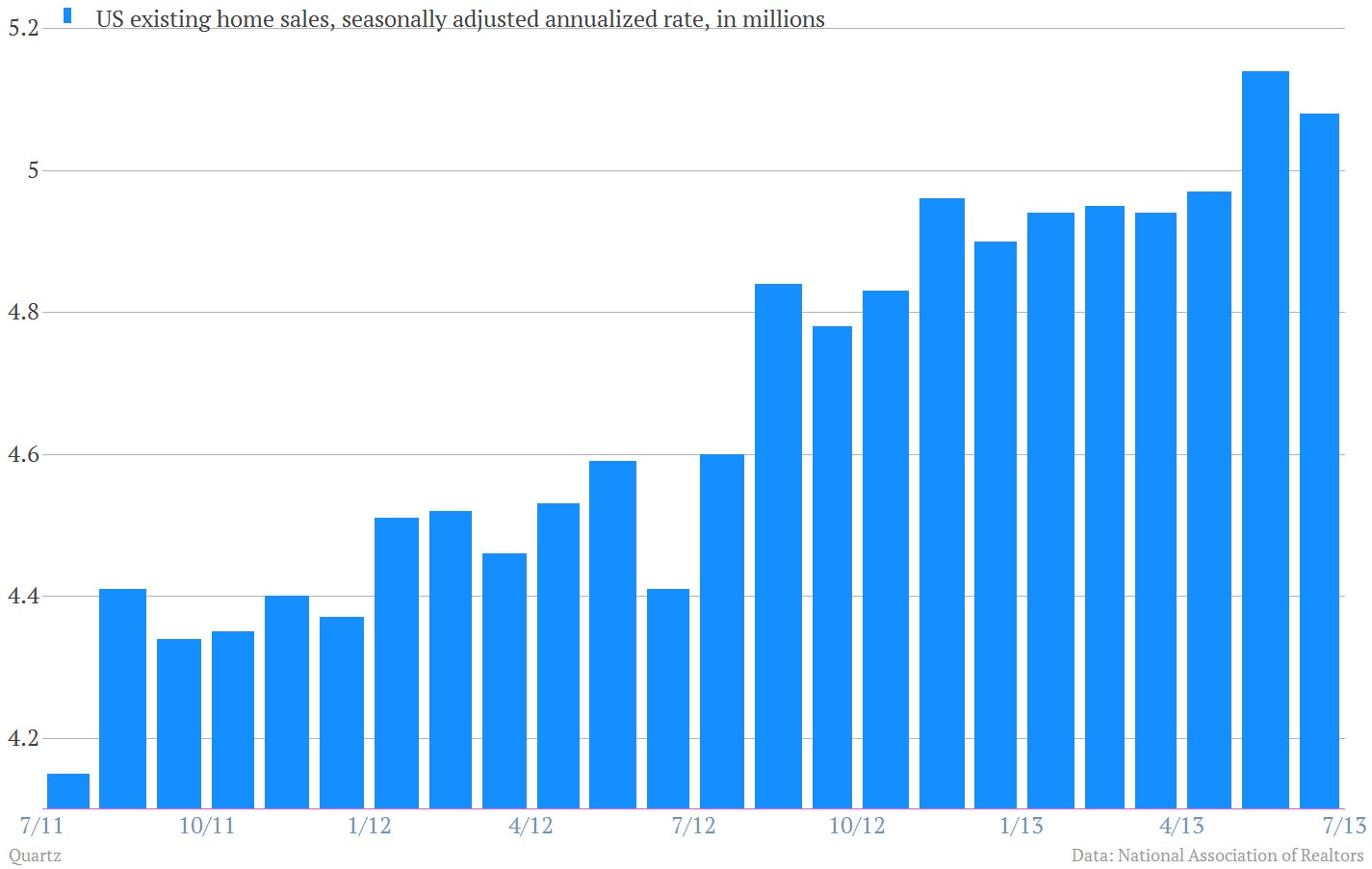

advanced and the housing sector has been strengthening …

But mortgage rates have risen somewhat …

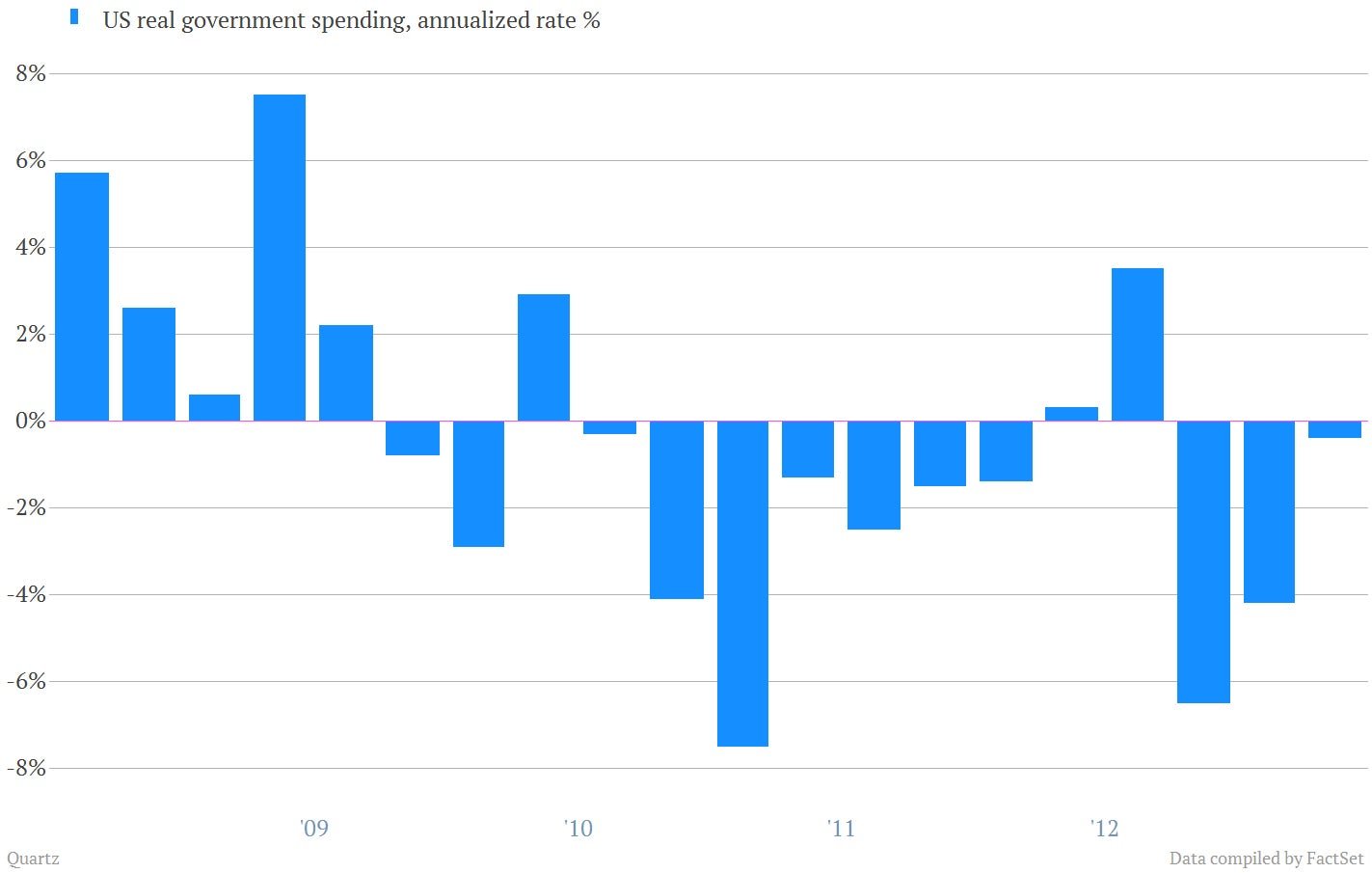

and fiscal policy is restraining economic growth…

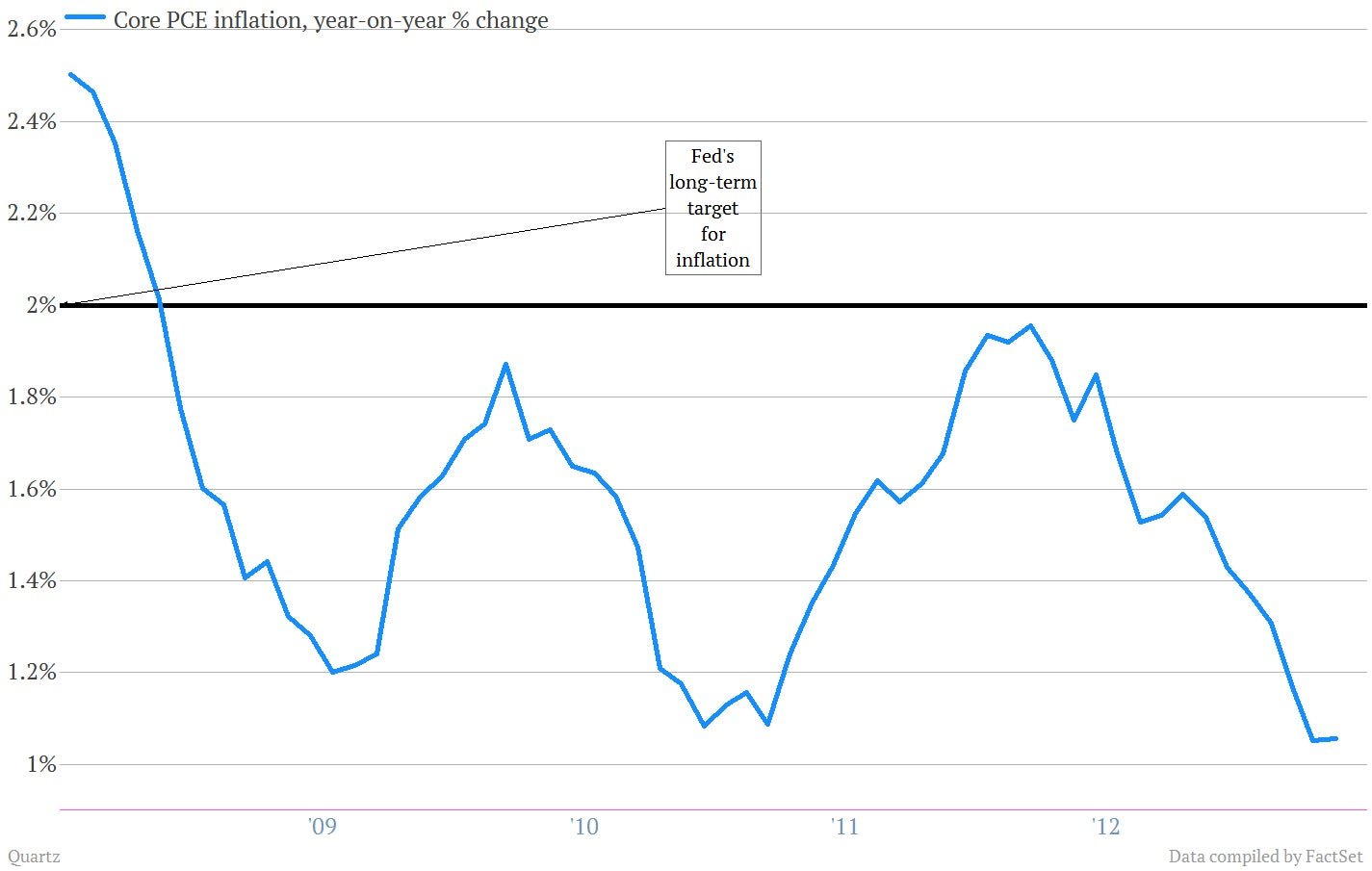

Partly reflecting transitory influences, inflation has been running below the Committee’s longer-run objective …

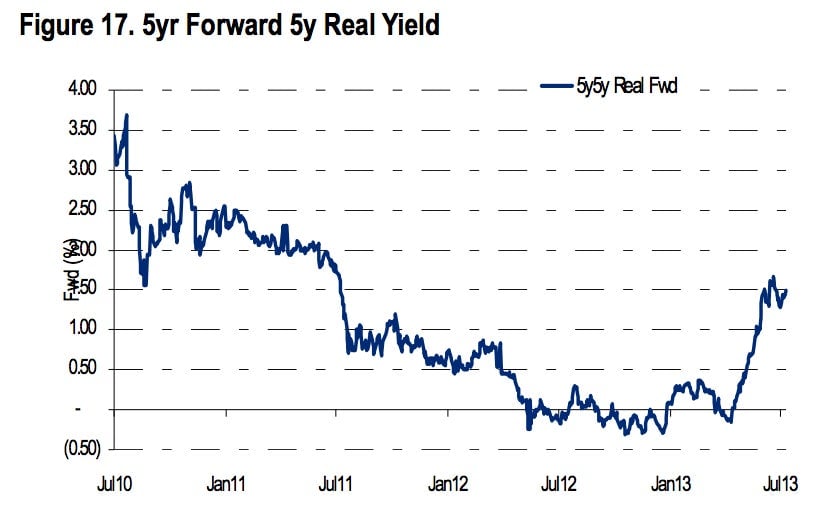

But longer-term inflation expectations have remained stable…

On that last point, the Fed did seem slightly more sympathetic to the notion that persistently low inflation could be a problem for the economy. “The Committee recognizes that inflation persistently below its 2% objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term,” the committee said. Markets seemed to interpret the Fed’s newfound concern about the risk of soft prices as an indication that it would be less likely to trim its bond buying program in September. Bond yields fell and stocks rose in the wake of the report.