The brightest spot in the global economy just got a bit brighter

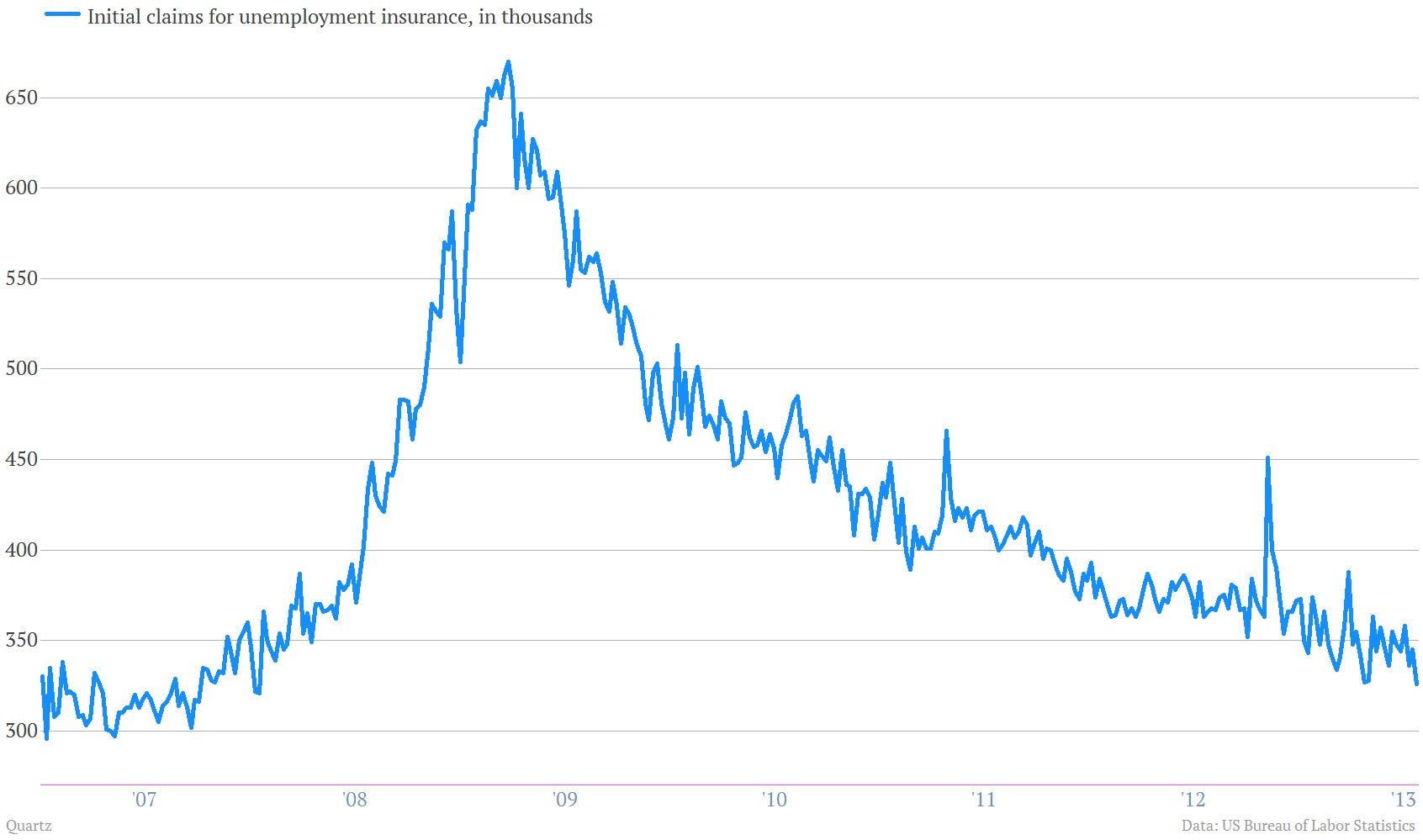

The last updates before Friday’s all important update on the US job market in July looked pretty darn good. Weekly claims for unemployment insurance fell to their lowest level since before the financial crisis was a twinkle in Ben Bernanke’s eye. (They were the lowest since January 2008.)

The last updates before Friday’s all important update on the US job market in July looked pretty darn good. Weekly claims for unemployment insurance fell to their lowest level since before the financial crisis was a twinkle in Ben Bernanke’s eye. (They were the lowest since January 2008.)

Meanwhile, one of the first important data points for July showed US industry cranking. The Institute for Supply Management’s manufacturing index hit 55.4, its highest level since July 2011. (A reading above 50 means the sector is expanding.)

What’s interesting is that such improvements likely mean the US Federal Reserve will lighten up later this year on its bond-buying program, which provides an economic lift. A few months ago, the prospect of this “tapering” of the $85-billion-a-month bond purchases startled the US stock market. But today’s rise of stocks to fresh all-time highs—the S&P scampered over 1,700 for the first time—suggests that confidence in the durability of the US recovery is starting to take hold.