Billions of dollars destined for Saudi Arabia demonstrate the clout of stock indexes

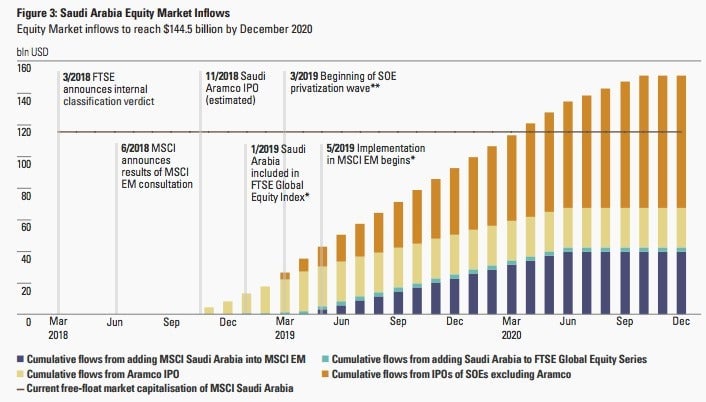

Some of the world’s most important arbiters of investment flows aren’t banks, governments, or hedge funds, but rather the index companies that decide which stocks belong in their benchmarks. For a demonstration of their growing clout, look to Saudi Arabia, where the equity market is in line to receive about $145 billion of investment flows over the next three years—in part thanks to indexes—according to State Street Global Advisors.

Some of the world’s most important arbiters of investment flows aren’t banks, governments, or hedge funds, but rather the index companies that decide which stocks belong in their benchmarks. For a demonstration of their growing clout, look to Saudi Arabia, where the equity market is in line to receive about $145 billion of investment flows over the next three years—in part thanks to indexes—according to State Street Global Advisors.

Developing robust capital markets is a key part of the kingdom’s plan, known as Vision 2030, to transform its economy and become less reliant on oil. Thanks to recent reforms, the Saudi stock market may get a boost through inclusion in key indices, according to State Street: FTSE Russell and MSCI are independently reviewing whether to upgrade the nation within their frameworks.

Saudi Arabia could be reclassified to Emerging Market status by MSCI, moving the country’s stocks into its Emerging Markets Index, which is tracked by some $1.6 trillion in assets. The country may also be close to an upgrade by FTSE Russell, which will reconsider the country’s status in March.

If Saudi Arabia’s stocks are reclassified by MSCI, its equity market could receive inflows of about $38 billion from passive funds that track that benchmark alone, according to State Street. Active managers, too, will buy Saudi stocks as a result—they’re judged by their performance relative to the same benchmarks, and won’t want to deviate too much from them.

And then there’s state-owned oil giant Aramco, which is preparing for a blockbuster IPO. This could drive as much as $40 billion of purely passive-related flows tied to MSCI indexes into the market, according to State Street.

“You shouldn’t underestimate how important the index inclusion is,” said Altaf Kassam, head of State Street’s strategy and research for Europe, the Middle East, and Africa.

Not all the money flowing into the Saudi stock market in State Street’s analysis comes from indexes, of course—privatization across a swath of other sectors could also channel money into the nation’s equity market.

It’s also important to acknowledge that Saudi Arabia’s path forward isn’t entirely assured: Norway’s gigantic sovereign fund recently said it may dump its oil investments, which implies a key investor may not participate in Aramco’s IPO should it go forward. Saudi Arabia is also embroiled in disputes with Qatar and Yemen, as well as a corruption crackdown that’s seen as a political purge.

Investing in Saudi Arabia remains risky, which is reflected in its outsider status among index providers. But if, or when, its stock market is reclassified by the major index companies, a lot more investors are going to buy into it, whether they want to or not.