Why China is desperate to shed its reliance on US corn

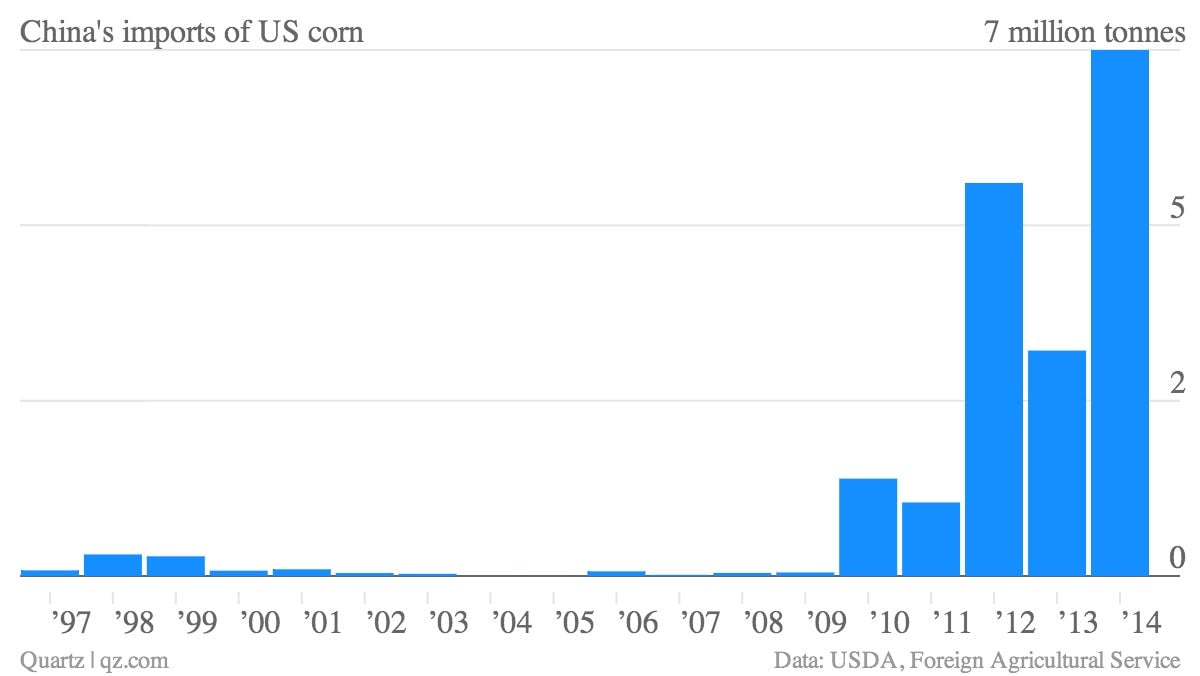

The US is the biggest corn exporter in the world. That’s especially true for China: 99.8% of China’s corn imports in the first four months of 2013—1.44 million tons (1.27 million tonnes)—came from the US.

The US is the biggest corn exporter in the world. That’s especially true for China: 99.8% of China’s corn imports in the first four months of 2013—1.44 million tons (1.27 million tonnes)—came from the US.

But that may soon change. China just cleared the first significant shipment of corn from Argentina last week, reports Reuters, and a Ukraine corn deal is imminent. But there are a couple of odd-seeming things about China’s lessening its reliance on US corn.

Argentine corn is typically cheaper than the US’s. But this year’s bumper harvest after years of drought has made US corn prices plunge around 40% (paywall) compared with last year. That makes it much cheaper than Chinese corn, or, for that matter, Argentine corn.

So why China’s rush to diversify?

One underlying issue here is price stability—and not just of corn. Around three pounds of corn are required to rear each pound of pork, which as JP Morgan estimated in a recent note, puts China on track to need nearly 180 million extra tons of corn by 2050, given its growing pork appetite. If natural disaster were to blight China’s corn production at the same time as a US drought hit, food prices could soar. Importing from Argentina helps mitigate that impact.

But imports are only a small factor in the overall corn supply equation; in fact, China is still 98.9% self-sufficient. In order to guarantee that supply, though, China’s state-owned grain reserve corporation, Sinograin, buys up corn at the government’s artificially high price if the market rate falls below that level. It then manages its corn reserves to influence prices.

That encourages farmers to plant, which is needed because the government is set on ramping up corn output. But falling prices due to increased output are now exacerbated by weakening consumer demand for meat—and, hence, feed—after the episode of dead pigs floating in rivers and outbreak of avian flu. That’s probably one reason that the government just raised its corn price support program by almost 6%.

But falling demand for pork and artificially high feed prices are driving China’s hog farmers out of business, which will result in a spike in pork prices in a year or so. Importing eases this pressure, something China’s biggest feed producer has begged the government to do. Since the Argentine corn imports are genetically modified, and hence approved only for animal feed in China, future imports could help a lot down the line.

The good news for US corn growers is that falling pork prices will likely drive the government to let Sinograin and other companies (mostly state-owned) with access to import licenses buy up US corn. Less cheery news for the Americans is that they’re rapidly losing global corn export share to Argentina’s and Brazil’s farmers. The US exported more than one-third of the world’s corn in the first few months of 2012; that fell to less than 25% in the same period of 2013.