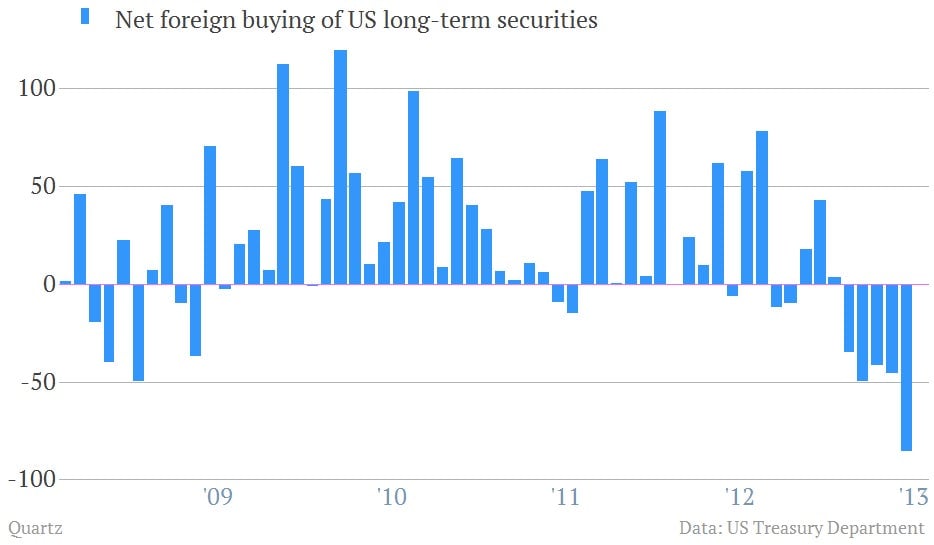

Foreigners dumped tons of US stocks and bonds after the Fed’s taper talk

It isn’t always the case, but today’s update on monthly foreign buying and selling of US Treasurys, stocks, and corporate bonds makes for some interesting reading.

It isn’t always the case, but today’s update on monthly foreign buying and selling of US Treasurys, stocks, and corporate bonds makes for some interesting reading.

It turns out that foreigners unloaded $85.4 billion of US securities in June, the most recent month for which data are available. That was when markets really began pricing in the US Federal Reserve’s chatter that it could start cutting down on its bond-buying program in the next few meetings. The Fed’s rate setting committee issued its latest update on June 19.

The selling pressure came from private investors, who dumped $81.4 billion in US long-term securities, mostly Treasurys. Foreign private investors sold more than $40 billion in Treasury bonds during June. In fact, China and Japan—the largest foreign creditors of the US—sold more than $40 billion on their own.

That was offset by a $3.8 billion increase in long-term securities holdings from foreign official accounts, mostly central banks, which use US securities—basically US government bonds—to stockpile excess cash. Importantly, those official foreign investors didn’t show major signs of turning away from Treasurys as a place to keep their cash. (The did sell a bit, though: $0.7 billion.)

That gets us to a $77.8 billion decline. The Treasury then tacked on another decline of about $19 billion to account for things like unrecorded principal payments to foreign holders of bonds. And it backed out some $11 billion in purchases of foreign bonds by US residents. Netted out, that gets us to $85.4 billion in total foreign divestment, making June by far the biggest month for dumping US assets in the post crisis era.