US banks commercial lending has been frisky, and possibly risky

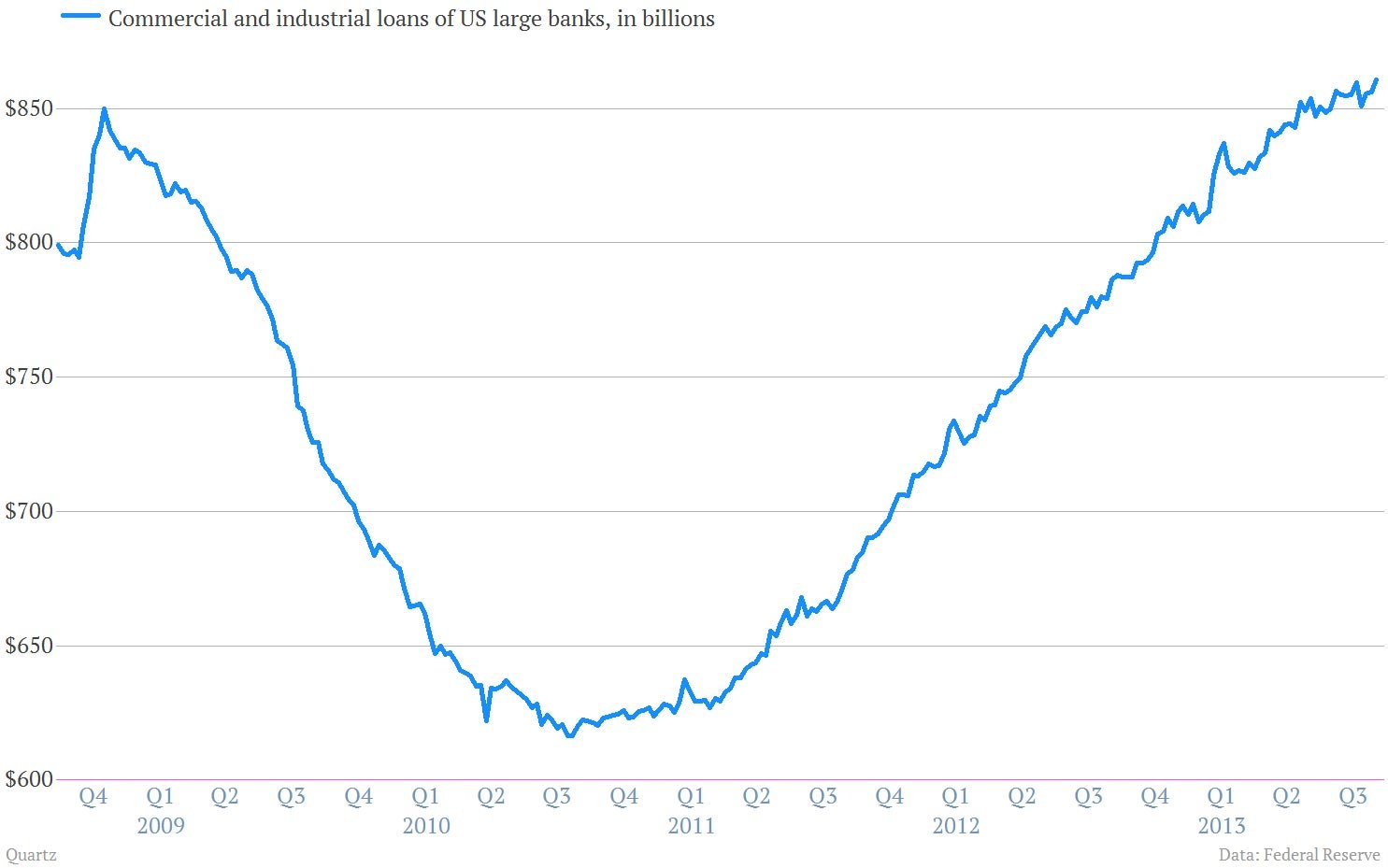

The collapse of the US housing market left American bankers decidedly spooked about lending to consumers. But banks have to lend. The solution? Lending to companies. Starting in the middle of 2010, American bankers started ramping up lending to companies. Commercial loans have boomed. Take a look.

The collapse of the US housing market left American bankers decidedly spooked about lending to consumers. But banks have to lend. The solution? Lending to companies. Starting in the middle of 2010, American bankers started ramping up lending to companies. Commercial loans have boomed. Take a look.

Meanwhile, mortgage lending, which is by far the largest segment of loans that US banks make, has been basically dead in the water.

It’s been logical for banks to focus on commercial lending. In the wake of the financial crisis, consumers weren’t in a mood to borrow. They were too busy deleveraging, either by paying down debt, or in worst case scenarios, defaulting. But there are some signs that bankers might be getting a bit too loose in their lending companies.

Moody’s noted that in the latest Federal Reserve survey of senior lenders at US banks, standards for commercial —in industry jargon, that’s commercial and industrial or C&I—loans had been getting markedly easier both in terms of price and covenants. (The stipulations on the loans.) “The findings are credit negative for US banks because an overheated C&I segment and looser lending standards sow the seeds for increased loan losses,” Moody’s analysts noted.

This is the paradox at the heart of the US economic recovery. To get over the crash—a crash brought on by excessive borrowing and lending—the economic powers-that-be had to encourage still more lending. (There were other options, such as allowing an even deeper, more painful depression to play out. But that’s rarely a palatable decision politically. It’s also debatable economically.) Now with the US economy on the mend, there’s a risk that lending could get out of hand again.

If there’s an upside to all this, it is that the regulatory deference shown to the markets isn’t quite as extreme as it was during the pre-crisis era. As part of its recent turn towards tapering, the Fed has been making noises about its concern for financial stability. (Translation: They don’t want markets soaring, and then crashing.) And there are signs that banking regulators are on top of things in the commercial lending markets. Let’s hope they stay there.