The huge mistake California (and the rest of the world) make on pension reform

Risk is in the eye of the beholder.

Risk is in the eye of the beholder.

California is confronting a huge retirement problem: Americans haven’t saved enough and remain uncertain about how to invest their savings. The state is considering a plan to automatically enrolled workers a program where 3% of their savings will go toward an account with a guaranteed 3% return. The purpose of this program seems to be giving people access to a low-risk saving vehicle. But while admirable to encourage more saving, it is not clear what risk the state of California is trying to mitigate: is it ensuring a certain amount of wealth or more income in retirement? The latter seems more probable because the program is touted to supplement Social Security income. If so, this plan’s design leaves Californians vulnerable to an larger source of risk.

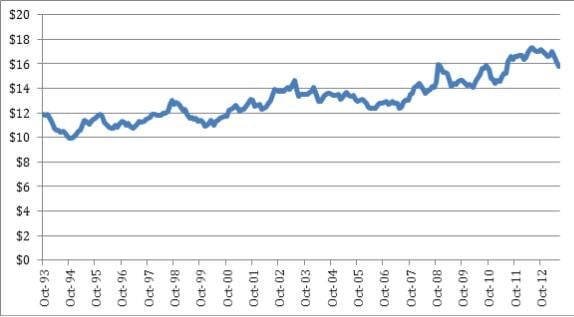

The proposal suggests when people retire they’ll take at least some of their accumulated assets and buy an annuity. An annuity is a contract where you give an insurance company money and in exchange they will make payments to you for a fixed amount of time or until you die. This ensures that you won’t run out of money. Insurance companies that offer annuities normally price them based on current interest rates. So as rates move around so do annuity prices. The figure below shows the price of $1-a-year of income for 20 years based on interest-rate data starting in 1993.

Guaranteeing a certain return minimizes one risk, that the value of your assets will never fall and you can predict exactly how much money you’ll have when you retire. But if you plan to buy an annuity, the income you actually get in retirement can vary more than 30%. Offering a guaranteed 3% return does nothing to hedge this risk.

Still, buying the annuity is a good idea because it ensures you won’t run out of money before you die. Yet the price of a future annuity is uncertain. To be sure, it is possible for California to guarantee an annuity price. But it’s not clear who bears that risk, which could pose more cost than guaranteeing the 3% return. Insurance companies are underwriting the 3% return guarantee, but there does not seem to be a clear plan on the risk posed by annuities.

This is an important issue to think through. Private accounts pose several sources of risk but, time and time again, only one—the return that assets earn—gets most of the attention. But inflation, annuity conversion, or outliving your assets are also major issues when the goal is income in retirement.

The problem is hardly confined to California—or the US, for that matter. Australia has mandatory private accounts but has not answered this question. As a result, Australians have incentive to spend all their savings once they retire, which undermines the point of the entire program. It’s remarkable that so many countries have moved to a retirement system where people save into their own accounts—but so little thought has been given to what people will do with all their savings when they retire.