Beset by falling iron prices, BHP Billiton finds a new way to bet on China

Today Australian mining giant BHP Billiton announced that its profit fell 30% in the first half of this year, as its largest sales category, iron, slumped along with demand from China.

Today Australian mining giant BHP Billiton announced that its profit fell 30% in the first half of this year, as its largest sales category, iron, slumped along with demand from China.

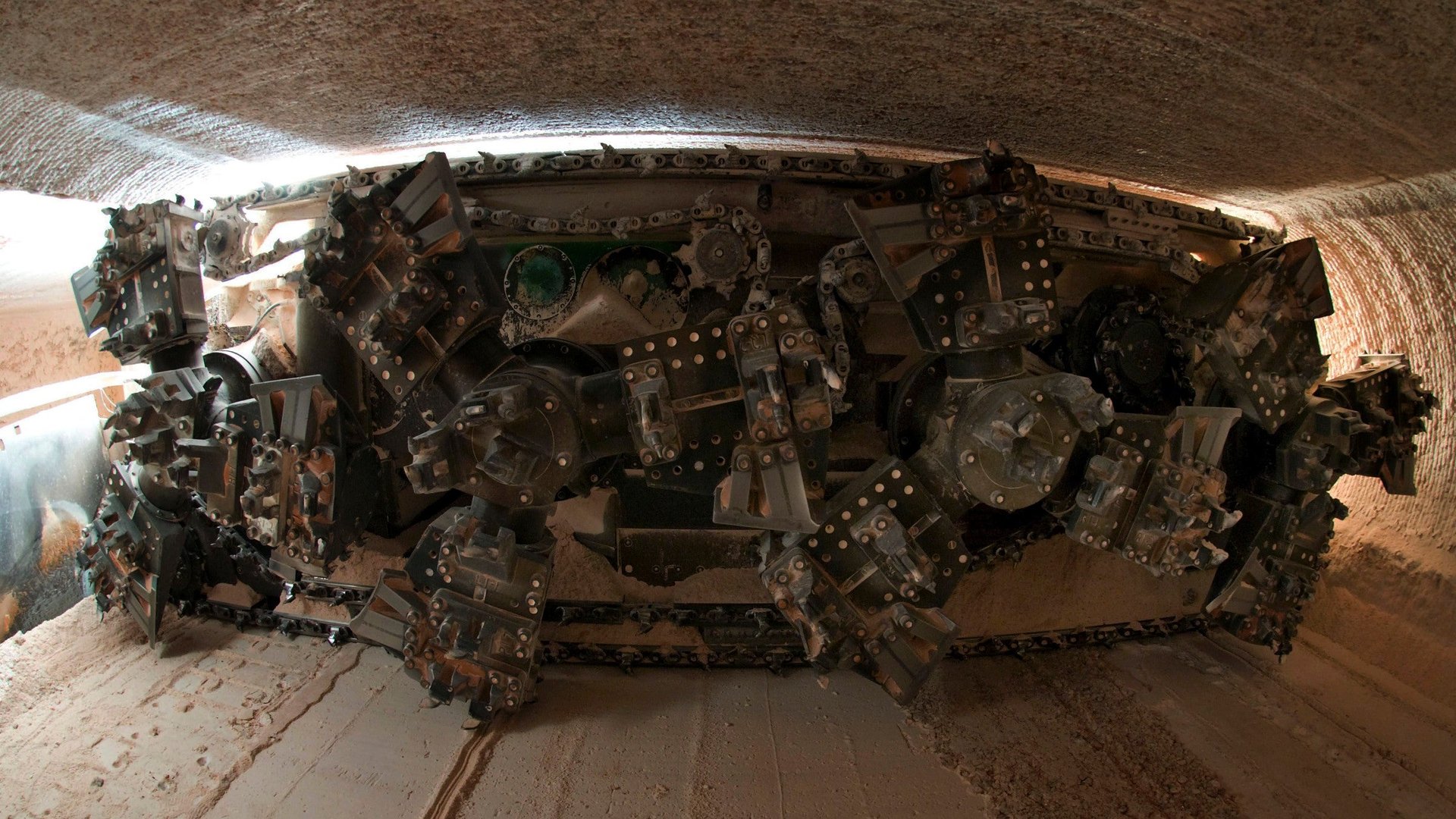

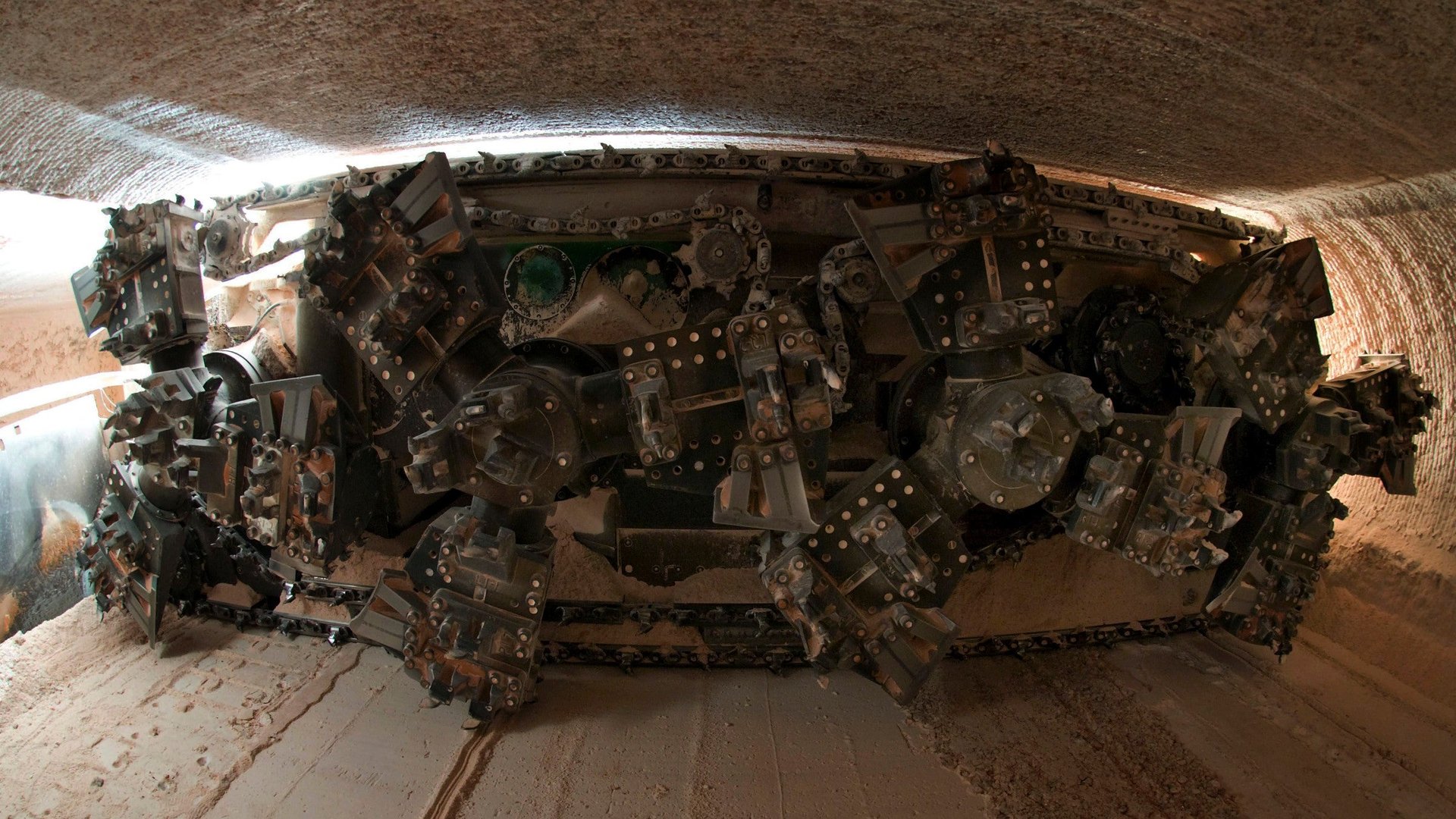

Luckily, the future is… demand from China! But not for iron ore; for food, and specifically, for potash, a key mineral ingredient in fertilizers. The company decided to invest $2.6 billion developing a new potash mine in Saskatchewan, Canada, and is considering bringing on a partner to co-invest in the project. The money will go toward preparing the infrastructure around the mine, though not to start mining straight away.

The CEO of BHP, Andrew Mackenzie, delivering his first earnings report since taking the top job at the world’s largest mining company earlier this year, reported that revenue for the year ending June 30 fell from $72.2 billion in 2012 to $65.5 billion in 2013. Though it’s been cutting costs (by some $2.7 billion so far this year), he said, BHP needed to be ready to produce a commodity that will influence the next stage of China’s growth. The quantities and kinds of food that a wealthier and more populous China will demand are likely to put a strain on the country’s arable land, so it will need potash fertilizers to boost crop yields.

The Jansen investment suggests that last month’s break-up of one of the two global potash cartels may not cause prices to fall by the 25% predicted by Uralkali, the Russian potash producer that broke up the club. The uncertainty had analysts wondering whether mining companies would continue investing in new extraction operations, but BHP’s decision is evidence that miners, at least, expect future demand to make such investments worthwhile down the road. Canada’s own potash firms, Potash Corporation of Canada and Agrium, likewise remained fairly sanguine about the development during recent earnings announcements.

Mackenzie said his company has expected lower prices—set by major buyers of the mineral like China and India—for some time, but that demand will rise 2% to 3% per year until 2030. That could leave a significant gap between supply and demand for BHP to fill in.

Still, it’s no sure thing—MacKenzie said the plan for Saskatchewan is to prepare the groundwork but leave BHP “the flexibility to enter the potash market only when the time is right,” likely not until 2020.