Berkshire Hathaway’s stock has risen more than one million percent under Warren Buffett

Warren Buffett seems closer to naming his replacement to run Berkshire Hathaway, the storied conglomerate that he took control of in 1965. The CEO is known for many things—his love of ice cream for breakfast and Cherry Cokes—but he’s also known for managing a company that has beaten the S&P 500 index of US stocks in 36 out of the past 52 years.

Warren Buffett seems closer to naming his replacement to run Berkshire Hathaway, the storied conglomerate that he took control of in 1965. The CEO is known for many things—his love of ice cream for breakfast and Cherry Cokes—but he’s also known for managing a company that has beaten the S&P 500 index of US stocks in 36 out of the past 52 years.

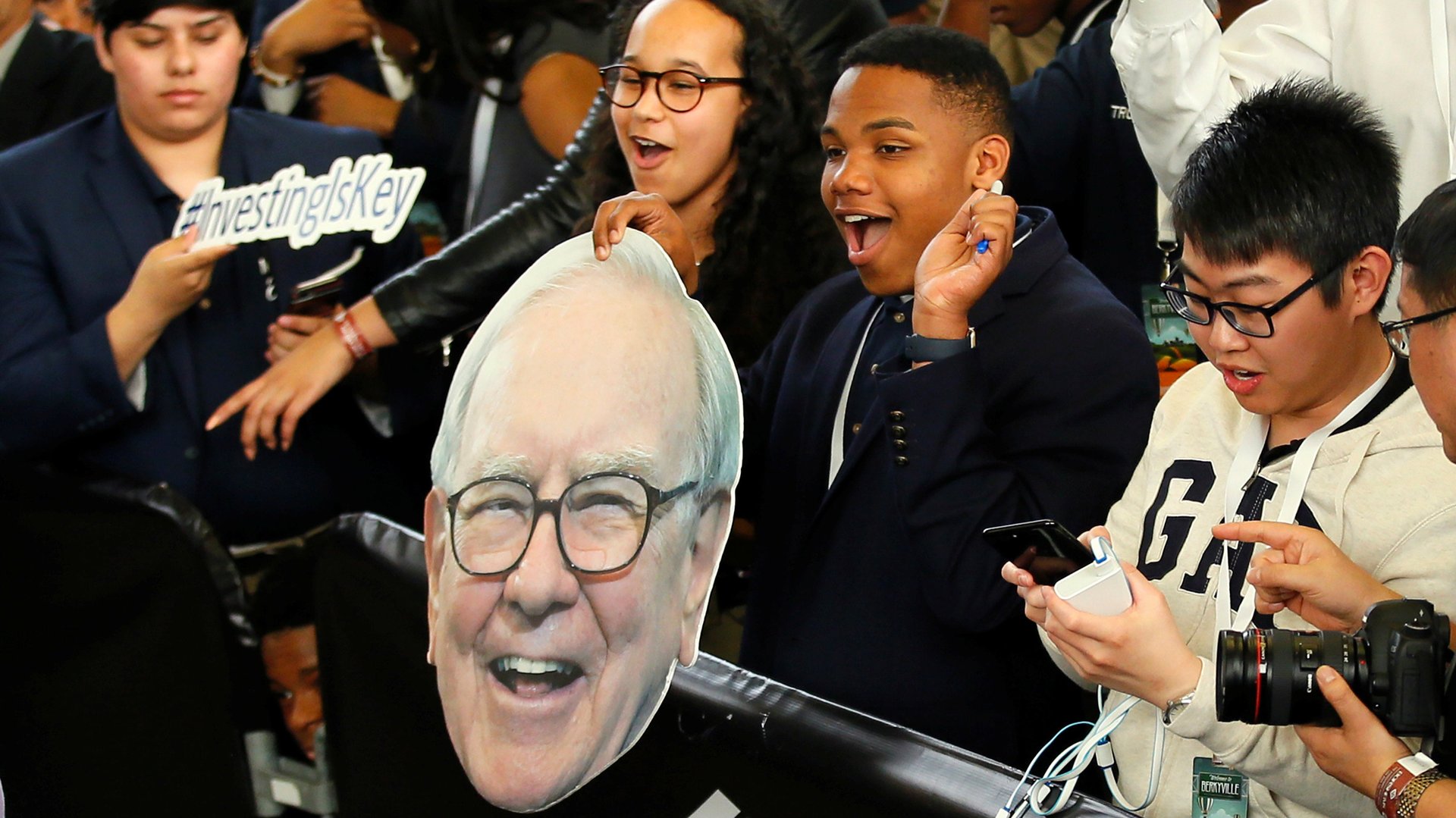

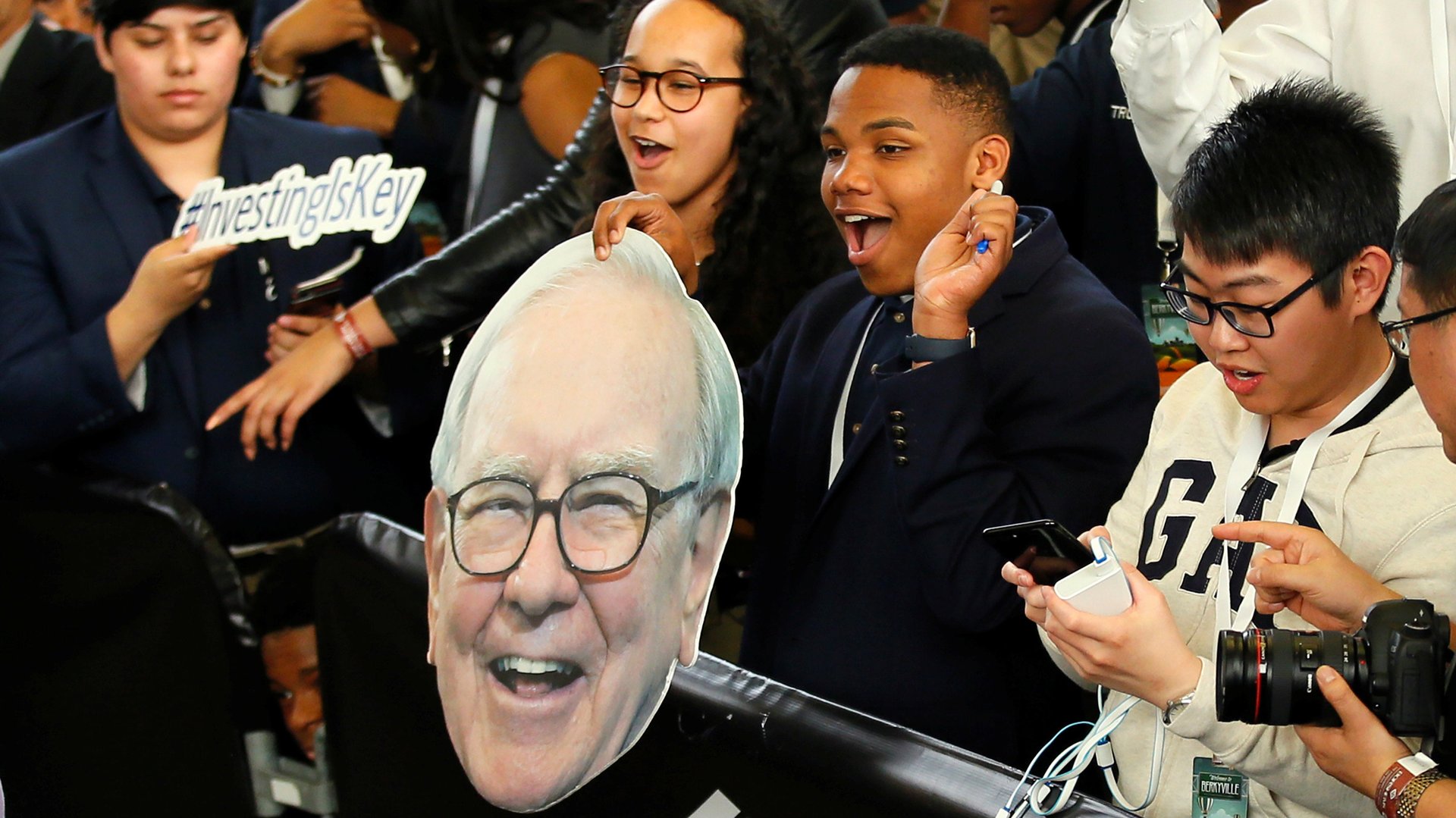

Although a hit rate of 70% would be so-so in many other walks of life, the feat has earned Buffett the moniker of “oracle” and near-religious admiration from investors around the world, given the difficulty of beating the market so consistently and comprehensively over such a long period of time.

Shortly after Buffett bought a controlling stake in Berkshire, he lamented in a letter to investors (pdf) that the firm was “hardly going to be as profitable as a Xerox, Fairchild Camera or National Video.” The stock traded at around $18 per share when he acquired his majority stake, and has appreciated by means of acquisitions and investment returns to $297,600 per share as of the end of last year, an increase of 1,600,000%. (The S&P 500 returned around 3,000% over the same period.) Given those gaudy returns, a key question is who will take over the enterprise when the 87-year-old Buffett and his partner, 94-year-old Charlie Munger, step down.

This week, the Oracle of Omaha gave another hint about Berkshire after Buffett: he appointed Gregory Abel and Ajit Jain to the company’s board as directors (pdf) and made them vice chairs, sending another signal that one of them will likely take his place at the helm of the company eventually. Running a $500 billion conglomerate with a remarkable track record of success is a very different proposition for Berkshire’s next boss than the small, struggling textile manufacturer in New England that Buffett bought so many years ago.