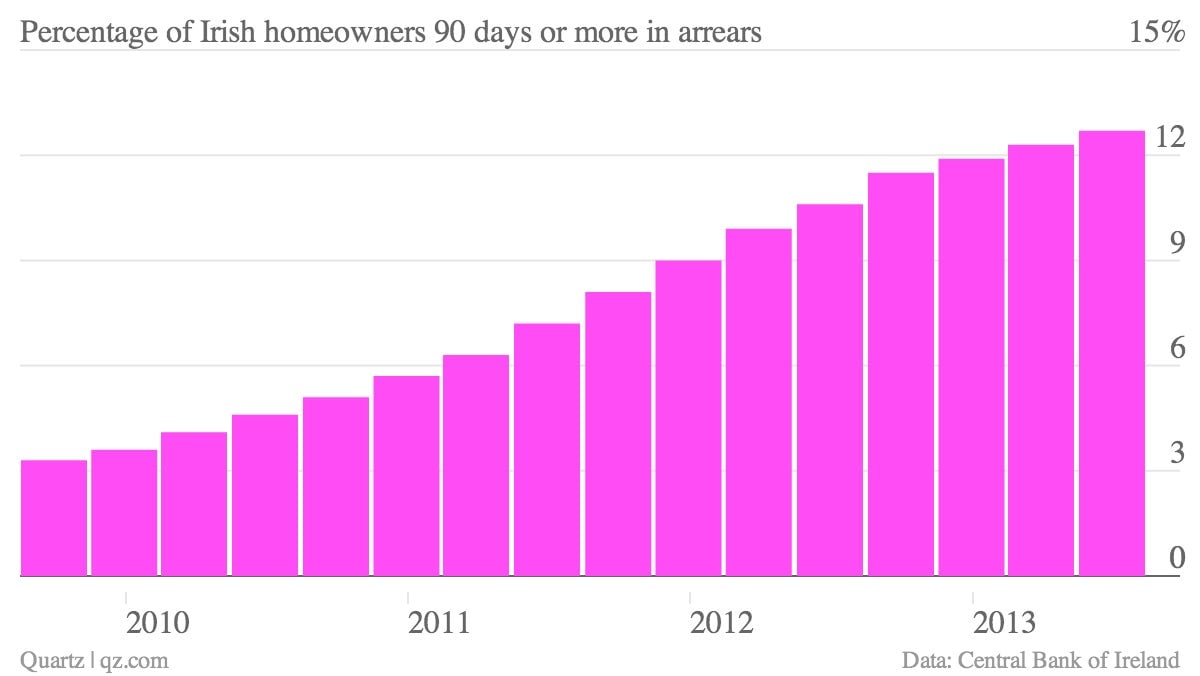

The Irish are still falling behind on their mortgage payments

In case you were wondering, Ireland’s housing market remains a terrible mess.

In case you were wondering, Ireland’s housing market remains a terrible mess.

The latest numbers from the Central Bank of Ireland out today show that 12.7% of all mortgages in Ireland were 90 days or more behind on payments in the second quarter. And things have been moving in the wrong direction for quite a while.

Some analysts argue that the official statistics understate the true extent of the problem, suggesting they don’t fully capture loans that are in forbearance for instance. (That’s when banks essentially stop collecting payments.) S&P has suggested that as much as 25% of Ireland’s mortgages are in some kind of trouble.

Why?

A host of reasons: A loophole in Irish law currently makes repossessions all but impossible. And banks claim many mortgage holders are gaming the system by simply ceasing to make their mortgage payments. “If someone is just not paying their mortgage then we will take a robust line,” David Duffy, chief executive of Allied Irish Bank said earlier this month. “There is no rent-free option available any more.”

Homeowner advocates, on the other hand, argue that banks refuse to face reality and cut deals with homeowners that reflect the how drastically the value of Irish real estate has fallen. Such agreements would likely force them to recognize steep losses in their portfolio of loans.

At any rate, the disorderly state of Ireland’s housing market should put to shame any of the European policy makers that are still championing Ireland as a model example for bailouts.