The crisis enveloping India’s currency just got serious. Here’s how to stop it

There’s really no denying it: India’s got a full-blown currency crisis on its hands.

There’s really no denying it: India’s got a full-blown currency crisis on its hands.

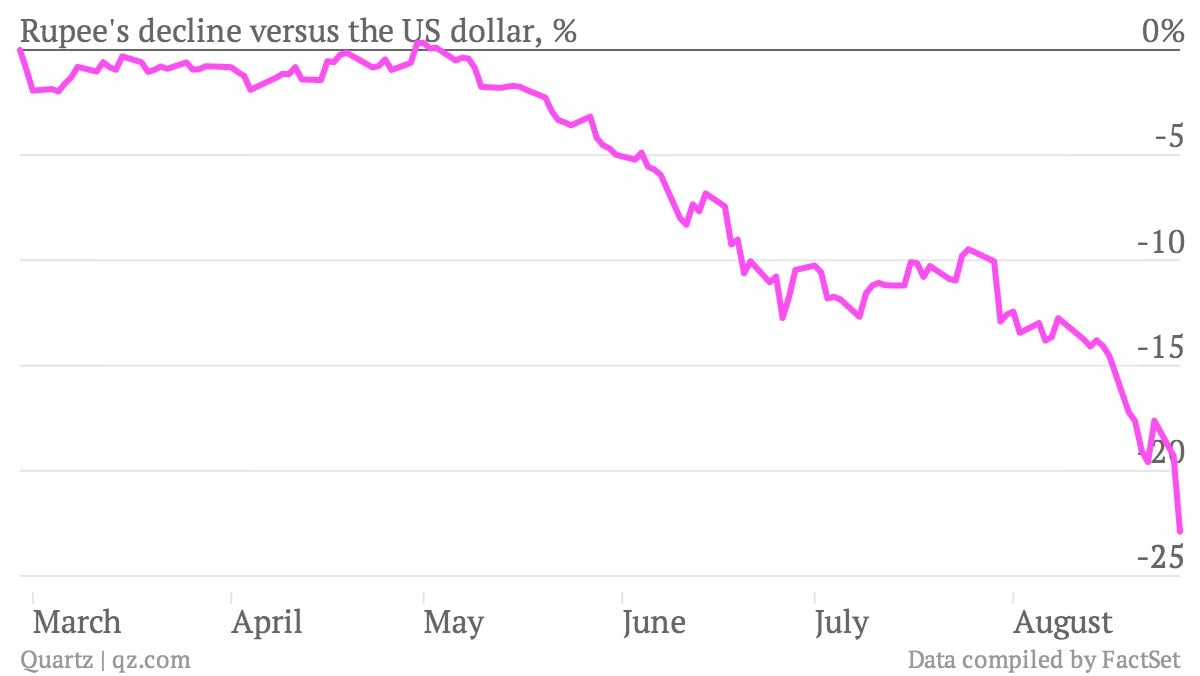

The rupee fell a remarkable 3% in trading today. At points it touched 67 per US dollar, a never-before-reached level. It’s fallen nearly 23% against the US dollar in the last six months.

People point out that the root of the crisis is India’s creaking economy. And yes, India needs far-reaching reforms. Corruption, labor market structure, subsidies. They all need work. But before it moves on any of those issues—if it ever does—India still needs to put the fire out.

Here’s how to do it.

Fight the markets

The Reserve Bank of India (RBI) needs to put everything it’s got into intervening in the markets to beat back the speculators pushing the rupee lower. That means it has to draw a line in the sand and defend it by using its stockpile of foreign exchange reserves to buy rupees in the open market.

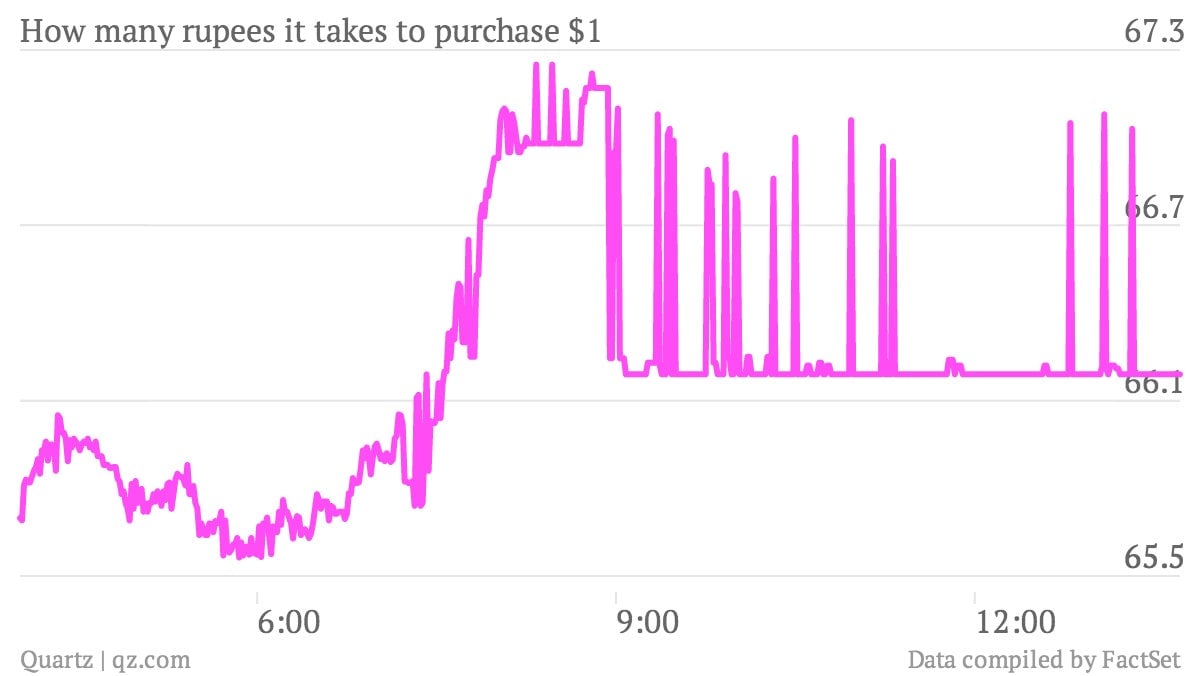

To be clear, the RBI has already been active in the markets. But it has shown little appetite for a real fight. The bank has tended to intervene late in the trading day, amid the thin liquidity that allows it to better push prices, and pushed up the value of the currency. That’s what it did today. Take a look at the chart below.

But the market is a bully. And it needs to be confronted face to face. ”RBI coming at after 4:30 is almost like a cosmetic surgery and quite often the following day the market opens with a gap,” Partha Bhattacharya, deputy CEO Mecklai Financial, told India’s Economic Times. We agree. The RBI needs to draw a line in the sand and defend it.

Get help

Once the RBI commits to a serious showdown with the markets, it will be tested. That means the RBI is going to have to dip into its FX reserves and continue buying until the market is convinced it will hold the line.

Naturally, the spotlight will then swing to the country’s reserves of hard currency. (Essentially FX reserves are the gunpowder a country has available to fight the currency war against the markets.) If the market sees them shrinking too much it will feel emboldened to keep pushing the value of the rupee lower.

These dynamics are already at play. Part of the reason for the sharp selloff in the rupee today was the fact that fresh data showed India’s currency reserves dwindled by $14 billion since the end of March.

That’s why the RBI needs help. It needs to find a reliable source of hard currency to convince the market is has almost unlimited buying power to defend the rupee.

An effective way of doing that is by cutting a deal with another central bank to swap currencies. These are called swap lines. The US Federal Reserve in recent years opened a bunch of swap lines with developed market central banks during the US financial panic and the euro zone crisis.

There are fresh reports that India is now looking for a source of such swap lines. But the task force in charge of trying to find partner countries that will hand India hard currency won’t report for a month, according to Bloomberg. They will soon find out they don’t have that long.

Clamp down on cash outflows

India’s got to thread a very difficult line here. It has to try to keep hard currency from fleeing the country. But it doesn’t want to impose the type of hard and fast capital controls that tend to make investors want to pull every last cent out of a country as fast as possible. So it can take half measures. And that’s what it’s done. It’s moved to cut the imports of commodities such as gold and oil as well as plasma televisions. It will likely do more.

And pull fresh cash in

Simply put, India has been relying on foreign investors to finance a current account deficit that’s been getting worse and worse. And since foreign investors now want their money back, India has got to find a way to cover the shortfall.

There are some sources of cash. For instance, the army of Indians working abroad has reportedly been eager to take advantage of the weakness in the currency to send money home in the form of remittances. The Indian government could even tap those folks for a low-cost loan by launching a so-called “diaspora bond.” The country is also reportedly considering allowing state-run industries to issue so-called quasi-sovereign bonds as a way to raise cash. And of course, there are always exports. But don’t hold your breath—exports have been stagnant for a while now.

It might not work

None of this is rocket science. This is the long-established playbook for central bankers in fighting off a currency crisis. But that doesn’t mean it always works.

If it doesn’t, India will have little choice but to go back to the International Monetary Fund for a loan. That’d be a painful replay of the loans India was forced to take from the IMF back in 1991. And it’d be humiliating for a country that was supposed to be a leader of a new phase of global growth.

But it also might be the best option.