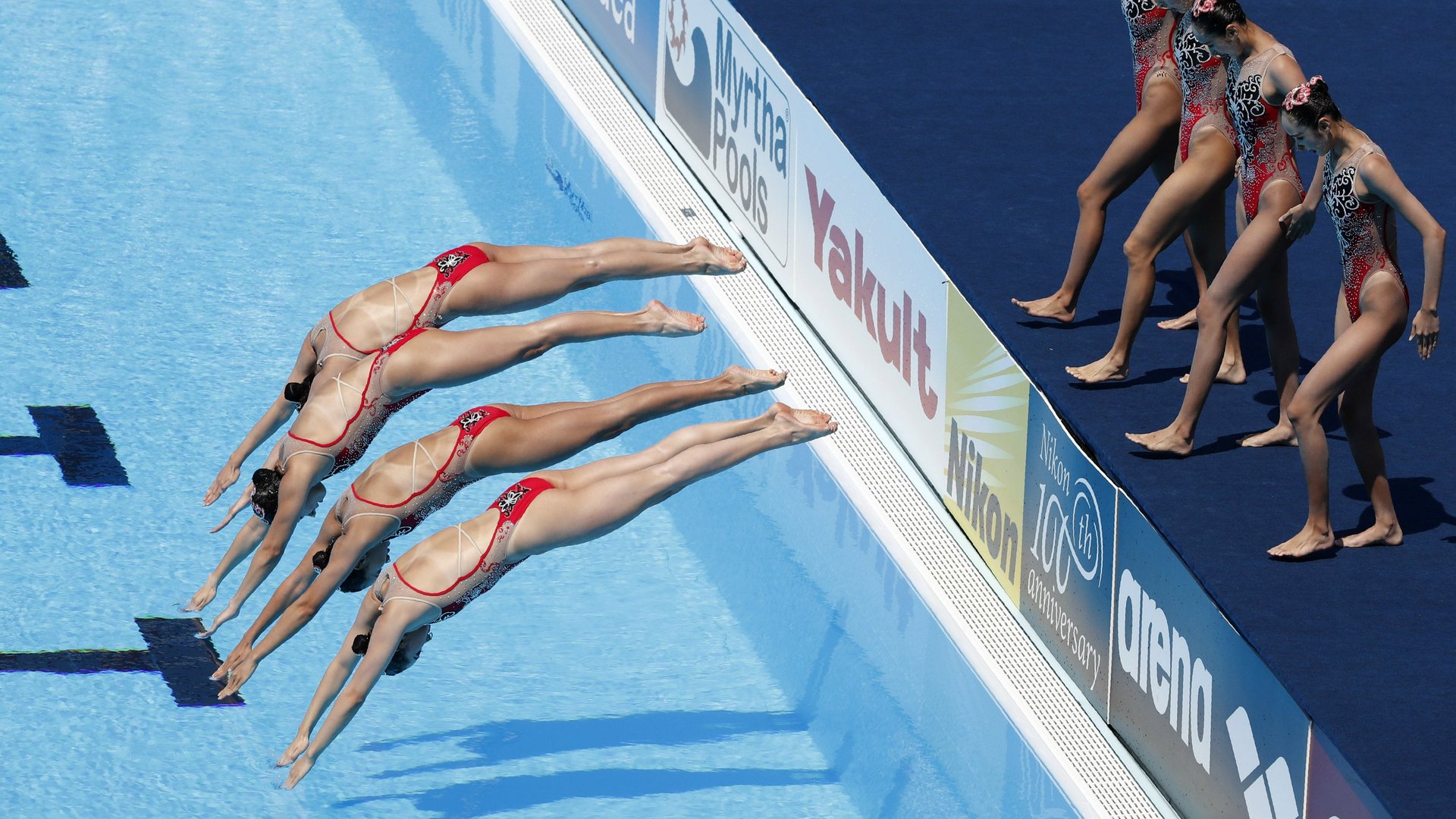

The economic buzzword of 2018 is “synchronous”

The best way to show you’re in the know in economic circles is by throwing around the word “synchronous.” That word is being used with increasing regularity to describe the current state of the global economy, which is experiencing a synchronized growth upswing that hasn’t been this widespread in a long time.

The best way to show you’re in the know in economic circles is by throwing around the word “synchronous.” That word is being used with increasing regularity to describe the current state of the global economy, which is experiencing a synchronized growth upswing that hasn’t been this widespread in a long time.

The word was popular at the World Economic Forum’s annual gathering of global elite in Davos, Switzerland last week. Business and political leaders enthused over robust GDP figures, strong company earnings, and record-breaking stock markets around the world. “It’s a time of enormous ebullience,” said Blackstone chief executive Steve Schwarzman.

Both the World Bank and the IMF have raised their outlooks for the global economy recently, noting with pleasure how broad-based growth has become. For the first time since the financial crisis, the global economy is “operating at or near full capacity,” the World Bank said this month.

“We are in an exceptionally favorable context,” Credit Suisse CEO Tidjane Thiam said on a panel in Davos. “There’s synchronous growth.” (There’s that word again.)

“The mood is pretty good from a business point of view because of the synchronous growth” said Dominic Barton, global managing partner of McKinsey. (And again!)

The economic momentum is expected to continue for the next few years. The US will get a short-term boost from tax cuts. Central bank stimulus into the euro area is paying off, with higher growth figures across the region, while Eastern Europe is benefiting from exports to Germany. Many emerging economies are resurgent thanks to rising commodity prices, with oil recently setting a three-year high.

Still, the widespread optimism makes some anxious, not least those that subscribe to the notion that you should always bet against the Davos consensus. Geopolitical ructions, big debt piles, widening inequality, job losses from technology, and the impact of climate change are all issues that should be addressed while the global economy is strengthening. As the IMF presented its increasingly positive economic forecasts, the organization’s chief economist said that, for governments, “the overarching risk is complacency.” This warning was echoed by the president of the World Bank.

Even then, business leaders striding around the Swiss resort town struggled to contain their enthusiasm.

“Roaming around Davos, it seems to be consensus among most participants here that 2018 is going to be a pretty good year for the global economy,” said Ray Nolte, the chief investment officer of SkyBridge Capital. “I really haven’t found anyone who is pessimistic.” And while this consensus makes Nolte nervous, he says he doesn’t know what could derail the positive sentiment this year. Growth levels are modest enough to continue at this pace for a long time, he said. Ten years on from the financial crisis, what Nolte calls “Post-Financial Stress Syndrome” has made investors more conservative than before.

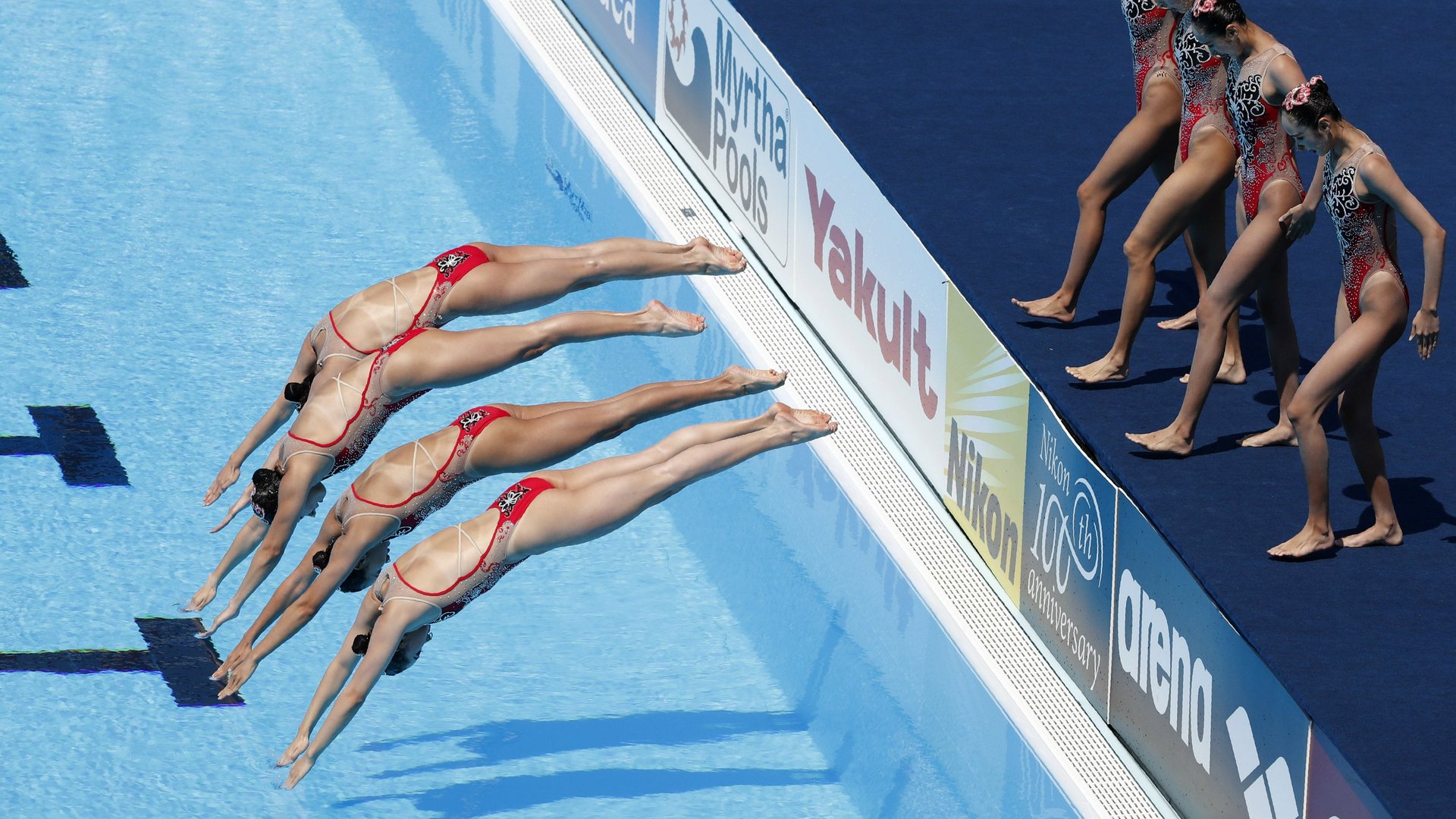

But the global co-ordination does worry the investment chief to some extent. “In past cycles, you’d tend to have one region helping out another region, this time they all seem to be in sync,” he said. “So when things are in sync do they go out of sync at the same time? That would be a potential issue.”

It’s a fear shared by Manny Maceda, a partner at Bain. “Every major region is looking forward optimistically, which probably means it’s time for me to get anxious,” he said in a video from Davos. “But right now, out here, the message is it’s good times all around the world.”

These underlying concerns are captured by another popular phrase: “inclusive” growth. A year earlier, the Davos set were meeting shortly after Brexit and as Donald Trump was being inaugurated. They feared populism was about to sweep across Europe.

The nationalist wave never came to pass, but heads of multinational organizations, politicians, and economists are calling for more inclusion in how global economic gains are distributed. One-fifth of emerging and developing countries experienced a decline in per capita income in 2017, said Christine Lagarde, managing director of the IMF. “We should not feel entirely satisfied” with the current state of economic growth, she added. “This is mostly a cyclical recovery.”