Will anyone buy Venezuela’s petro cryptocurrency?

There’s a lot of debate about whether governments will eventually adopt the technology that underpins cryptocurrencies like bitcoin. Venezuela—reeling from US and European sanctions, collapsing oil exports, and hyperinflation that could climb to 13,000%—may be the first to actually try it.

There’s a lot of debate about whether governments will eventually adopt the technology that underpins cryptocurrencies like bitcoin. Venezuela—reeling from US and European sanctions, collapsing oil exports, and hyperinflation that could climb to 13,000%—may be the first to actually try it.

The South American country is due to launch a first phase of its state-created cryptocurrency today (Feb. 20), and President Nicolas Maduro’s government has said the ”petro” will help Venezuela raise cash despite sanctions. Venzuelan officials say they expect support from investors in the likes of Qatar and even the US. Yet there’s plenty of reason for skepticism about its prospects.

The petro will backed by the country’s oil reserves—the world’s largest—and will be accepted as payment for things like national taxes and public services. All people need to do, according to the government website, is download their digital wallet. The so-called pre-sale that begins today will consist of tokens on the ethereum blockchain that can be redeemed for petros, according to a white paper (pdf) about the offering.

How Venezuela can profit

If successful, the transaction could hypothetically raise $2 billion or more, according to some estimates. About 38% of the transaction will be sold in the discounted pre-sale, while 44% goes to the public offering, with the rest (18%) distributed to the government’s Superintendency of Currency and Related Activities. The government will issue a total of 82.4 million petros (each of which is divisible by 100 million units, known as a mene). According to reports, petros won’t actually be redeemable for a barrel of crude (there’s no mention of a mechanism to do so in the financial documents provided).

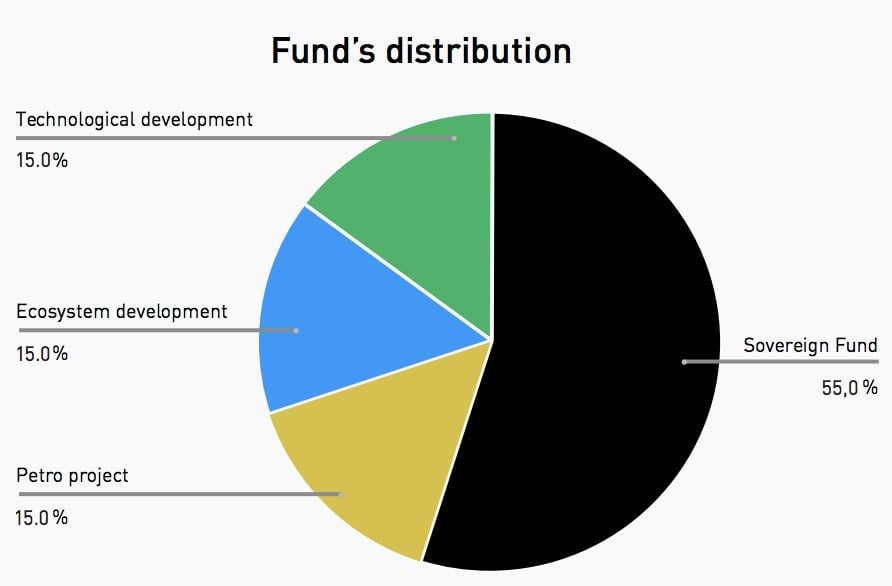

The petro will reportedly be sold in hard currency and other cryptos, not domestic bolivars, and Venezuela says it will enable so-called atomic swaps with other cryptos, which doesn’t require a third-party exchange. Most of the money from the initial offering funds will go to a sovereign wealth fund, while 30% is earmarked for “ecosystem development” and “technological development.”

Other governments are also investigating the cryptographically secured architecture behind digital coins like bitcoin. The Bank of England is researching such a possibility, as is Sweden’s central bank. That could be useful as more and more people conduct transactions digitally. Right now when you pay with a card or through your phone, the money generally has to pass from one bank or financial services firm to another. A sovereign currency issued on a blockchain-style ledger could be a digital form of cash—potentially transferred directly between users.

A way around the US dollar

Venezuela and Russia—which is considering a crypto form of the ruble, according to the Financial Times—want to use the technology for their own ends. These countries have been battered by US-led sanctions which can cut them off from the American banking system, making it hard to obtain the dollars necessary for many types of commerce. The dollar enables American governments to exert enormous force and influence without having to fire a missile or write a line of malicious computer code, and getting out from under the dollar has long been a dream for these countries.

If Venezuela and Russia could establish a new payments system using crypto, the US would have less control over them and their economies, Hans Humes, CEO of Greylock Capital Management, said in an interview on Bloomberg Television. Even though Venezuela is economically feeble, these ambitions are something Washington must pay attention to, he said.

Venezuela, after all, is behind on payments on billions of dollars worth of bonds that it can’t refinance because of US sanctions. However, it’s not clear that a blockchain would make Venezuela’s government more reputable. While the petro is “backed” by oil, substantial stakes in the nation’s prized oil projects are already owned by the likes of Russia. And it doesn’t help that Venezuela’s congress has said the petro tokens are illegal because the legislature didn’t approve the transaction, according to the Guardian.

Hyperinflation, a sign of the government’s lack of ability to manage its own economy, has made its existing currency just about worthless. Granted, people are pouring money into cryptocurrencies that were explicitly designed as a joke, suggesting that Venezuela could somehow benefit from the mania. But given its history and the risk of running afoul of US watchdogs, the new currency still seems a lot like the old one—even if it’s been sprinkled with cryptocurrency dust.