Andreesen Horowitz’s first space investment is an internet satellite, naturally

The venture fund known for arguing that “software is eating the world” has taken a bite out of space with an $18 million investment in a satellite-builder called Astranis.

The venture fund known for arguing that “software is eating the world” has taken a bite out of space with an $18 million investment in a satellite-builder called Astranis.

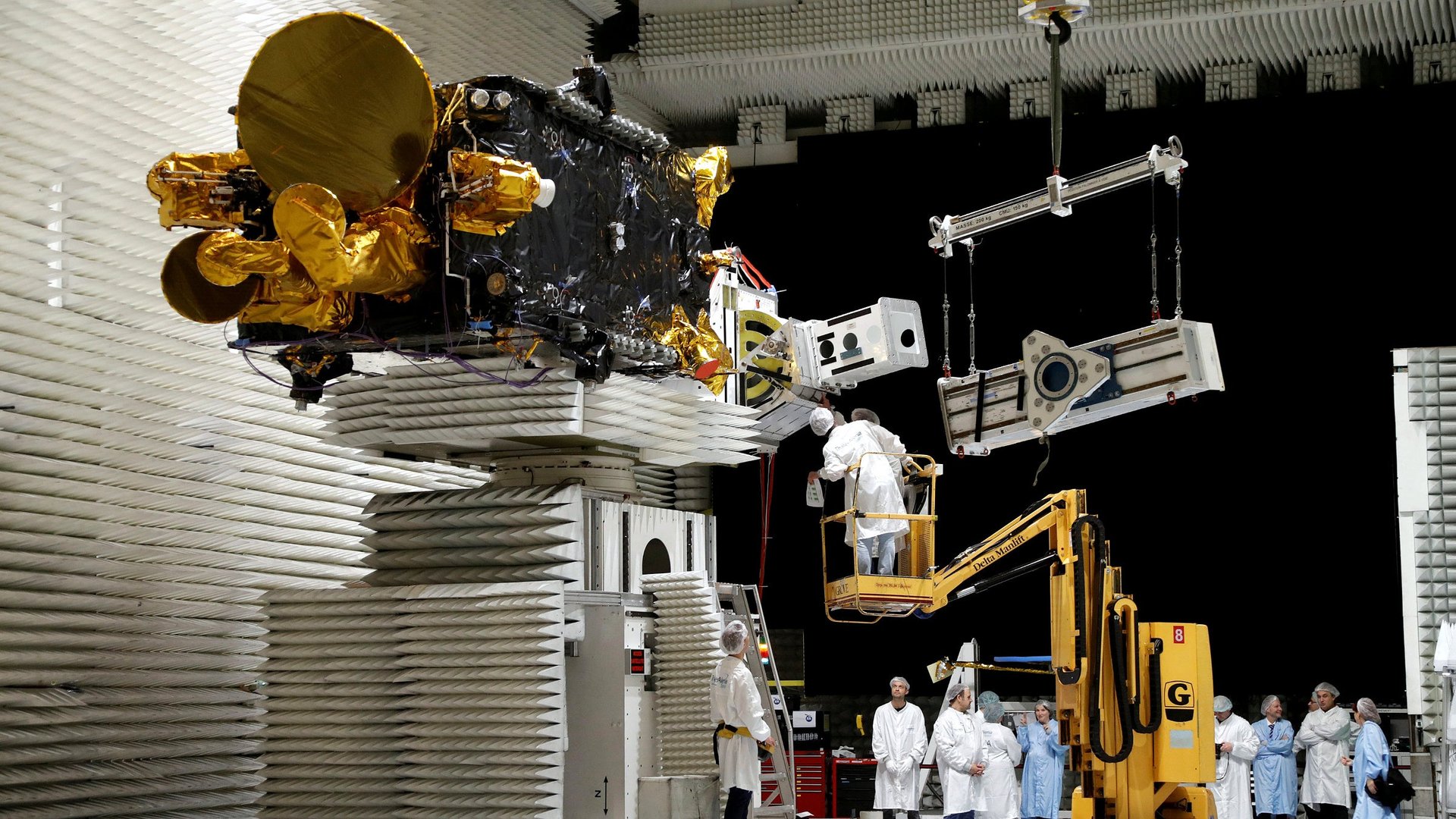

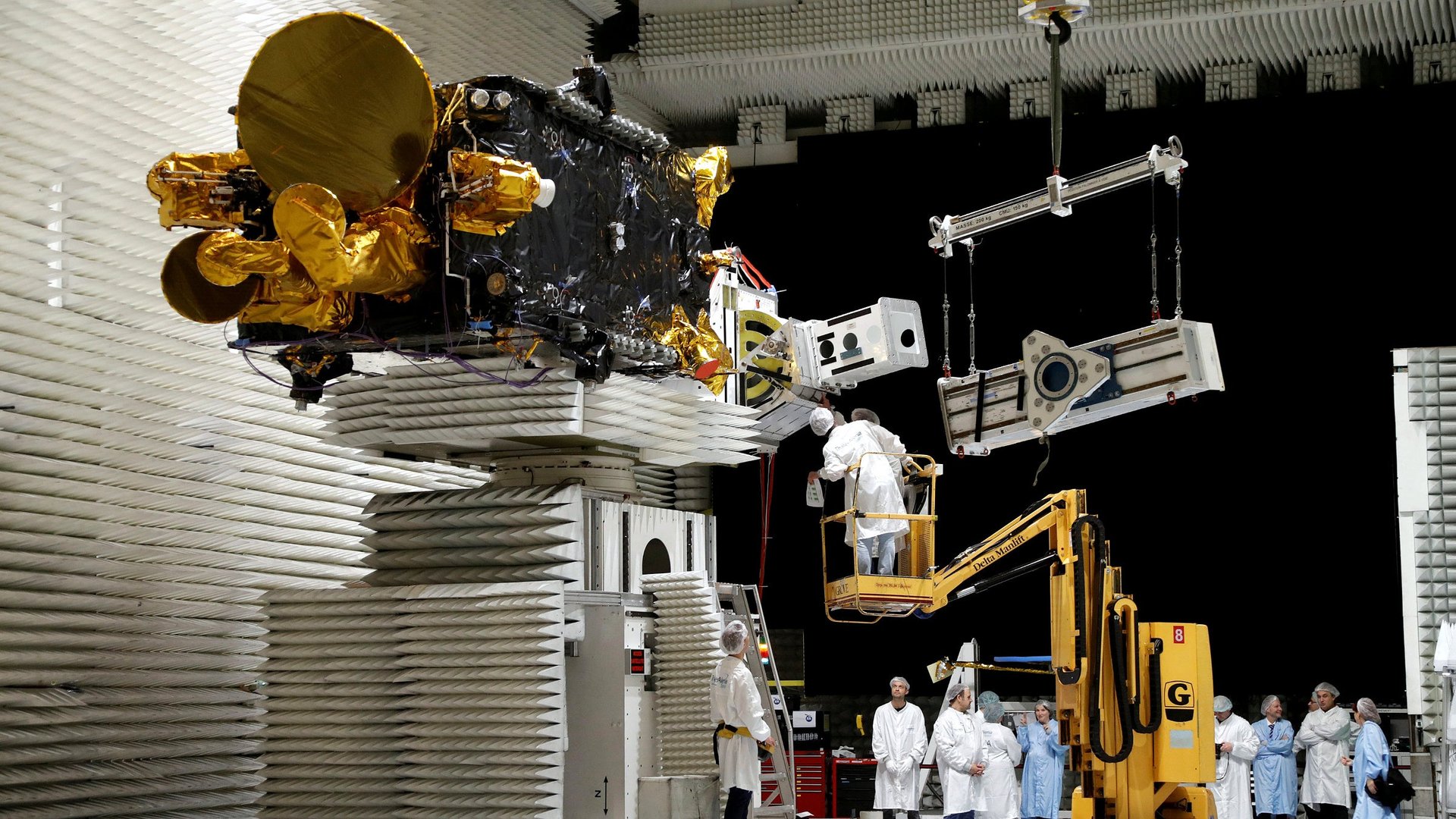

The company has developed an small, low-cost satellite design to provide internet connectivity from geostationary orbit, a very high altitude where satellites remain in place over one part of the earth. Having tested a prototype in low-earth orbit earlier this year, Astranis will use its new funds to build a full-fledged satellite with several gigabits of capacity and launch it next year.

The team is emblematic of the new space industry: One co-founder, John Gedmark, helped set up the Commercial Spaceflight Federation, a trade group for boosting private space activity; the other, Ryan McLinko, was an engineer at Planet, the earth imaging company at the forefront of the boom in small satellite investment.

Data from Preqin, which tracks venture capital deals, shows growing investment into an industry that was once limited to incumbent firms, mostly government contractors.

Silicon Valley investors are increasingly attracted to the argument that advances in electronics miniaturization, batteries, and antennae technology will combine with the world’s insatiable desire for connectivity and data to make formerly risky business plans in space appealing.

“Think about the amount of work it took to connect the first 3.5 billion [people to the internet,]” says Martin Casado, the Andreesen Horowitz partner who led the investment and will join Astranis’ board. “I think that’s the order of magnitude we’re talking when it comes to connecting the next three billion…even chipping away ten percent of that problem, five percent of the problem, is a $10 billion-plus company.”

Casado, who developed an important software networking protocol as a Stanford graduate student and became an executive at VMware before joining Andreesen Horowitz, sees similarities between his early work and Astranis. Each seeks to profit by giving larger network operators the tools to execute for their customers.

“We’re putting up infrastructure here, and these are pipes, and they can be used for a whole wide array of applications,” Gedmark tells Quartz.

The CEO says one advantage is his satellite’s use of software-defined radio, which allows it to be reprogrammed to operate efficiently on many different radio frequencies. This will help Astranis with a key challenge: It doesn’t have rights to operate their satellites on any existing frequencies, and has yet to announce any specific telecom partners.

Unlike other satellite internet plays, whether from more established companies like ViaSat, which just announced 100 mbps internet service from a new, high-capacity satellite, or bolder efforts like SpaceX’s plans to launch a huge new satellite constellation, Astranis is not seeking to operate its own satellites. Instead, Gedmark aims to sell them to existing satellite telecoms as smaller, cheaper substitutes for older satellites that might cost hundreds of millions to build and insure.

Satellite operators already pay tens of millions of dollars just to reserve space in geostationary orbit to send and receive radio signals. That’s one reason they spend a lot on their flying computers: So they can be sure of reliable return on those investments. That can create a vicious cycle, however, where companies may have orbital rights but lack the capital to make use of it before their access expires. Casado sees an opportunity in that dynamic.

“There’s a tremendous amount of demand to put satellites up in an area to use the spectrum that’s starting to time out,” Casado said, making this “a very opportunistic time for [Astranis] to engage those spectrum holders.”

Tim Farrar, a satellite industry consultant, says the idea has merit. “This is a good reason for Astranis to be frequency agile,” he tells Quartz. “An initial business plan might in fact be to offer to hold slots for satellite operators until they can build their bigger, more capable satellites that can make better use of the scarce spectrum rights in GEO.”

The other question about Astranis’s business plan comes from their emphasis on the ultra-high stationary orbit, more than 35,000 kilometers above the earth. The sheer physical distance—almost equal to a trip around the world—means higher latency and worse service for interactive applications like video chat or gaming. That’s one reason why SpaceX and OneWeb, another new satellite telecom firm, are betting on large constellations flying no more than 1,400 kilometers above the planet to deliver the fastest possible service.

Each plan comes with trade-offs: The low-flying constellations require bigger capital investments and more complicated technology to handle network traffic between fast-moving orbital computers. Astranis, Casado says, is “a nice solution poised between two extremes”—the expensive technology proposed by SpaceX and its competitors, and the legacy satellites operated by most space telecoms.