Despite a slowdown in the last few years, the Indian e-commerce market remains one of the world’s fastest-growing and is set to overtake several global peers.

“We expect the online retail market in India to grow at a CAGR of 29.2% to cross $73 billion in 2022, representing nearly 5.7% of total retail sales,” says a March 22 report by US-based Forrester Research. “We expect apparel, footwear, and grocery to continue to be a key focus for online retailers in 2018.”

Over the last couple of years, the Indian e-commerce sector has witnessed a slowdown due to regulatory actions like new guidelines for foreign direct investment (FDI), the demonetisation of two high-value notes, which sucked cash out of consumers’ hands, and the new goods and services tax regime which led to a decline in consumer spending, Forrester said.

Yet, India, with its $27 billion e-commerce market, may soon close the gap with Australia’s $31 billion one.

“Reduction in data prices and the launch of affordable 4G devices will further boost the expansion of the buyer base for online retail in markets like India,” Forrester said. “Increasing adoption of mobile payments will also boost sales via mobile devices.”

Amazon is closing in on Flipkart

Within India, the e-commerce war heated up after US-based Amazon gained a firm footing against homegrown rival Flipkart.

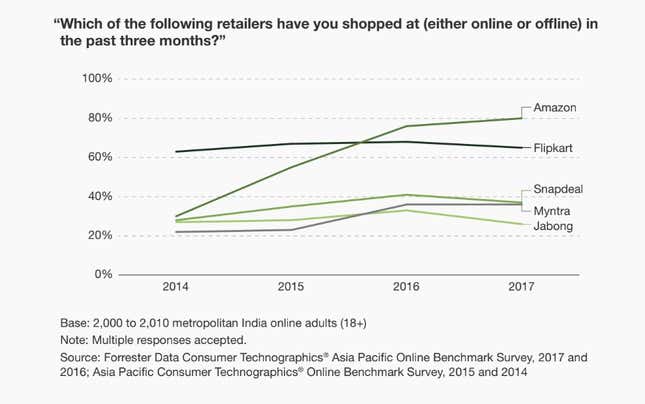

“After surpassing Flipkart in 2016 for the first time, Amazon has strengthened its position as metropolitan Indian consumers’ preferred online retail destination and is aggressively closing the gap with Flipkart to become the single-largest online retailer in India in terms of sales,” Forrester said.

In 2018, Flipkart may find it even harder to battle Amazon, the report said. “Fashion remains the only category where Flipkart has a significant edge due to its acquisition of fashion online retailers Myntra and Jabong. With Amazon’s continuing focus on fashion and grocery in 2017 and 2018, Flipkart will find it difficult to retain its edge in 2018,” the report said.