Dishwashers and cars can save emerging markets, Goldman Sachs says

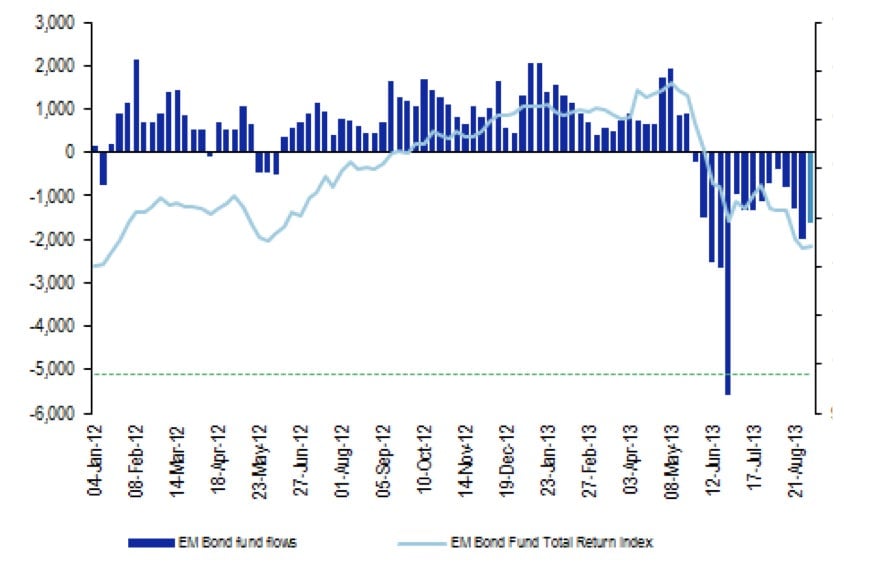

With India, China and Brazil all struggling recently to the maintain breakneck growth, many investors are giving up on the EMs altogether. Check out this Morgan Stanley chart which shows investors dumping emerging market bonds in recent months.

With India, China and Brazil all struggling recently to the maintain breakneck growth, many investors are giving up on the EMs altogether. Check out this Morgan Stanley chart which shows investors dumping emerging market bonds in recent months.

A lot of the pessimism is tied to the belief that the EM growth model we’ve come to know and love—either extracting commodities out of the ground (Brazil) or using those commodities to feed factories built by a boom in investment (China)—can’t really work any more. But don’t despair, say analysts at Goldman Sachs. There’s another source of growth glinting in the golden sun of the glorious future: Dishwashers.

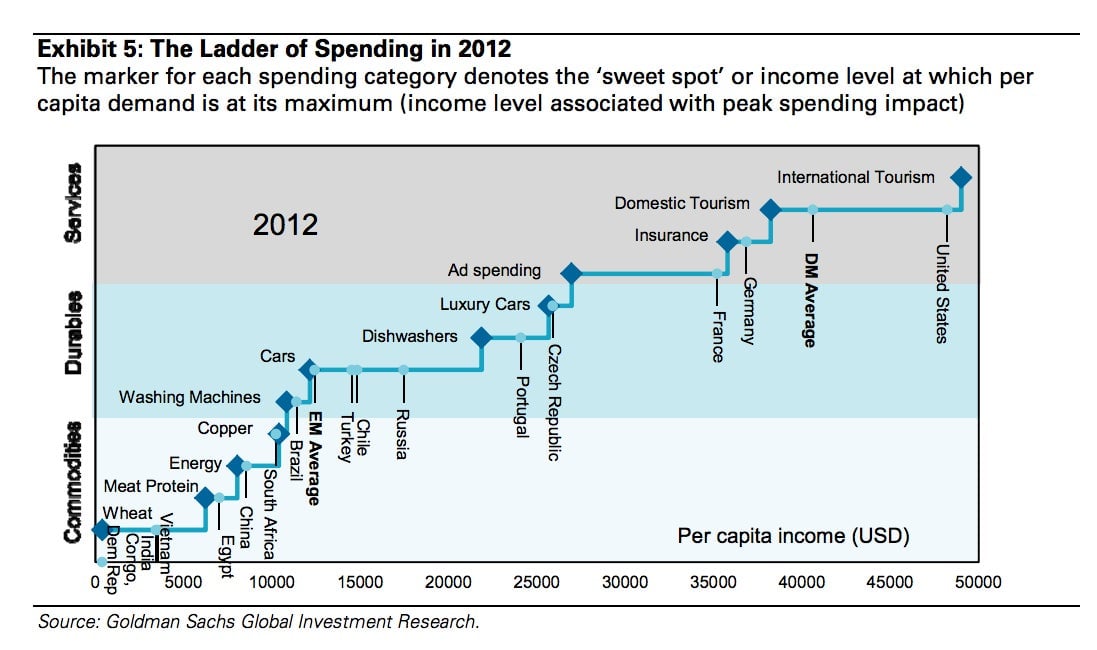

Analysts at Goldman Sachs suggest in a recent note that rising per capita incomes in emerging market nations could mean sales of consumer durable goods—larger items designed to last a while like dishwashers, washing machines and cars—are set to surge. “If commodities have been the locus of maximum global demand pressure over the past several years, we may be passing to the point where consumer durables, especially high-end consumer durables, experience similar pressure over the next decade,” wrote Goldman analysts in a research note published Wednesday.

To back up this thesis, they published a pretty nifty chart that shows at what point national per capita income levels spur growth in spending on different items. As the poorest countries inch up the ladder they start buying more wheat, meats, energy and raw materials like copper. When they get there, these countries are within spitting distance of a bump in sales of durable goods.

Of course, Goldman economists allow themselves plenty of wiggle room. They openly acknowledge that their estimates of income growth for developing nations might not go as planned if the emerging economic growth doesn’t develop as expected.

Still, they see demand for durable goods picking up steam for China and Brazil and peaking sometime over the next decade. Their models also suggest a second boomlet in spending when incomes in poorer EM nations such as India rise enough demand for washing machines around 2040.

Of course this is all just another way of laying out case for a grand “rebalancing” of the global economy. That’s the shorthand economists use to describe an expected rise of consumption among emerging market nations such as China who have built their economies on investment in factories that feed demand in richer foreign nations.

As we’ve said before, expectations of a rebalancing toward consumption in emerging market countries have been part of economic conventional wisdom for years with little evidence that it’s coming to pass. That doesn’t mean it won’t happen. But we wouldn’t hold our breath for it to happen any time soon. For investors looking for a source of consumer spending to fuel economic growth in the short term, we’d look to the old, reliable US consumer.