Investors fleeing emerging markets are still showing the love to South Korea

The world is loving on Korea, and not just because of the latest K-pop.

The world is loving on Korea, and not just because of the latest K-pop.

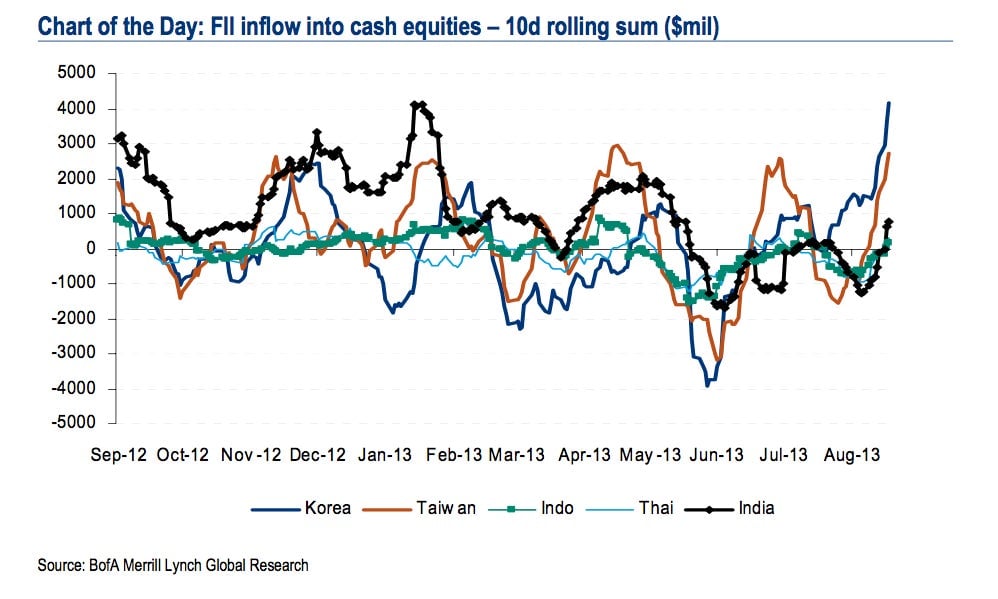

Investors who’ve yanked their cash from emerging markets in recent months aren’t fleeing from Korea, which is being flooded with foreign capital. Check out the inflows into the South Korean stock market, for example, in this chart from Deutsche Bank foreign exchange analysts.

Bank of America analysts cottoned onto the same trend, and noted Korea’s outperformance versus some other Asian nations lately.

Why do people love Korea so much? Unlike many emerging markets that are running large current account deficits, Korea is running a sizable current account surplus. (That means it sells a lot more to foreigners than it buys from them.) That surplus has left Korea with record high foreign currency reserves, which gives investors confidence that Korea can repay foreign lenders whenever needed. The weakening of the Japanese yen—a move Japan’s government hopes will reinvigorate its economy—has also shifted funds towards Korea, where the currency is more stable.

But if money continues pouring into Korea, its currency may strengthen too much. That would raise the price of Korean exports for foreign buyers. Another problem with large inflows into bond and stock markets is that they can quickly flow out if investors turn sour. Such was the case during the Asian financial crisis of the late 1990s; wilds swings in foreign cash flows are notorious for causing problems in developing countries.

With the US Federal Reserve expected to comment further on its taper plans next week, Korean regulators may be ready to take action to combat large inflows of foreign money, including raising taxes on the bond holdings of foreign investors. (They took similar steps back in 2011.) Stay tuned.