Why naming a startup funding round wrong could cost millions

While raising outside capital is not the only way to obtain financing for a startup, it seems to be the preferred method for new technologies where revenue or a business model is unclear. A common trend is emerging: more often than not, I hear that folks are raising their “seed round,” typically the initial money used to capitalize a company or if founders have capitalized, the first money taken from outside investors. This money could be from friends and family, along with some angel investors or venture capitalists. Some of the money could be “dumb” money (money with no other benefits attached); some could be “smart” money (money from a strategic partner, a well-connected angel investor, or an executive with deep, long-standing connections in the given industry).

While raising outside capital is not the only way to obtain financing for a startup, it seems to be the preferred method for new technologies where revenue or a business model is unclear. A common trend is emerging: more often than not, I hear that folks are raising their “seed round,” typically the initial money used to capitalize a company or if founders have capitalized, the first money taken from outside investors. This money could be from friends and family, along with some angel investors or venture capitalists. Some of the money could be “dumb” money (money with no other benefits attached); some could be “smart” money (money from a strategic partner, a well-connected angel investor, or an executive with deep, long-standing connections in the given industry).

Regardless, at the seed stage the company has many unknowns including, most likely, how they are going to return an investor’s capital with an acceptable return. Thus, a “seed round” is another way of saying, “we are raising very risky money.” Less common, are other folks telling me that they are raising an “Angel Round.” I scratched my head at this, but I quickly realized that an angel round is USUALLY first money in (like a seed round) OR a post-seed round but a pre-series A round (a bridge round when you aren’t quite ready for venture capitalists but haven’t quite failed yet) as defined here.

But, wait! A few answers on Quora argue that the rounds are essentially the same; consistent with the context the founders are making (i.e. we’re raising risky first money in our venture). Seed financing refers to the life cycle of the company while angel financing refers to the person providing capital. In parallel, upon success and scaling, the company will need to raise various series’ of financings from venture capitalists, private equity, banks, strategic partners, etc. Recently, LivingSocial raised a Series G financing (the life cycle of the company) while many others raised a “venture round,” where venture capitalists provided capital. Of course there are always anomalies like Color’s “fat startup” $41 million seed round.

While the analysis is rudimentary (nominal dollars is usually not as important as terms), it does show that constraining by investor type leads to typically less money. If the goal is to raise as much money as possible (again terms notwithstanding), the data show that you should let potential investors (whoever they may be) know what stage the business is in and not who you are looking to court.

In raising capital, it’s always good to have more than one person interested, which provides social proof, and prevents the investor from feeling like the target of the quote attributed to PT Barnum that a “sucker is born every minute.” As most marketplaces show, the difference in price between one buyer and at least two can be enormous if you get them caught in a bidding war. However, if one of these parties feels like he is not the target or has no chance in attaining his goal, he probably won’t even “show up.”

Employers do the same thing with job applicants all the time. When a job description says the candidate needs 3-5 years, great candidates without that experience sometimes do not apply. Depending on the position, you may have missed an opportunity to hire an amazing person and not even ever know it.

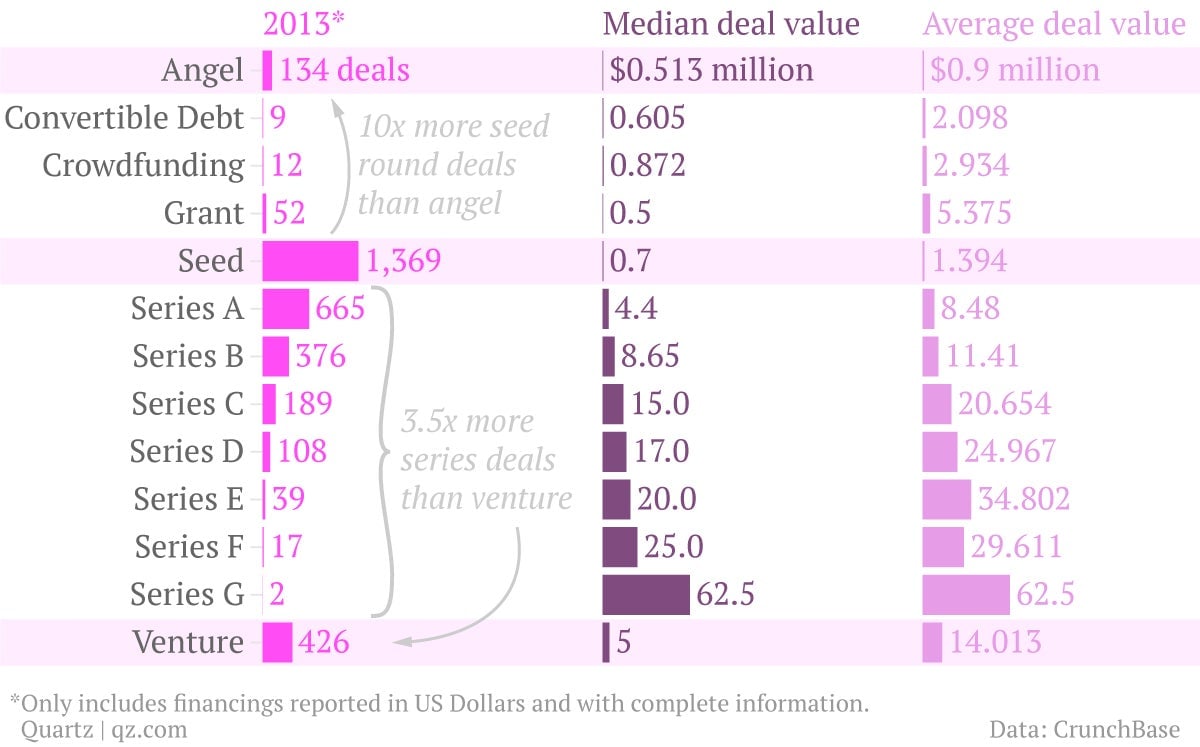

Looking at 2013 data from Crunchbase, here is what we found: The data show that almost 10 times more seed rounds were raised versus angel and almost 3.5 times more “series” rounds versus “venture” rounds. Angel rounds raised about half a million dollars while seed rounds raised 40% more. A “Series A” round raised $4.5 million although all venture rounds raised a median of $5 million; assuming a venture round covers all Series A-G.

Imagine Color was to raise an “angel round” perhaps as “funds” Sequoia and Bain would never have bothered to apply. In other words, invite everyone to the party and see who RSVPs, because you never know.