Investors are fiending for US and European stocks, but they’re not so hot on Japan

The recent flood of corporate bond issues has a slight whiff of desperation, as if borrowers know that conditions will not be this favorable for much longer, thanks to looming interest rate hikes in the US and beyond. Fear of rising interest rates is having another related effect: Investors are ditching bonds for stocks they hope will offer higher returns.

The recent flood of corporate bond issues has a slight whiff of desperation, as if borrowers know that conditions will not be this favorable for much longer, thanks to looming interest rate hikes in the US and beyond. Fear of rising interest rates is having another related effect: Investors are ditching bonds for stocks they hope will offer higher returns.

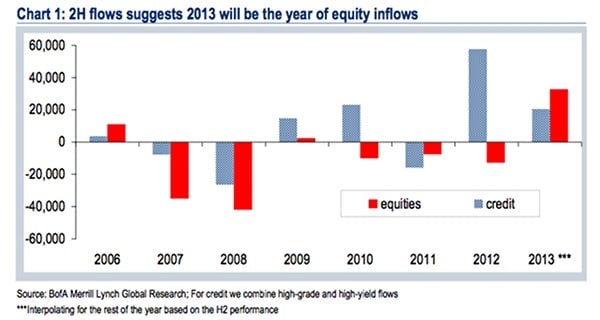

A new report from Bank of America Merrill Lynch ran the numbers for European equity funds, and the result is striking. At the current pace of inflows, European equity funds are on track to attract $33 billion in new money this year, an all-time record, as detailed in the chart below.

In its weekly take on the markets, Marketfield Asset Management writes that the growing attraction of European shares is the “most significant change to perception this quarter” among investors, with the region set to offer “leadership for global markets during the next recovery phase, which may be already underway.”

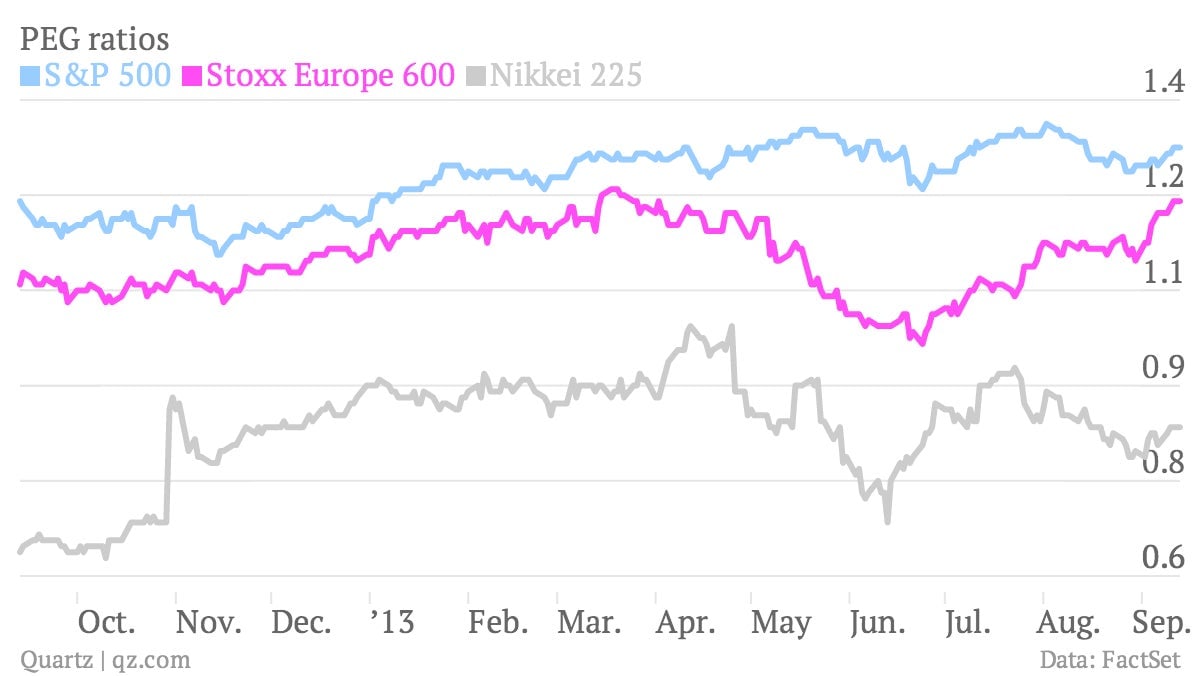

The S&P 500 and Stoxx Europe 600 indexes are both up around 15% over the past year. But in terms of valuation, by most common measures, European shares are cheaper. This gap is narrowing, however, thanks to burgeoning enthusiasm for European stocks. The chart below shows the PEG ratio for benchmark stock indexes, which is the price-to-earnings ratio over expected growth in earnings-per-share. The measure is a gauge of how richly investors value the prospect of companies’ profit growth.

As you can see, Japanese stocks are the best bet on valuation terms. Despite a 60% boost in the Nikkei 225 over the past year, they still trade at a discount to stocks in Europe and America. Encouraged by the looming impact of the by the stimulus prompted by Abenomics, analysts have doubled their estimate for 2013 earnings growth at Tokyo-listed firms over the past year, according to FactSet. Fund flows into Japan, however, have been patchy. Despite all of its troubles, investors seem to think Europe is a surer thing.