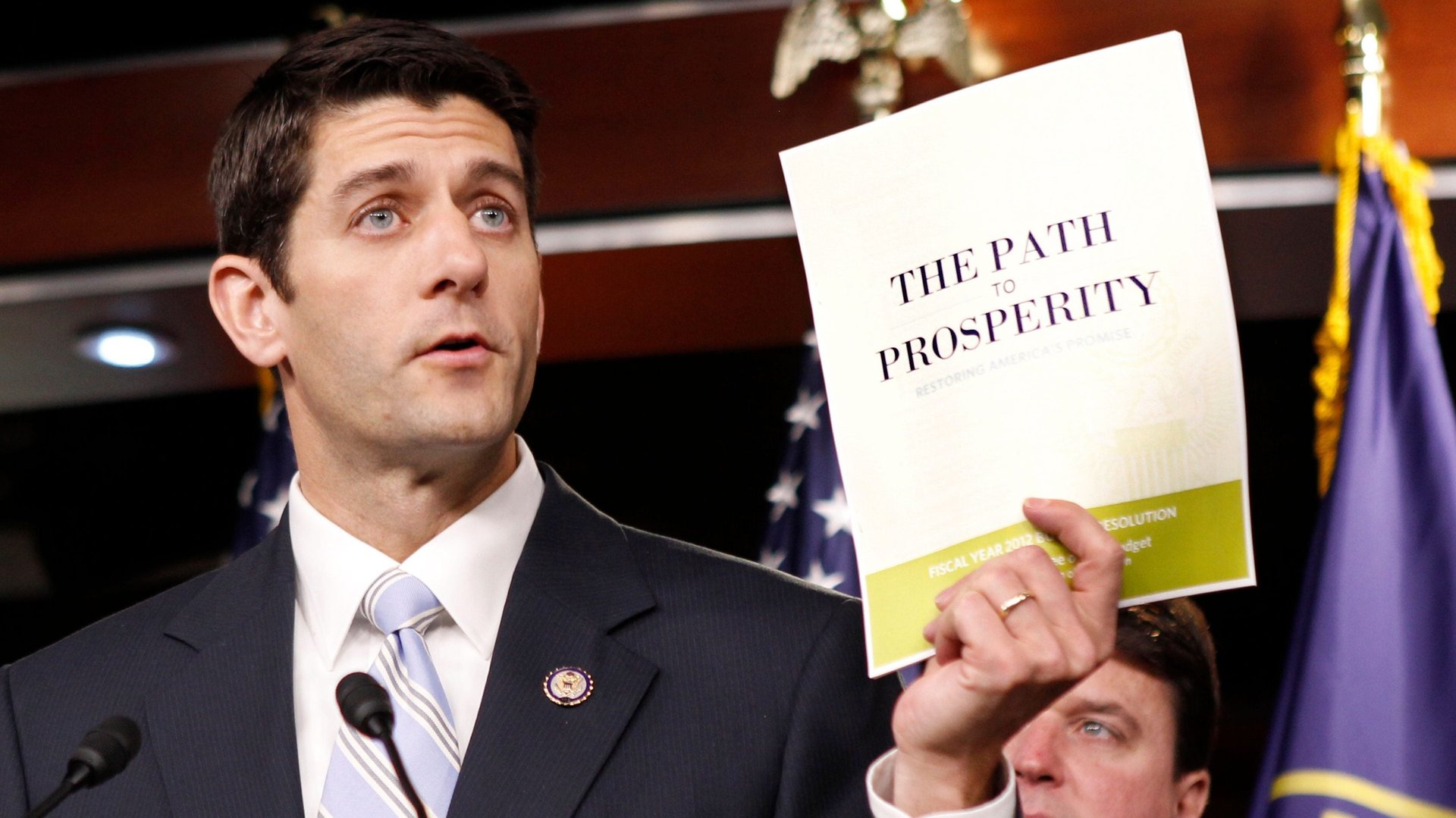

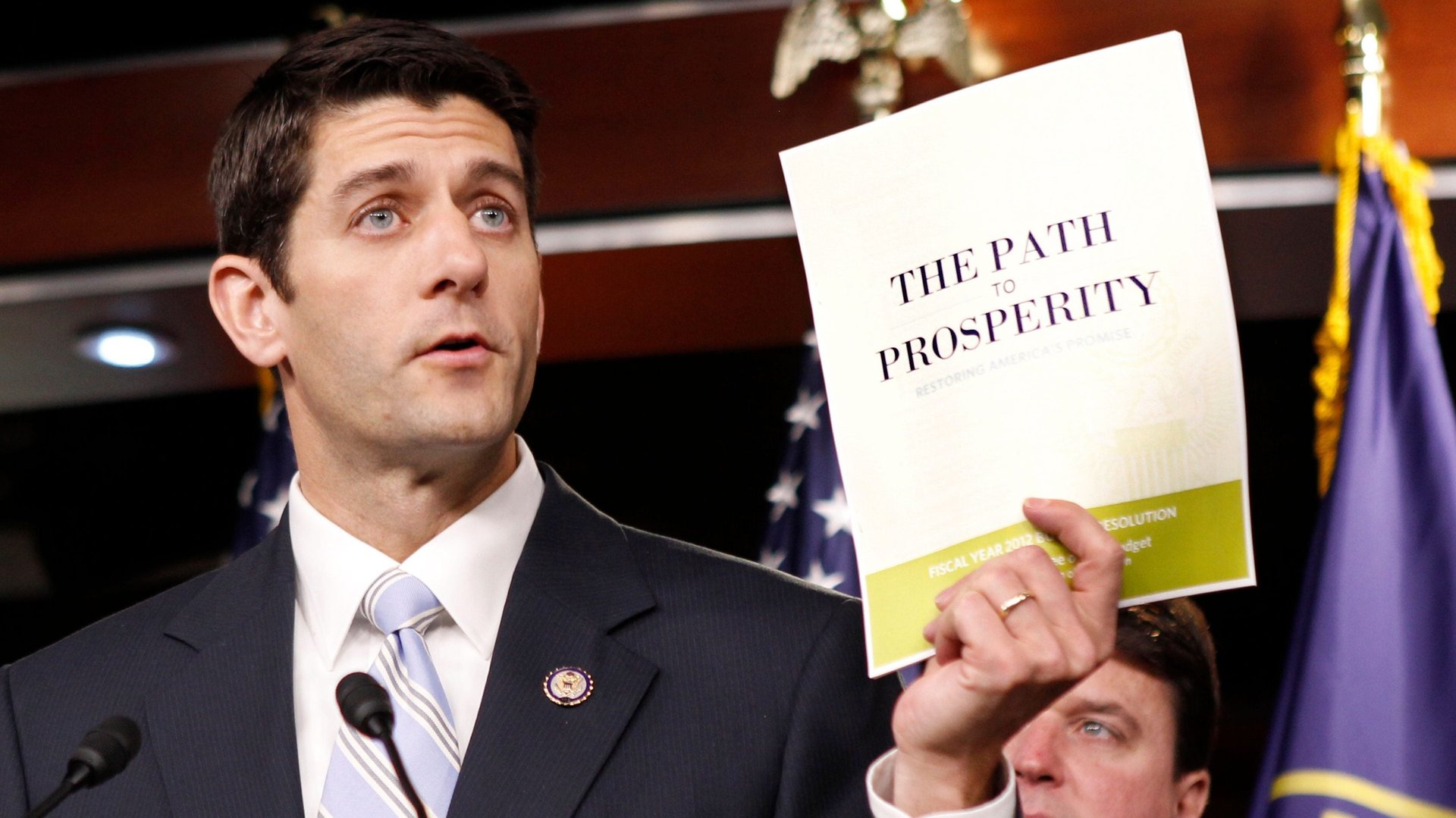

Grading Paul Ryan: Did the Tea Party’s weightlifting wunderkind deliver?

Few lawmakers have risen through the US political system in modern times with as much speed and fanfare as Paul Ryan, outgoing House Speaker.

Few lawmakers have risen through the US political system in modern times with as much speed and fanfare as Paul Ryan, outgoing House Speaker.

The Wisconsin native was elected to the House of Representatives in 1998 at the age of 28, after defeating an opponent twenty years his senior (who griped Ryan knew “how to land really hard blows politically while appearing to be a nice person”) on a platform of simplifying the tax code.

By 2007, he was the top Republican on the Budget Committee. In 2012 he was a vice presidential nominee. By 2015 he was the Speaker of the House, third in line for the presidency. It was all thanks to being quickly seen in DC as a “policy wonk,” one adept at confronting then-president Barack Obama with figures, not just open disdain.

His decision not to run again, announced Wednesday, was long-rumored but still shook Washington. After all, this should have been Ryan’s proudest moment: Republicans control the White House and both sides of Congress, and passed a massive tax bill along the lines of Ryan’s long-promised reforms. Sure, Republicans could lose the House in November, but Ryan’s ouster wasn’t set in stone. After all, he won his seat in 2016 with 65% of the vote (the Democratic candidate got 30%).

Now fellow Republicans may force Ryan out of the House before November, unwilling to be led into contentious midterms by a “lame duck”. His legacy is already being described as a tragedy of his own making, after he failed to control Donald Trump’s unprecedented attacks on Constitutional norms, immigrants, and fiscal austerity.

After twenty years in Congress, what will Ryan be leave behind? Quartz looked at his most-repeated promises, and how they fared:

Fundraising: A+

There has never been a House representative as successful as Ryan at raising money for his party, not even Nancy Pelosi, the Democrat from California, notes Adam Smith, the spokesman for Every Voice, which tracks money in US elections.

“Team Ryan,” the joint fundraising committee that Ryan heads, has raised nearly $56 million so far for the 2018 elections, and raised over $65 million in the 2016 election. “He is a record-setting fund raiser,” Smith said, noting it was helpful when “your agenda is very much in line with the donor class.” Koch Industries, the industrial complex owned by the Koch brothers, was top Team Ryan donor in 2016, and Charles Koch and his wife donated nearly $500,000 to the team after the tax bill passed.

Reducing spending (via the American safety net): D

Eight years ago, Ryan, then the ranking Republican on the budget Committee, introduced a bill called Roadmap for America’s Future 2010. It would slash spending on social programs, to stave off a “European-style welfare state where double-digit unemployment becomes a way of life.”

The unsuccessful bill would reduce taxes on corporations and wealthy Americans, while reducing the size of government by privatizing Social Security, capping health care spending, and limiting programs like food stamps. As Budget Chairman, Ryan introduced subsequent, similar versions that slashed programs for low-income Americans. The Ryan budget is “Robin Hood in reverse—on steroids,” said the president of the Center on Budget and Policy Priorities, a DC think tank, in 2012.

Hard numbers would say Ryan has failed, despite two decades of trying. Last month, Congress released a $1.3 trillion spending bill that fiscal conservatives called an “orgy of new spending.” It increased federal health care programs by $10 billion, even before Congress funds Social Security or Medicare.

Ryan doesn’t get an “F” on slashing spending, however—his dream of cutting programs for the poor is the foundation of Republican political platforms, and has been embraced by the Trump administration. In the latest spending bill, the budget for “food stamps” has been cut 6%, and the White House is pushing work requirements for welfare recipients.

Slashing taxes on companies and the rich: A

Ryan was so enthusiastic when the “Tax Cuts and Jobs Act” passed last year that the enormous gavel he was wielding bounced off the podium.

It is a boon for corporations and the wealthy, slashing corporate taxes by 40% and giving the biggest breaks to the top-earning households. Warren Buffett’s Berkshire Hathaway alone is getting a $29 billion tax break.

But critics say the bill will strip funding from the public schools that 90% of US families use, could reduce incomes for the working class, and is based on a “trickle down” theory of economics that has historically been proven wrong.

Postcard-sized tax returns: F

The idea that America would simplify its tax code so much that taxpayers would be able to file their income taxes using a post card has become a much-repeated Republican trope. Ryan was the first to push that promise, when he pledged to deliver a tax code that “fits on a postcard” back in 2010.

The new tax bill has done the opposite of this promised simplification, experts say. Filing on a postcard is “clearly has not been the case,” said Aaron Scherb, the director of legislative affairs for Common Cause, an anti-corruption watchdog: “The accountants I’ve talked to say its never been more complicated after tax reform.”

Repealing Obamacare: D

From the very beginning, Ryan was a passionate, ideological voice against the Affordable Care Act, the US healthcare bill known as “Obamacare.” He argued ahead of its passage in 2010 that making health insurance mandatory was a condescending and paternalistic idea.

As speaker, he oversaw some of the approximately 100 successful House votes to repeal the ACA, which were all vetoed by president Obama. But after Trump became president, Ryan could not get the votes for a repeal act he penned himself.

The Affordable Care Act’s reach has been damaged by the Ryan-led tax care bill, however, and other Trump administration efforts to chip away at the program.

Reducing the deficit: F

Ryan’s battles with Obama often centered around his desire to cut federal deficits. After Trump’s tax bill was passed Ryan’s insistence on cutting deficits looks more like political posturing.

Thanks to the Ryan-backed tax cuts for the wealthy and corporations, the US is now set to suffer a massive deficit expansion, despite the strong economy. By 2028, the US deficit is set to grow to a higher level compared to GDP than at any time since just after WWII, Congressional Budget office director Keith Hall testified today to the House of Representatives.

Fitness: C

Ryan’s relative youth in a Congress where the average age is 57, and his penchant for home “P90X” workouts have earned him a reputation as the US’s fittest Congressman, but there are some questions about how fit, exactly, he is.

“It was Ryan’s fitness regime—and Herculean strength on all things fiscal—that inspired this workout-themed sitting for Person of the Year,” Time magazine wrote in a 2012 photo spread that inspired a flood of memes. Later, Runners World discovered Ryan had lied about his marathon time, shaving off more than an hour. Others have questioned his claim that he had six to eight percent body fat, about that of Olympic sprinters or Tour de France cyclists.