If Yellen became Fed chair, would low inflation change her bond-buying stance?

The US Federal Reserve has been looking at how to cut back on its hefty stimulus program, fearing that the easy money policy could start to distort prices in certain areas of the economy. But the central bank is also leery of persistent low inflation; the measure has continued to fall well below the Fed’s target inflation rate of 2%, which would argue for continuing the stimulus.

The US Federal Reserve has been looking at how to cut back on its hefty stimulus program, fearing that the easy money policy could start to distort prices in certain areas of the economy. But the central bank is also leery of persistent low inflation; the measure has continued to fall well below the Fed’s target inflation rate of 2%, which would argue for continuing the stimulus.

With the question looming of who will take over the Fed from Ben Bernanke, investors have been taking bets on how the changing of the guard would affect the Fed’s stance on winding down the stimulus. Here’s how that might play out:

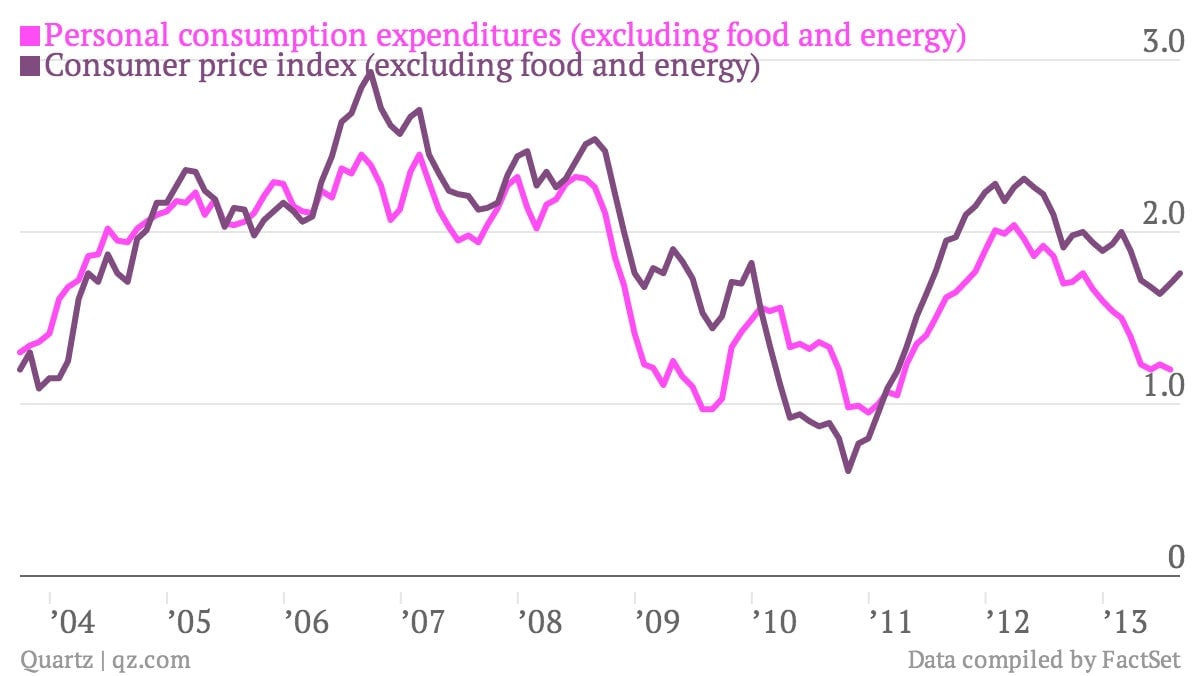

First, a look at the latest read on the US consumer price index. In August, prices had risen 1.5% from a year ago, slightly less than analysts expected. Excluding food and energy inflation, prices rose 1.8% from the previous year—more in line with what economists had predicted.

But by the Fed’s measure, inflation is even lower. The Federal Reserve prefers another calculation called “personal consumption expenditures,” which gives less weight to inflation in rents and more to healthcare costs. (The Economist and FT Alphaville have detailed explanations of why these two measures diverge.) The last reading on core PCE (excluding food and energy) was 1.2% in July, far lower than the Fed’s predictions.

A small but vocal group within the Fed has been concerned that “tapering” its bond-buying program could push inflation even lower. Slightly positive inflation encourages individuals and businesses to invest, anticipating that the value of their cash will be worth less in future. Deflation—falling prices—reverses that logic, and is notoriously difficult for central bankers to control (see: Japan).

Fed vice chair Janet Yellen, now the frontrunner to succeed Bernanke as Fed chair, is known for have been dovish over the last few years—in other words, for being amenable to easy money policies like bond-buying. But she has consistently followed the slightly less dovish lead of Bernanke, who may favor tapering sooner. US Treasurys have rallied since economist Lawrence Summers officially dropped out of the race, probably because investors believe Yellen would be more likely to carry on quantitative easing than Summers.

The first decisions on whether or not to begin the taper are likely to come in the next few months, while Bernanke is still in office. But if inflation continues to fall, it’s possible Yellen might be swayed by the Fed’s deflation worrywarts to slow or halt the taper.