Apple and Microsoft have turned tech into a dividend-paying paradise

Maybe tech investors have become spoiled by the lavish dividends of recent years.

Maybe tech investors have become spoiled by the lavish dividends of recent years.

The market just shrugged off the news that Microsoft is going to buy back another $40 billion worth of stock and boost its dividend by 22%. Shares are up a mere 0.5%.

But remember, during the peak of Microsoft’s powers in 1990s the idea of the tech behemoth even offering a dividend was laughable. And investors wouldn’t have wanted one. At that time, the tech sector was where the risk-hungry roamed in search of the next growth stock. If you were looking for staid, dividend-paying securities, tech was the last place you went.

Times have changed. Over the last year, technology has been the top sector of the S&P 500 when it comes to doling out dividends. Before Microsoft made its announcement this morning, year-over-year dividend growth was up 62% at the company. That left the second-best sector for dividend growth, financials, in the dust: dividends per share were up only 19% over the trailing 12 months (TTM), according to an analysis from market research company FactSet.

Of course, a large part of this overall increase is due to one company: Apple, which announced a dividend in March 2012 and boosted it significantly this year. In fact, Apple has pushed $10.28 billion in dividends to shareholders over the last 12 months, second only to ExxonMobil, which paid out $10.57 billion over the same period.

But even without Apple, the tech sector would have still been the best dividend payer over the last year, with dividends-per-share rising 26%, according to FactSet. And for what it’s worth, Microsoft is no slouch when it comes to dividends. It paid out $7.46 billion in dividends over the last 12 months, the fifth largest amount in the S&P 500.

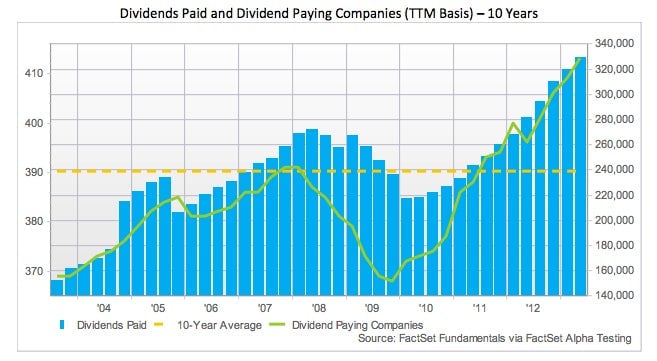

Meanwhile, rising tech dividend payments are part and parcel of a broad-based increase in shareholder payouts in the stock market. Corporations have increasingly turned to payouts to coax stock-averse investors—many of whom were burnt in the market tumble of 2008—into owning shares. Over the last 12 months dividend payments for S&P 500 stocks amounted to $329 billion. That’s more than double the level of 2003 and about 38% higher than the 10-year average, according to FactSet. Take a look.