No, the US student debt bubble isn’t popping

After five years of crisis—financial, economic, European—market observers have been conditioned to constantly watch for the next bubble ready to blow. US student debt has long been considered a likely candidate, but not any longer. Here’s why:

After five years of crisis—financial, economic, European—market observers have been conditioned to constantly watch for the next bubble ready to blow. US student debt has long been considered a likely candidate, but not any longer. Here’s why:

Unlike most other forms of non-mortgage borrowing, levels of student debt have continued to climb during the US recession and its slow recovery.

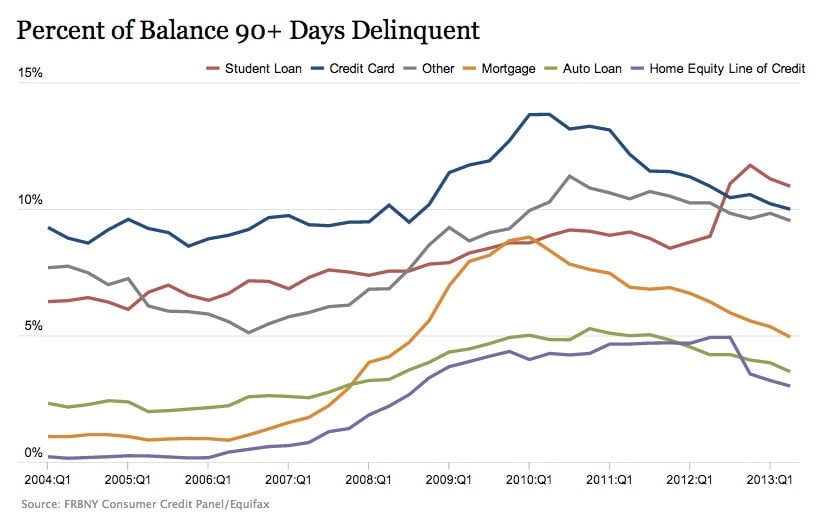

And thanks to the tough time US young people were having finding jobs during and after the recession, delinquency rates on student debt—the red line in the chart below—had been on a sharp rise.

But more recently, student delinquency rates have joined the downtrend in delinquencies seen in other forms of lending, thanks in part to an improving US job market.

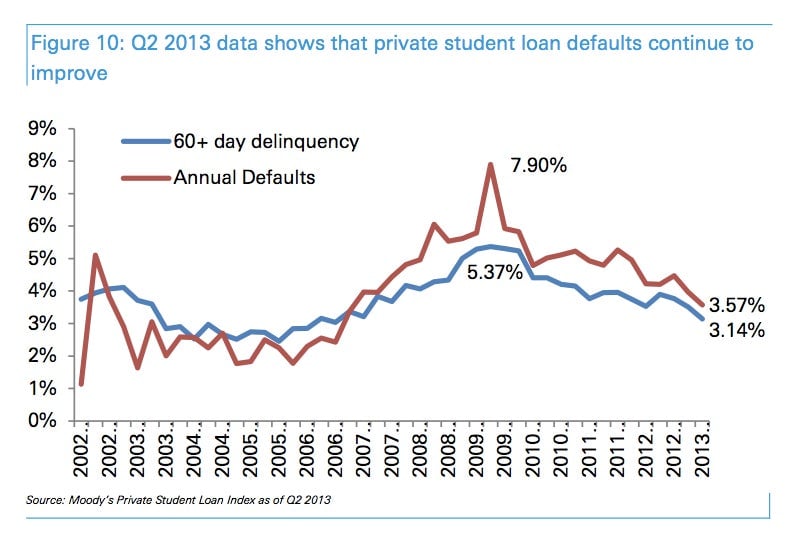

In its weekly research note on asset-backed securities—the packages of mortgage, auto, student and credit card loans that lenders bundle off and sell to investors—Deutsche Bank analysts spotlighted improving trends in the private US student loan market too.

Deutsche analysts wrote:

Given the correlation between defaults and employment, we expect performance to improve as labor conditions for young workers improve. The unemployment rate for 20- to 29-year olds holding bachelor’s degrees has fallen from 17.6% in 2009 to 13.5% in 2011, using data reported in February 2013 from the Current Population Survey.

As long as the US job market continues to improve, crisis junkies may need to start looking elsewhere for their next fix.