Investors are getting worried about US debt, so they’re buying US debt

The rising tempo of debt-ceiling shenanigans in Washington DC has started to register in the financial markets.

The rising tempo of debt-ceiling shenanigans in Washington DC has started to register in the financial markets.

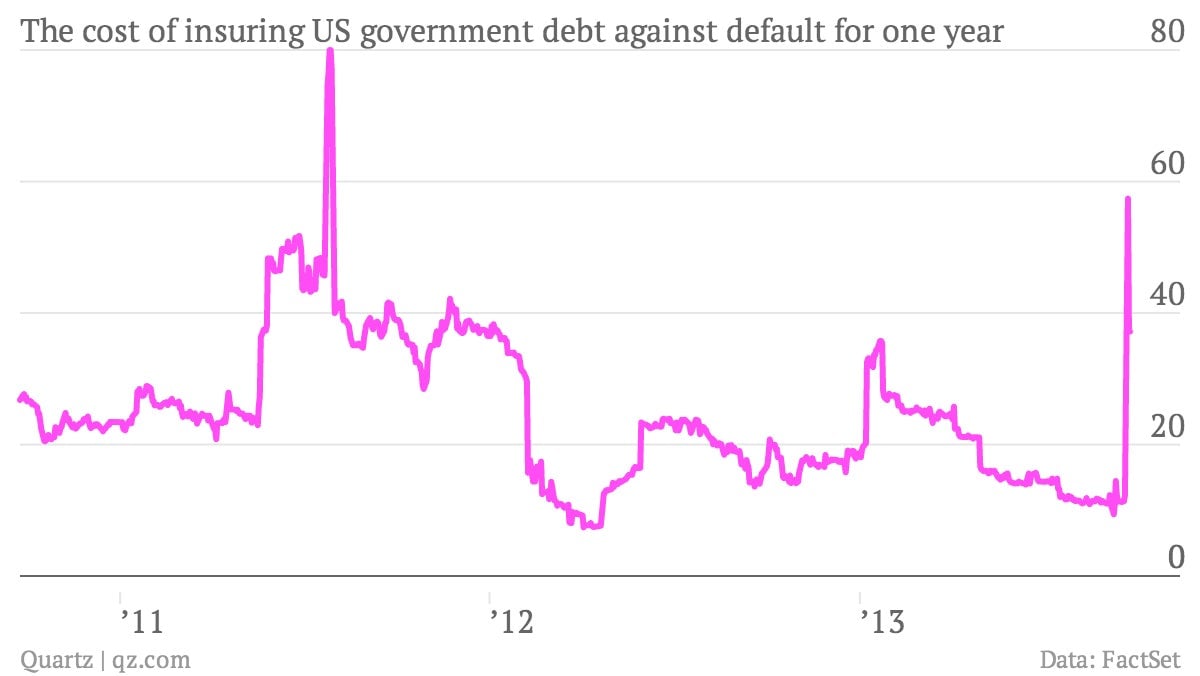

Check out the surge in 1-year CDS on US government debt. (This is essentially the cost of default insurance on US Treasury bonds.) It shot up over the last few days, hitting levels not seen since back in 2011, when that summer’s debt ceiling fight raised concerns of a US default. Take this as a sign that investors are worried once again about the risk of a US debt default.

If the US fails to pay its bills on time, that would basically throw the entire financial system into disarray, since the yield on US Treasury bonds, known as the “risk free rate,” is the starting point for assessing how much interest to charge everybody else. In sum, a US debt default would likely have terrible effects on the global economy.

And yet, oddly, where do investors go to protect themselves from the risk of such a catastrophe? Traditionally, the US government bond market. Why? Because those investments are risk free! They’re also the easiest thing to buy and sell anywhere in the global financial markets, which makes them almost like a form of cash.

And that’s just what investors are doing, fleeing stocks—partly fearing the fallout of political games over the US budget—in favor of US Treasurys, which are basically ground zero for the political games over the US budget.

It’s worth noting that the Fed’s recent decision not to taper off its bond purchases is also helping to push buyers back into US Treasurys.

The thinking goes something like this: “Yes, the risks of a US default are rising. But they’re still incredibly low compared to everything else. And we’re very confident that there’s going to be no substantial problem with the US paying its bills. So frankly, even with the stupidity playing out in Washington, we think that at most its going to damage consumer confidence a bit, which would hurt stocks more than bonds. So we’d rather own bonds.”