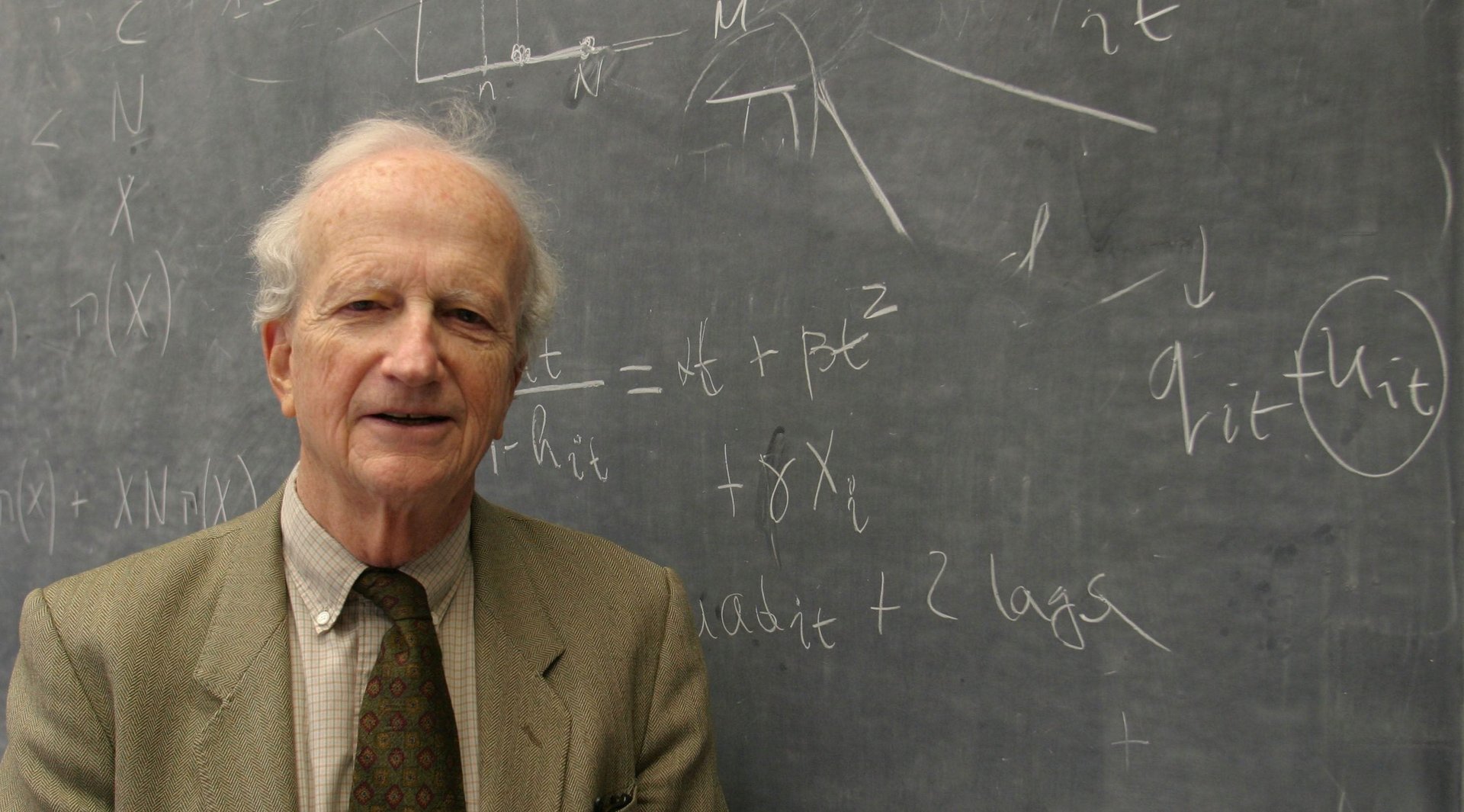

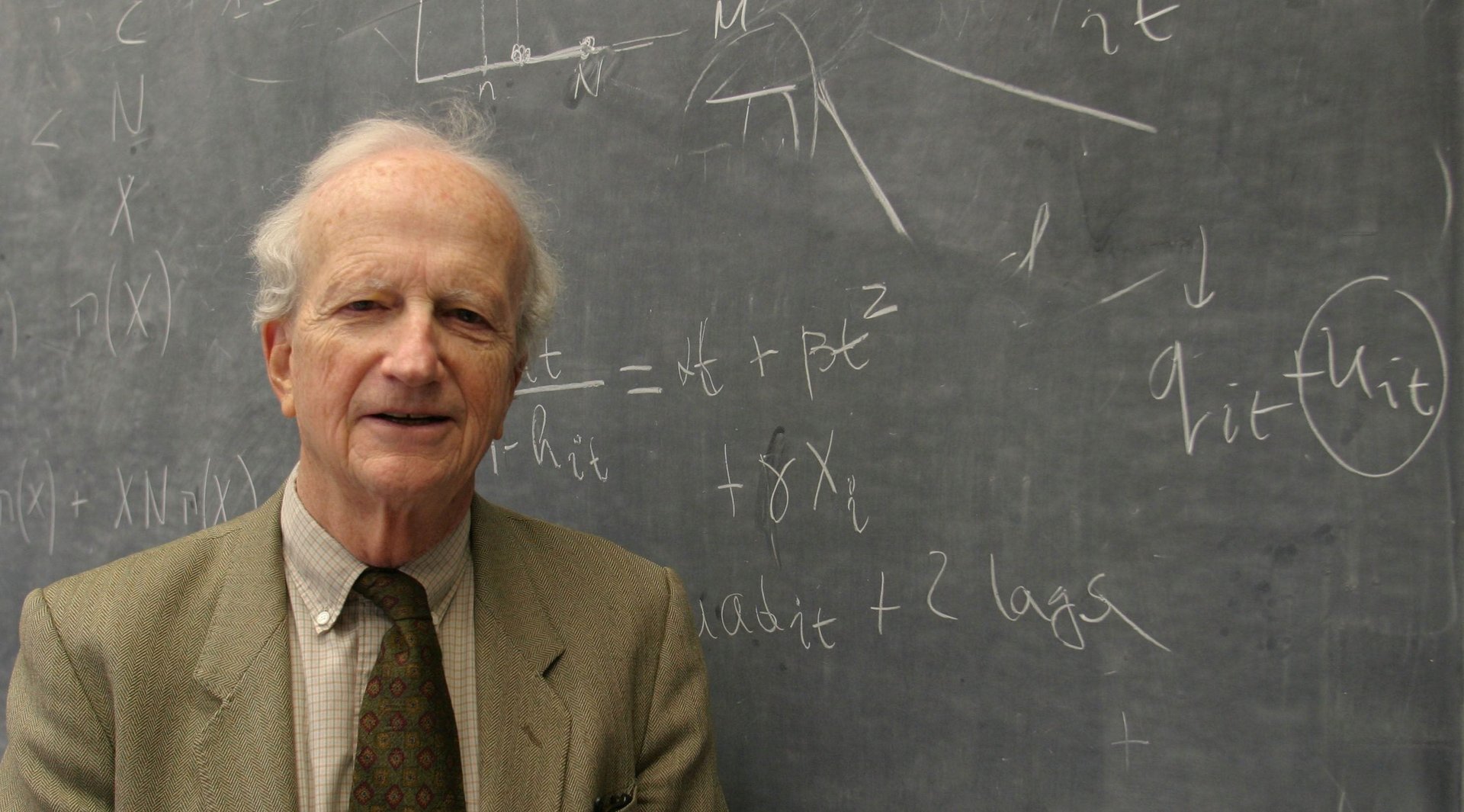

Even after his death, a Nobel prize-winning economist is taking on inequality

In a new paper, decorated economist Gary Becker and his coauthors argue that wealthy families stay rich because they pass down not just money to their children but “human capital”—in other words, the access to education and skills that allows them to maintain their perch atop society.

In a new paper, decorated economist Gary Becker and his coauthors argue that wealthy families stay rich because they pass down not just money to their children but “human capital”—in other words, the access to education and skills that allows them to maintain their perch atop society.

Becker, who won the Nobel prize in 1992, pioneered the study of the family as an economic unit. The paper, titled “A Theory of Intergenerational Mobility,” which will be published in the Journal of Political Economy, is an important contribution to his body of work. It’s even more notable because Becker died in 2014.

Becker was working on the paper in the years leading up to his death, said Scott Duke Kominers, a Harvard Business School professor who is a co-author, along with Kevin Murphy of the University of Chicago, and Jorg Spenkuch of Northwestern. ”Kevin, Jorg, and I were all in conversations with him about different parts of it,” Kominers said in an email. “Then after Gary died, we got together to finish the paper, working from and extending early draft notes Gary had assembled.”

The long delay is a result of the ponderous nature of academic publishing, which calls for unaffiliated experts to read and comment on the work, which can leading to multiple revisions.

The paper helps explain the persistence of inequality, and why it can be so hard for lower-income families to move into the upper ranks of wealth. At the heart of the argument is the idea the rich parents can offer their children more advantages, and those advantages endure for generation after generation, defying the normal expectation that they eventually erode. In the way that poor families can be trapped in poverty due to what economists call neighborhood effects—the external factors such as crime and lack of access to high-quality education and healthcare—wealth accumulates in rich families because of professional connections, legacy admissions at colleges, and countless other factors that ease the affluent through life.

The paper ties together major threads of Becker’s scholarship about the family and the role of the household in economic production, said Murphy, who was a colleague of Becker’s for years at Chicago. In particular, he said, it draws on Becker’s conviction that human capital is a particularly underappreciated aspect of wealth generation.

“One of the most important things I inherit from my parents is not just money, but skills and talent,” Murphy said. “It’s not just about financial resources, but human-capital resources.”

The paper suggests income redistribution through increased taxes on the rich is insufficient for addressing inequality, because it fails to solve the problem of human capital, Murphy said. A smarter public policy approach would be increased investment in education to help develop skills that would pay dividends over a lifetime and passed down to future generations, he said.

Becker was politically conservative, and favored school choice as a way to improve education options among poor families, Murphy said. Becker also was opposed to government programs that discouraged work, in part because they limit the ability to accumulate the skills and connections that make up human capital. “It’s better to be economically active,” Murphy said, “because it give you a better chance of learning those skills and passing them along.”