We are so far away from the cashless society, reveals new study from Mastercard

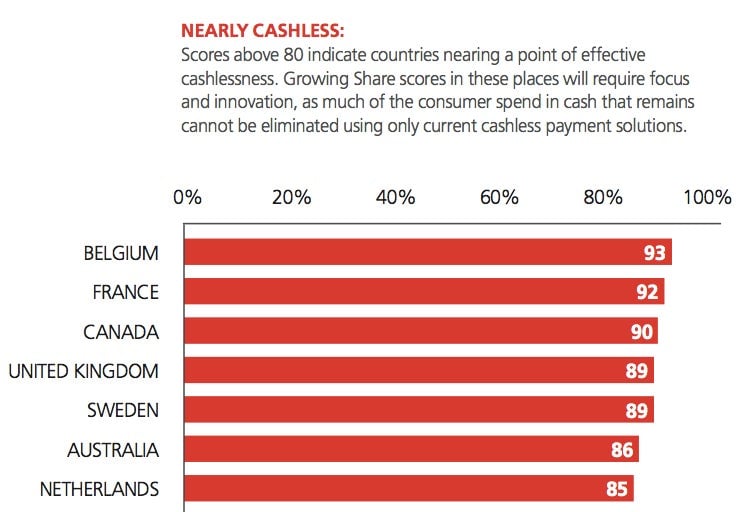

How far are we from the mythical “cashless society”? A new study from Mastercard seems to suggest that, as measured by the dollar amount of consumer transactions, some countries are but a hairsbreadth away already, with only 7% of the value of consumer transactions taking place in cash in Belgium, 8% in France and 10% in Canada.

How far are we from the mythical “cashless society”? A new study from Mastercard seems to suggest that, as measured by the dollar amount of consumer transactions, some countries are but a hairsbreadth away already, with only 7% of the value of consumer transactions taking place in cash in Belgium, 8% in France and 10% in Canada.

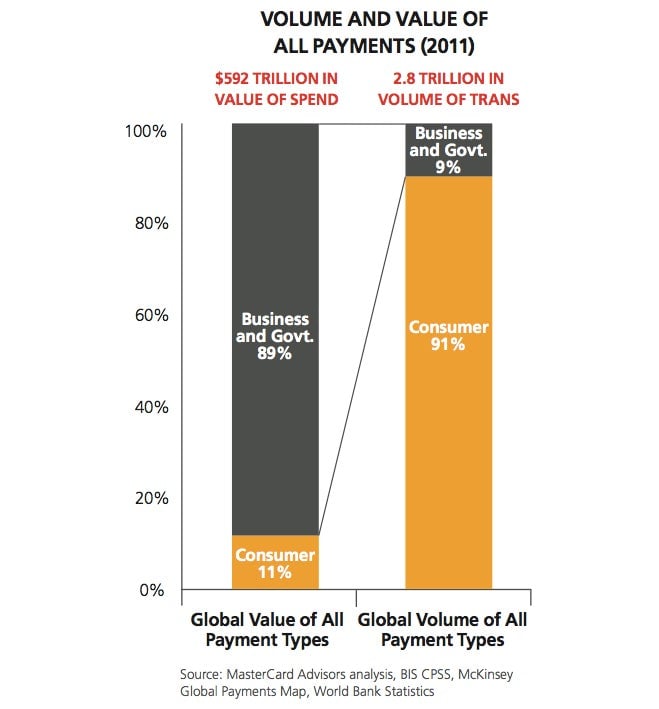

But there’s a great big asterisk to all of this: Consumer purchases constitute only 11% of all payments worldwide, or $2.8 trillion of $592 trillion, once you throw in what governments and business spend.

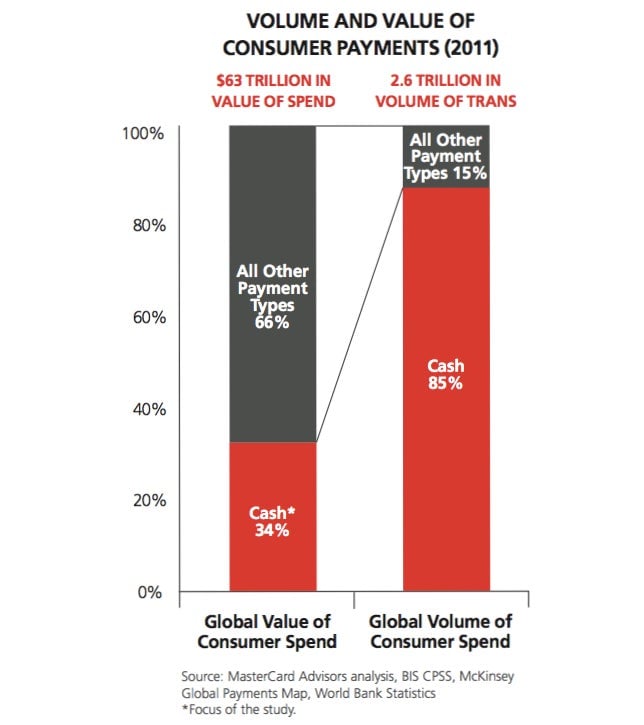

Cashless transactions aren’t beating cash transactions if you count up the number of transactions, rather than their value. In fact, 85% of all transactions are conducted in cash. But the much higher average value of non-cash transactions means that only 34% of the value of all consumer transactions worldwide was in cash.

China, for example, saw a 20% drop in the value of cash payments for consumer goods between 2006 and 2011, and now 55% of the value of transactions in the country were non-cash.

Cash also still has uses beyond small, everyday transactions; black markets, criminal syndicates and tax evasion all require it. It’s just that, especially in rich countries, it’s easier to use something like, oh, a Mastercard. The ongoing utility of cash is one reason that the US $100 bill is more popular than ever—mostly as a means of exchange outside the US.