Investors are starting to doubt America’s willingness to pay its bills

Let the whirlwind of worry begin.

Let the whirlwind of worry begin.

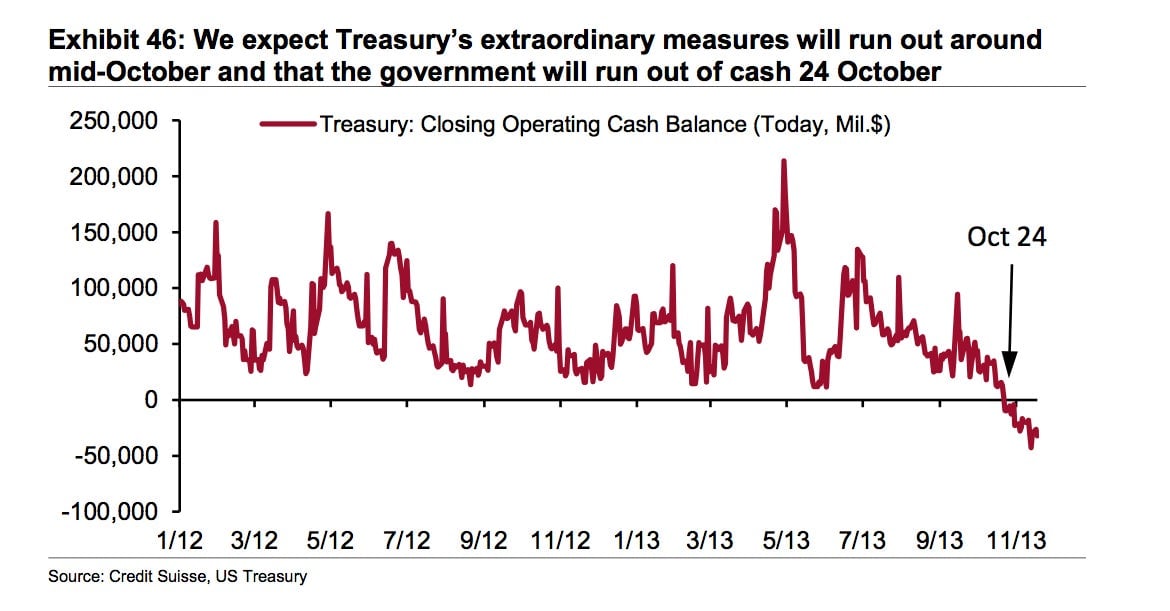

You can see investors starting to avoid owning US short-term debt that matures around the time the US government is set to hit the country’s debt ceiling, which is likely to be sometime in late October. (There is no exact date.) Here’s a Credit Suisse chart that shows the bank’s estimate for when Uncle Sam will run out of money without the debt ceiling being raised.

You can tell people are starting to worry, albeit slightly, because interest rates on short-term T-bills have started to rise more than they should. The move isn’t gigantic. It’s basically a couple basis points, or 0.01 percentage points. In 2011, when the US went right the brink of default over a similar debt ceiling fight, Treasury bills shot higher by about 20 basis points, as people got worried the US wouldn’t cough up payments to creditors on time.

Granted, it’s still nearly unthinkable that the US wouldn’t pay its bills on time. But people that own Treasury bills—short-term US government debt—are by their nature extremely risk-averse. Since these bills yield so little, no one uses them to make money. Their purpose is really to not lose money. No wonder then that concerns about full faith and credit show up here first.