Italy’s government is on the brink of collapse—so what else is new?

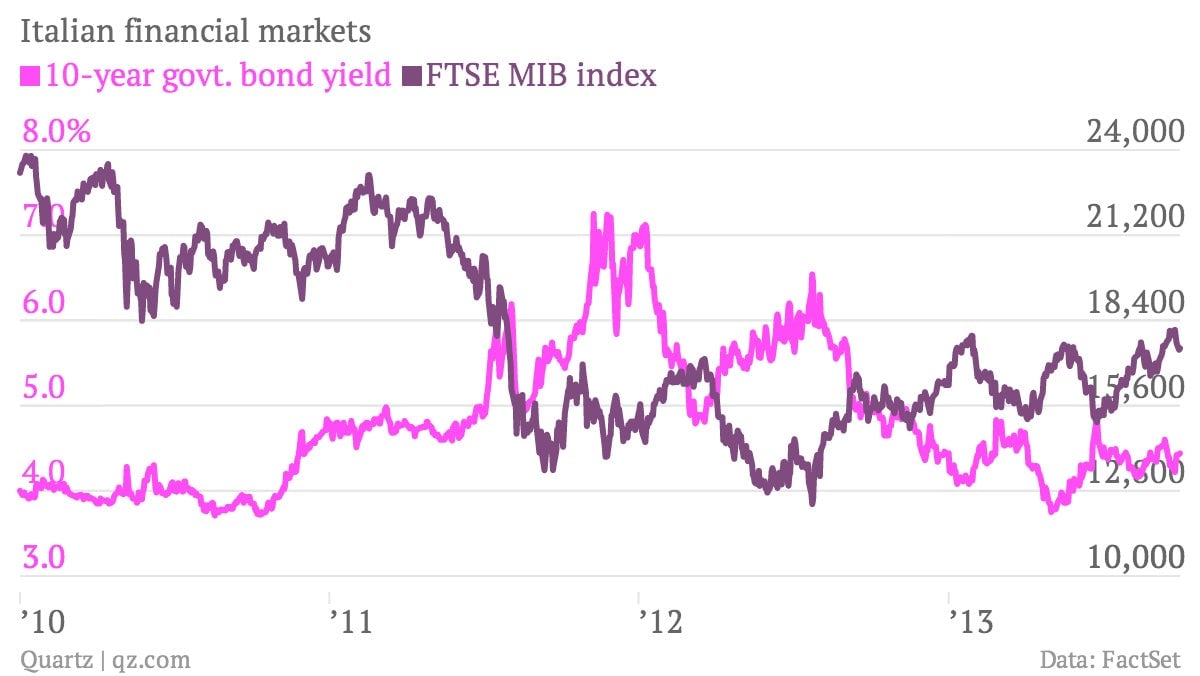

In Italy, the government is teetering. A credit ratings downgrade looms. Two of the country’s three largest banks are in turmoil, as is the main telecoms operator. Given the headlines, it’s surprising how subdued the market reaction has been; bond yields have barely budged and stocks are down by less than 1% so far this week. Has dysfunction in Italy’s parliament and boardrooms finally lost its capacity to surprise?

In Italy, the government is teetering. A credit ratings downgrade looms. Two of the country’s three largest banks are in turmoil, as is the main telecoms operator. Given the headlines, it’s surprising how subdued the market reaction has been; bond yields have barely budged and stocks are down by less than 1% so far this week. Has dysfunction in Italy’s parliament and boardrooms finally lost its capacity to surprise?

Uncertainty stalks the government…

Prime minister Enrico Letta faces a crucial test in the Italian parliament tomorrow (Oct. 2), when he will address both houses before facing a vote of confidence in his leadership. Silvio Berlusconi, convicted of tax fraud and facing expulsion from the Senate, called for his party’s ministers to quit Letta’s cabinet and force a new election. There are signs of dissent within the ranks of Berlusconi’s party, but even if Letta survives the confidence vote he will not be left with much of a mandate to pass meaningful reforms—including a crucial budget for 2014.

It took months to cobble together the current government after an election in February, with Letta’s center-left and Berlusconi’s center-right parties grudgingly agreeing to form a coalition (Italy’s 62nd government since the post-war republic was founded 67 years ago). The outcome of tomorrow’s showdown is difficult to predict, with think tank Open Europe walking through a few of the possible scenarios, none of them particularly encouraging for the fragile Italian economy.

…and companies are flailing…

Meanwhile, the head of Italy’s second-largest bank, Intesa Sanpaolo, quit over the weekend after a clash with the foundations that own a big chunk of the bank’s shares. The third-largest lender, Monte dei Paschi di Siena, is still struggling to convince the European Commission that its restructuring plan is tough enough to justify the billions of euros that the government has pumped into the bank. The CEO of Telecom Italia is also reportedly on the way out later this week, following his own run-in with key investors.

…but markets hope what Berlusconi breaks, Draghi can fix

In previous years, a shaky government and wobbly banks pushed Italy to the brink of an international bailout. As it happens, the relative calm that is greeting the latest ructions is thanks to another Italian: Mario Draghi. The president of the European Central Bank pledged to do “whatever it takes“ to preserve the euro zone during a particularly nasty bout of investor jitters last year. Although this pledge has never been tested, the markets seem to be taking Draghi at his word. Traders were further comforted by Draghi’s hints last week that the ECB might offer another round of emergency liquidity for banks, which would be especially welcome for hard-up Italian lenders.

If Italy soon slips back into a full-blown political crisis, it will be the sternest test yet of Draghi’s promise to ride to the rescue. Is the ECB president willing, quite literally, to put his money where his mouth is? Investors seem to think so, but this particular Italian drama is far from over.