Square is almost as valuable as two of the biggest US exchange companies combined

Square’s market capitalization is about to overtake the combined value of financial stalwarts Nasdaq and Cboe, which operate some of the world’s most important exchange-trading platforms.

Square’s market capitalization is about to overtake the combined value of financial stalwarts Nasdaq and Cboe, which operate some of the world’s most important exchange-trading platforms.

The San Francisco-based firm’s share price has more than doubled in the past year, reaching a record high yesterday (June 18) after its payment app was approved for bitcoin trading by the New York State Department of Financial Services.

The licence comes after the DFS reviewed the fintech’s anti-money laundering and cybersecurity policies, among other things. It allows New Yorkers to buy and sell bitcoin through Square’s Cash app, which provides a peer-to-peer payments service that is a little like Venmo’s.

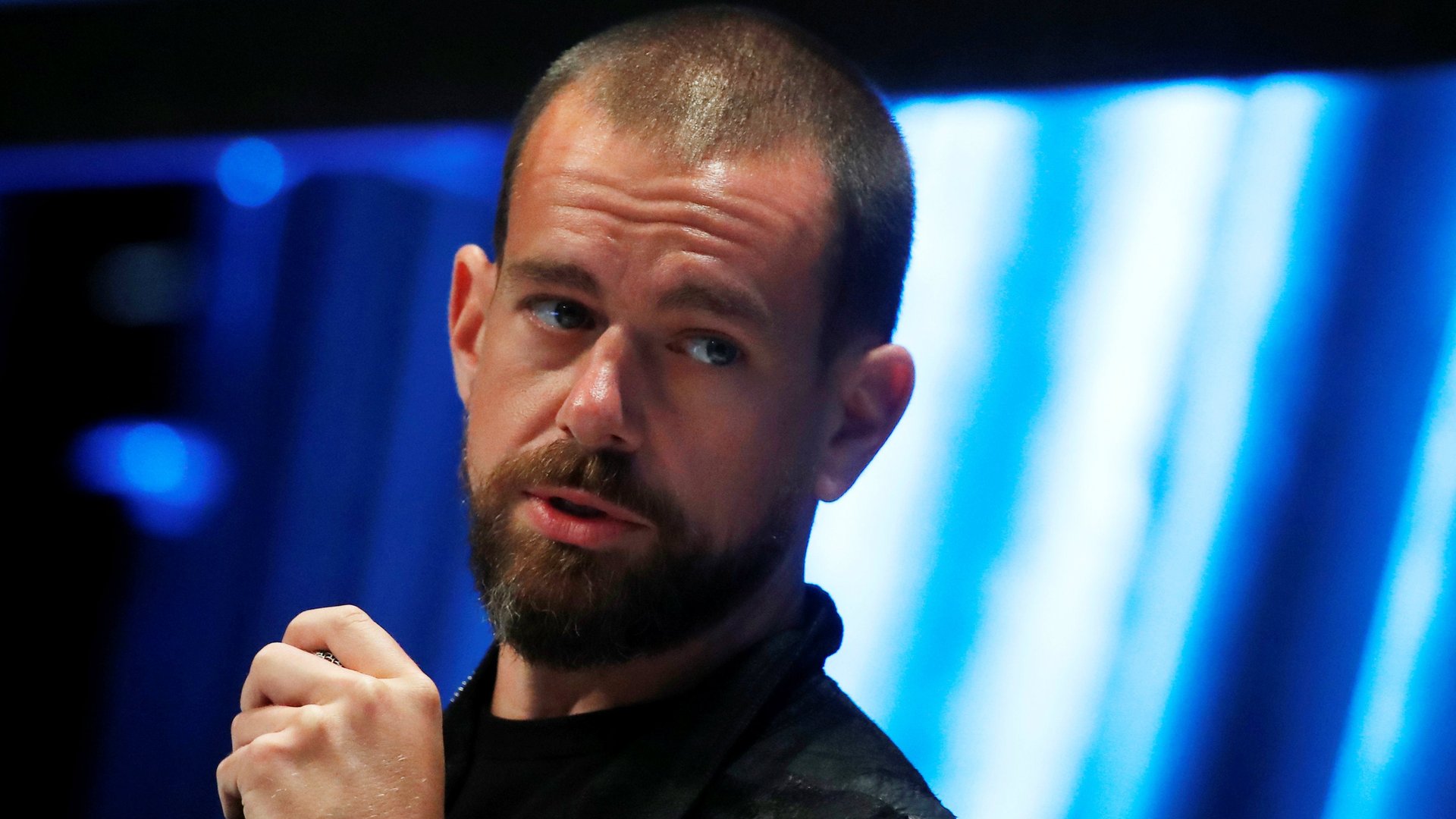

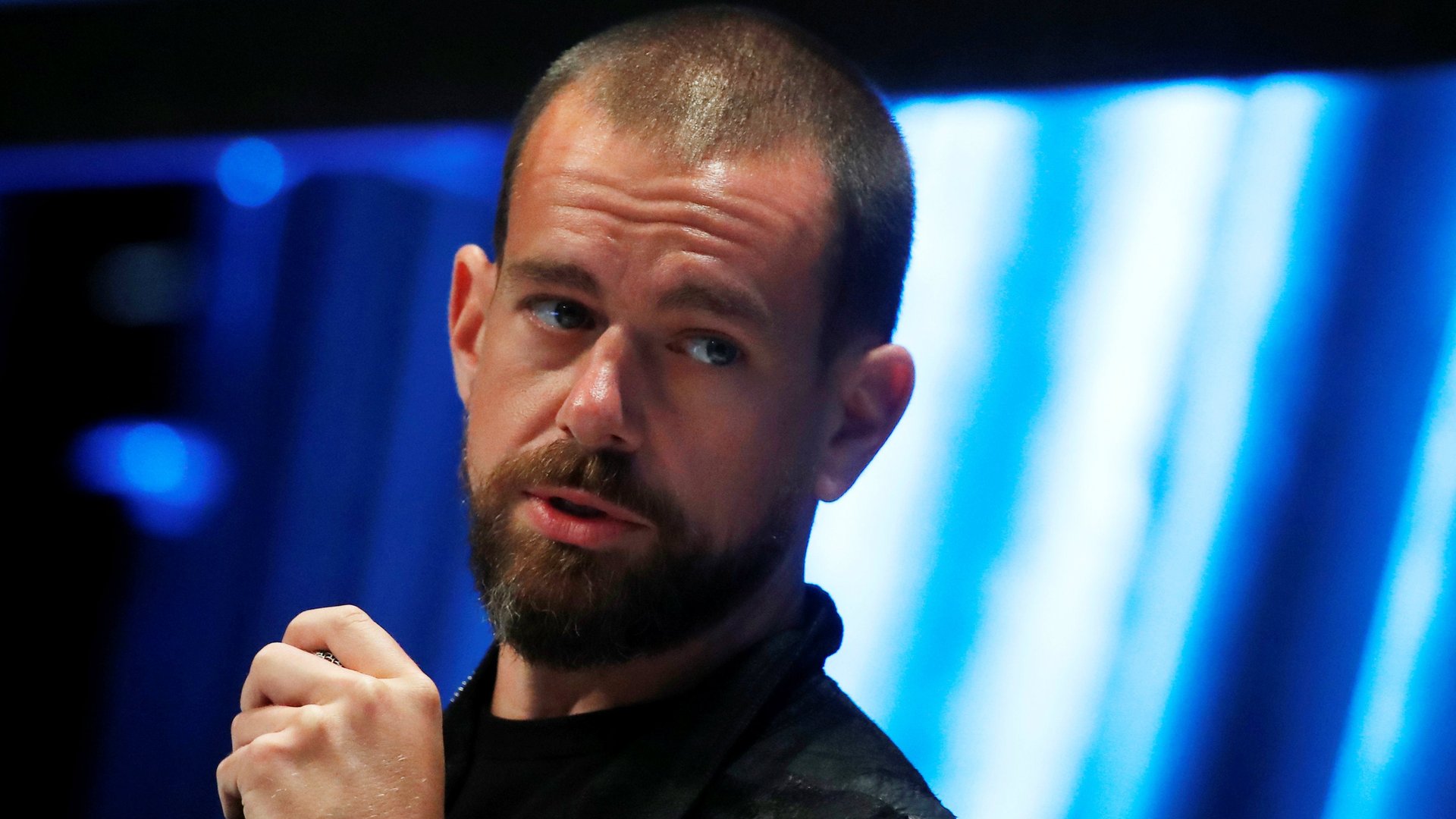

The nine-year-old company is best known for its card-payment dongle (and for being run by part-time Twitter CEO Jack Dorsey), but it has steadily widened its offerings. In April it bought Weebly, which businesses can use to build an online store or professional website. It launched its Cash App in the UK the same month. And Square Capital lent out $339 million (pdf) during the first three months of 2018, a 35% increase from a year earlier.

But it’s the bitcoin trading that has seemingly provided the most sizzle. Square’s stock has been turbocharged since it said in November that it was exploring crypto offerings.

A year ago, Square’s $9 billion market capitalization was less than that of Cboe and Nasdaq’s at $10 billion and $11.8 billion, respectively. By October, Square was bigger than both exchanges companies, which have long-running profitable businesses. Nasdaq operates some of the best-known stock exchanges in the world and also has a lucrative business selling market technology. Chicago-based Cboe runs vital stock and derivative markets in the US and Europe, and provides trading for bitcoin futures.

The obvious question is whether Square’s stock is overheated. Bitcoin has shown that it can be a great way to lure new customers and investors, but it’s hard to say whether those parties will be loyal if crypto-mania continues to dissipate. In the meantime, the company faces stiff competition from firms like PayPal, which recently bought a European company similar to Square called iZettle.

While Square’s market value has soared above Nasdaq and Cboe, those companies are profitable, with a combined net income of nearly $300 million during the first quarter. Square’s loss widened to $24 million, from $15 million a year earlier. Tech companies and crypto are a hot combination. Maybe too hot.