How billions in bank fines may be boosting the British economy

Brits bought more cars this September than in any over the past five years, a UK auto association reported today. This follows buoyant purchasing managers’ indexes, consumer confidence numbers and other survey-based data that an economist at HSBC recently described as “staggering.” Falling unemployment, soaring property prices and upgrades to GDP forecasts round out the picture of a British economy in rude health.

Brits bought more cars this September than in any over the past five years, a UK auto association reported today. This follows buoyant purchasing managers’ indexes, consumer confidence numbers and other survey-based data that an economist at HSBC recently described as “staggering.” Falling unemployment, soaring property prices and upgrades to GDP forecasts round out the picture of a British economy in rude health.

This is all fairly puzzling, considering that British incomes are stagnant at best. For years, inflation-adjusted wages in the UK have been falling at one of the fastest rates in Europe. How does this square with the other data, particularly big-ticket purchases like cars?

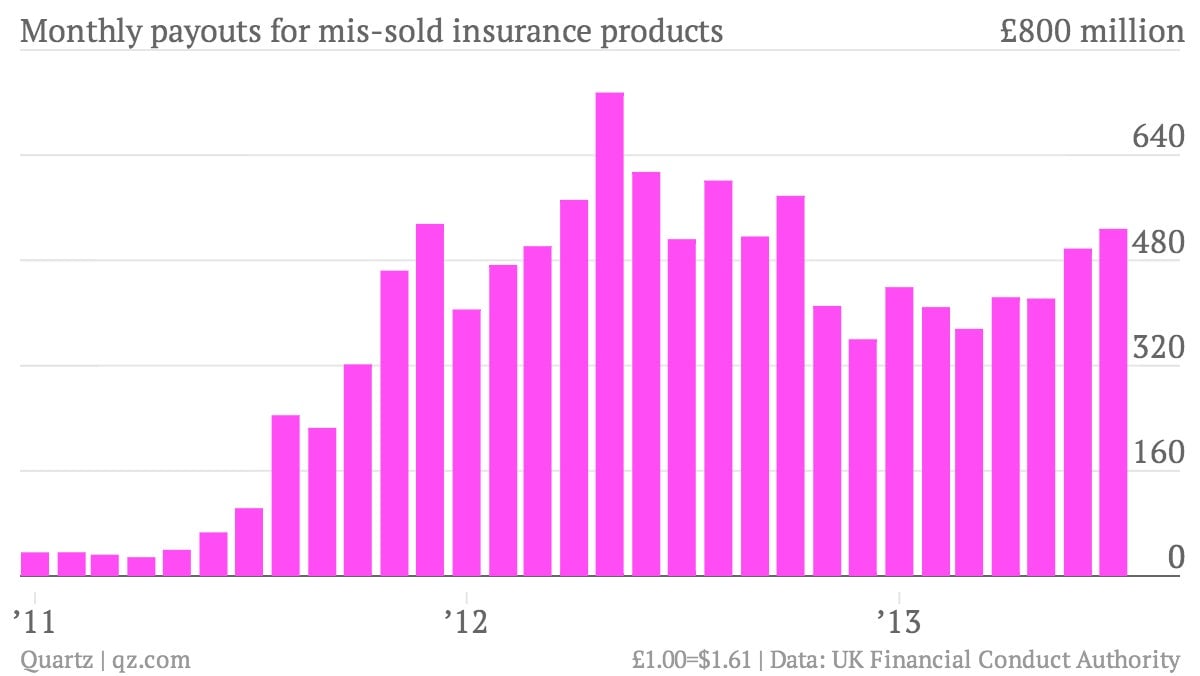

Some think they have the answer: bank fines. Since 2011, British banks have paid customers some £11.5 billion ($18.5 billion) in refunds and compensation for mis-sold insurance products. Payment protection insurance (PPI), which was once peddled aggressively alongside loans and credit cards, proved opaque and inadequate, which landed the country’s major banks in the dock following an avalanche of complaints. The High Court ruled against lenders in 2011, opening the spigot for claims from disgruntled customers.

The cottage industry that sprang up to process PPI complaints has created thousands of jobs in addition to returning billions of pounds (plus interest and penalties) to consumers’ wallets, as detailed in the Wall Street Journal. And complaints about past PPI sales are still rising, with banks setting aside as much as £16 billion to cover future payouts.

These are large amounts, but are they large enough to explain the strangely confident British consumer? At the current rate of around £500 million per month, PPI refunds only account for 0.6% of overall consumption (assuming they are spent in full). Lloyd’s Banking Group recently said that its average PPI claim netted the recipient £1,700, which is a decent sum but not enough to buy, say, a car.

Even if the jump in car sales doesn’t come down to bank fines alone, the PPI industry explains a lot about the UK economy. (Anyone living in the UK knows it is rather well staffed, judging by the volume of cold calls, texts and spam email generated by companies pledging to help you process PPI complaints.) Britain’s labor productivity is much lower than other industrialized countries; although the country is producing jobs, they are not particularly well-paid nor do they generate much output per worker. But a job is a job, even if it is processing claims against banks’ past misdeeds; the confidence created by rising employment and the odd bank windfall may indeed be enough to explain the resilience of British shoppers.

And there’s more to come. Banks were chided by regulators today for slow payouts in another mis-selling case: peddling dodgy derivatives to small businesses. Car dealerships that focus on corporate fleets are rubbing their hands in anticipation.